- Kyiv School of Economics

- About the School

- News

- Impact of Foreign Companies Self-Sanctioning On RF Economy

Impact of Foreign Companies Self-Sanctioning On RF Economy

12 July 2022. Release №9

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 03-10.07.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains 40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce that we are in the process of merging with project leave-russia.org which was developed by a team of volunteers.

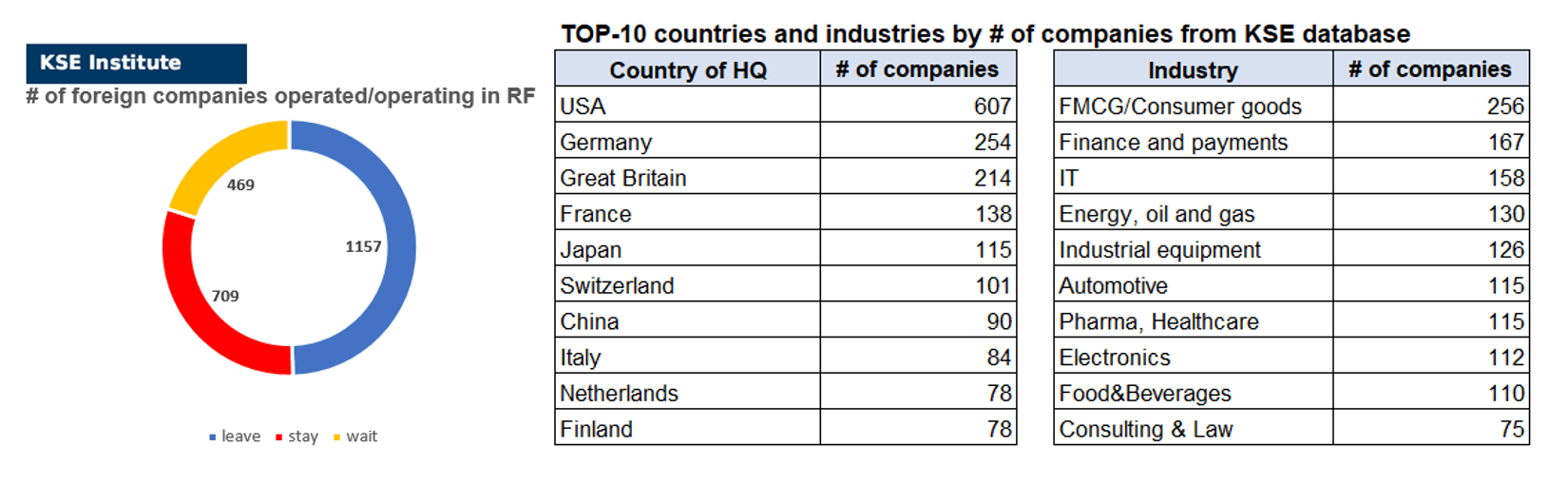

KSE DATABASE SNAPSHOT as of 10.07.2022

Number of the companies that continue Russian operations (KSE’s status “stay”¹ ) – 709 (+4 per week²)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status “wait”) – 469 (+5 per week)

Number of the companies that have curtailed Russian operations (KSE’s status “leave”) – 1 157 (+2 per week)

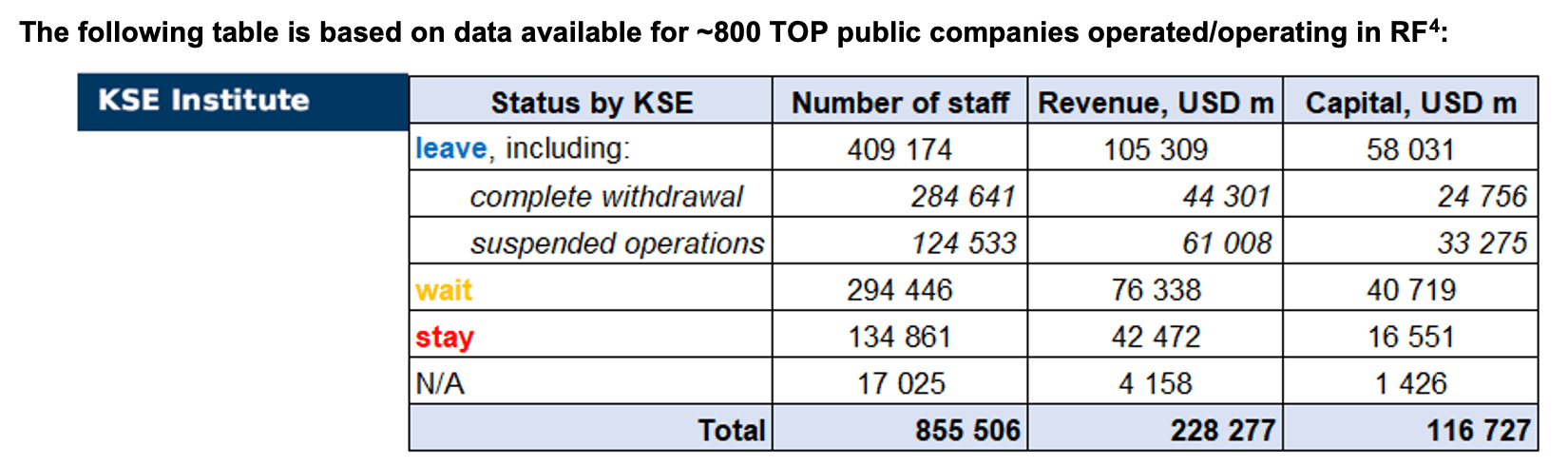

As of July 10, we have identified about 2,335 companies, organizations and their brands from 77 countries and 56 industries and analyzed their position on the Russian market. About half of them are public ones, for ~800³ public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity), which allowed us to calculate the value of capital invested in the country (about $116.7 billion), local revenue (about $228.3 billion), as well as staff (about 0.855 million people). 1,626 foreign companies have reduced, suspended or ceased operations in Russia.

As can be seen from the tables below, As of July 10, companies that declared a complete withdrawal from Russia had $44.3bn in revenues and $24.8bn in capital; companies that suspended their operations on the Russian market had yearly revenue of $61.0bn and $33.3bn in capital. TOP-70 companies-the largest taxpayers paid ~ $20,2bn of taxes annually – haven’t completely withdrawn yet, although suspended or scaled back.

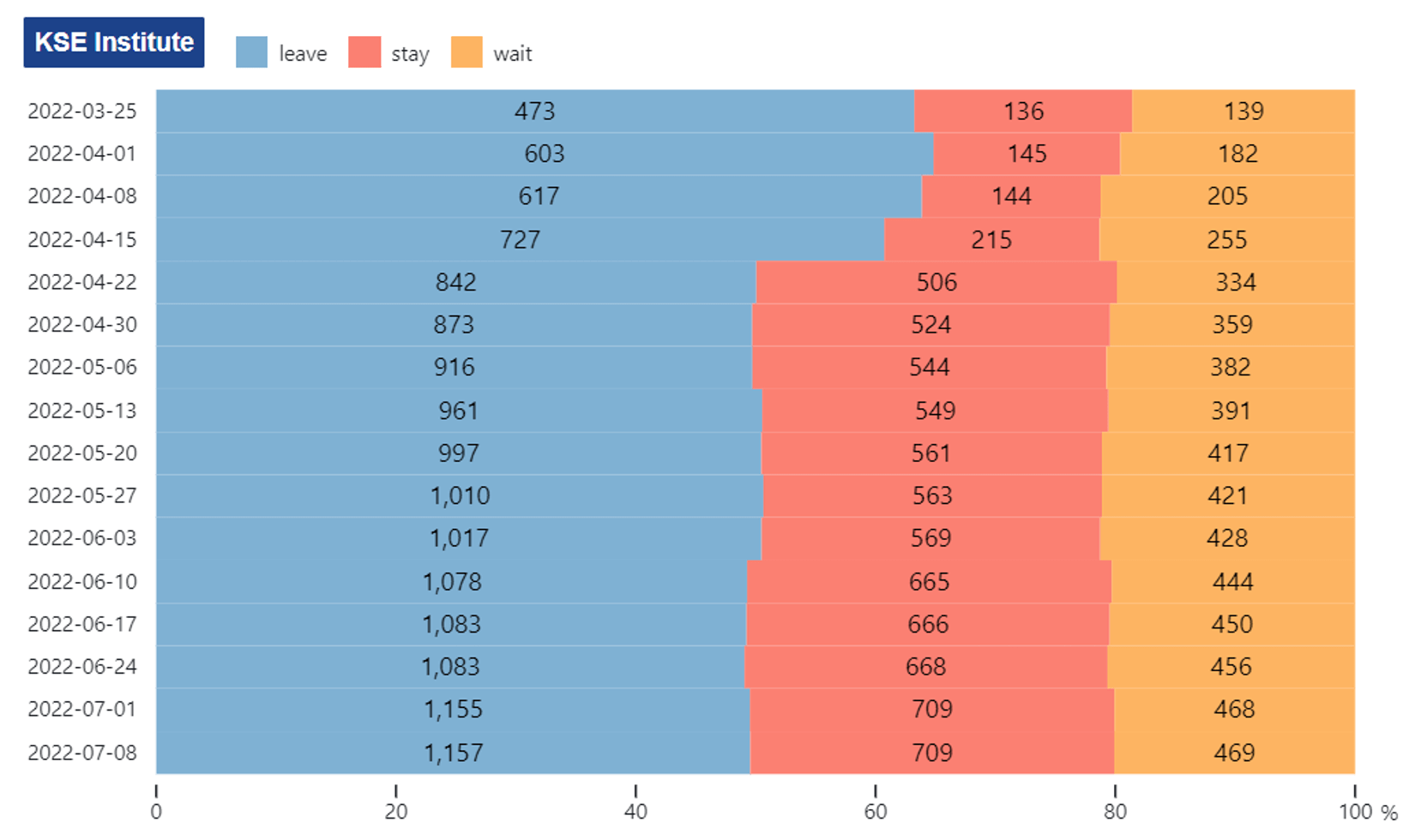

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about a half (49.6%) of foreign companies have already announced their withdrawal from the Russian market, but another 30.4% are still remaining in the country.

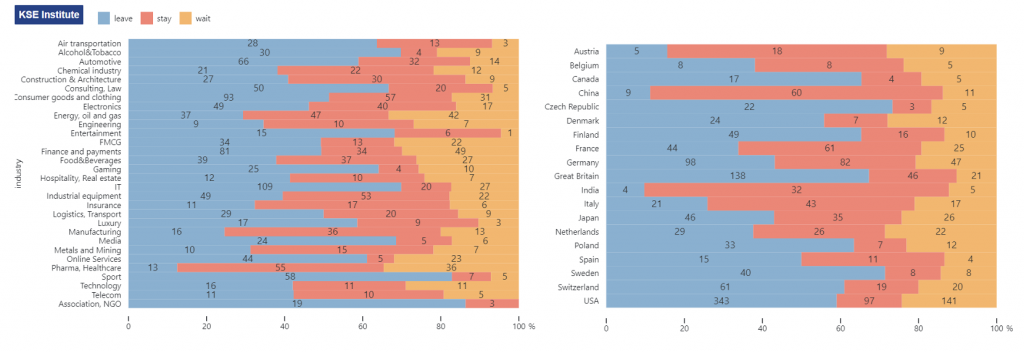

The actions of companies by sector (based on the KSE database, with at least 20 companies representing the industry or country) are shown in the graphs below.

Decisions of Western companies by country and sector:

WEEKLY FOCUS. HOW MUCH WILL FOREIGN COMPANIES LOSE OVER LEAVING RUSSIA?

Despite the Russian government’s statement that leaving Russia will be unpleasant for foreign companies, it will not be a disaster for them. At the same time, hundreds of thousands of jobs, billions of lost companies’ revenues and budget income are at risk within the country.

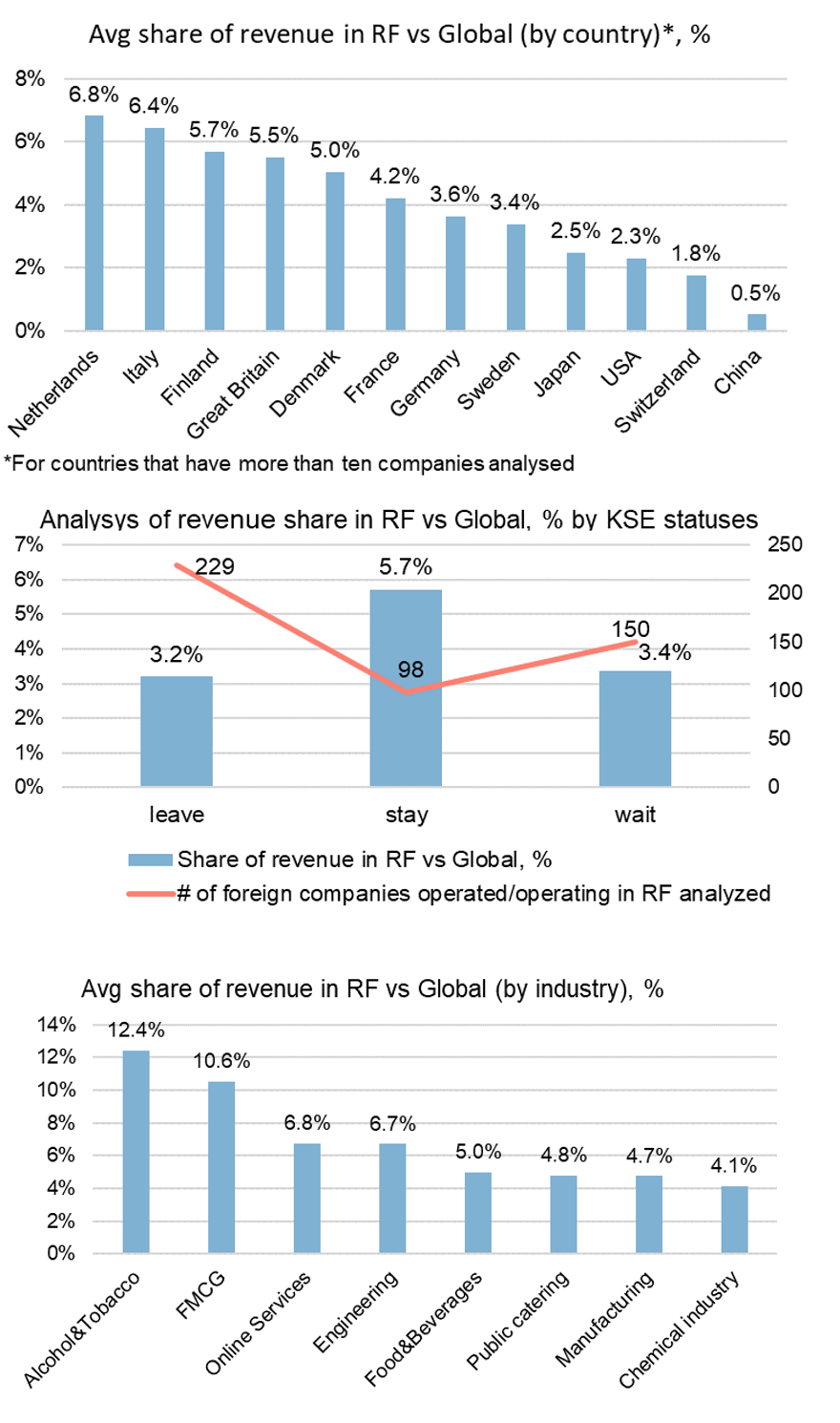

KSE Institute analyzed annual reports of about 500 companies and their decisions to exit Russia. It concluded that for most foreign companies operating in Russia before February 24th, business in this country accounted, on average, for less than 4% of total revenues (see graph to the right).

The share of business for those companies that have already announced their exit from Russia (on average, 3.2% for 229 analyzed companies) is significantly lower than for companies that remain (5.7% for 98 companies) and slightly lower for wait-and-see companies (3.4% for 150 companies), see graph to the right.

If we analyze these data by industry, the following sectors have a share of local revenue higher than 4%: Alcohol and tobacco (12.4%), FMCG/consumer goods (10.6%), Online – services (6.8%), Engineering (6.7%), Food and Beverages (5.0%), Public catering (4.8%), Industrial Production ( 4.7%) and Chemical industry (4.1%), see graph to the right.

Data source: KSE Institute database, Wikipedia and company websites

For separate companies, dependency on the Russian market can be much higher. For instance, for Dutch retailer Spar and French Leroy Merlin, the share of Russian revenue is close to 60%. And for Turkish glass producer Şişecam and Italian manufacturer of chocolate and confectionery products, Ferrero is above 50%. No wonder these companies are reluctant to leave the market. At the same time, there are examples of decisions to leave Russia even with high exposure to the market. Latvian Elko Grupa, a distributor of IT and consumer electronics with a share of sales in Russia at 53%, was one of the first to exit the market entirely. Recently, Finland’s Nokian Tires announced their decision to leave Russia, despite the share of Russian revenues being 49%.

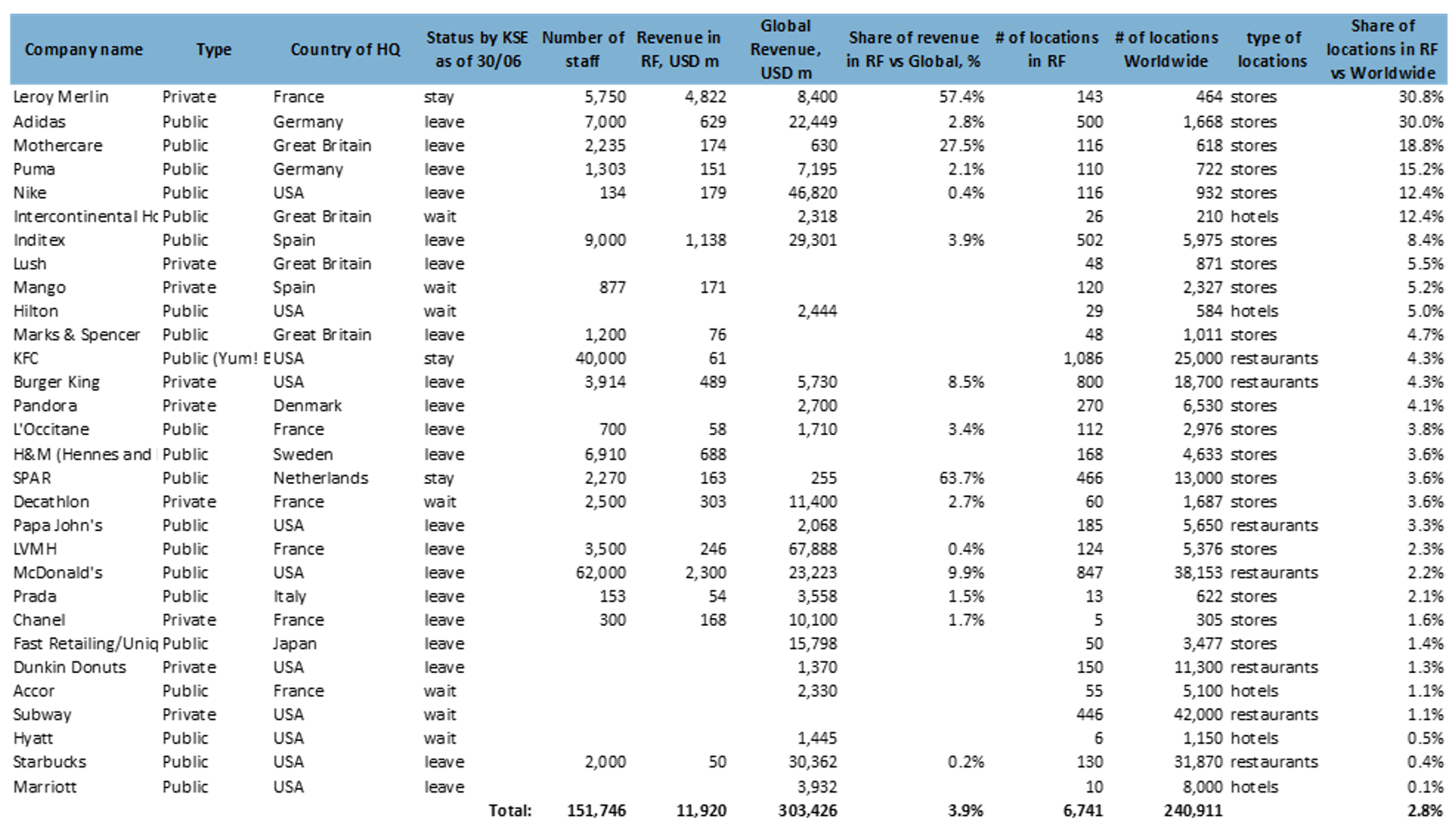

KSE Institute also analyzed 18 popular brands in the consumer sector that sold food and beverages, clothing, cosmetics and household chemicals, five hotel chains and seven restaurant chains. For most consumer brands that left or intended to leave Russia, business in this country accounted, on average, for less than 4% of revenue. On the other hand, Russians will first feel the absence of these products and services. At the same time, the total number of locations in the Russian Federation for analyzed companies was 6,741 compared to 240,911 locations worldwide, so the share of premises in Russia is also relatively low – 2.8%.

Data source: KSE Institute database, Wikipedia and company websites

Recently our partners, We are Ukraine, analyzed the Top-100 most expensive brands by comparing their business in Russia and abroad and came to the conclusion that only 22 out of the 100 most valuable global brands haven’t been working in or with Russia at the time when it waged a full-scale war against Ukraine on February 24, 2022. The rest of the 78 companies faced the dilemma — leave the aggressor country for good, reduce some operations in the hope of buying some time, or ignore the world’s biggest humanitarian disaster since WWII and continue doing business as usual in Russia.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)

04.07.2022

*Mitsui OSK Lines (Japan, Marine Transportation) Status by KSE – stay

Japan’s largest shipping company, Mitsui OSK, President and CEO Takeshi Hashimoto said on the 3rd that Japan had no choice but to continue buying Russian liquefied natural gas (LNG).

https://news.v.daum.net/v/20220704142411489

*Schneider Electric (France, Electronics) Status by KSE – leave

France’s Schneider Electric to sell Russia unit to local management

05.07.2022

*Indian Institute of Spices Research (IISR) (India, Agriculture) Status by KSE – stay

The Indian Institute of Spices Research (IISR) under the Indian Council for Agricultural Research (ICAR) inked a Memorandum of Understanding (MoU) with Lysterra LLC, a Russia-based company for commercialisation of biocapsule, an encapsulation technology for bio-fertilisation.

*MSD (USA, Pharma, Healthcare) Status by KSE – wait

The American MSD stops supplying the Russian Federation with vaccines against chickenpox, rubella, measles and mumps, which are also produced by other manufacturers, but will retain sales of its drugs that do not have analogues.

https://www.kommersant.ru/doc/5446031

*IKEA (Sweden, Consumer goods and clothing) Status by KSE – leave

IKEA reopens for online fire sale in Russia before market exit

*Huawei (China, Electronics) Status by KSE – wait

Huawei is actively recruiting new employees in Russia

https://www.kommersant.ru/doc/5436796

*PwC (Great Britain, Consulting & Law) Status by KSE – leave

On 30 June the legal agreement for the departure of the firm in Russia from the PwC Network was signed. “ We can confirm that today (4 July 2022) all aspects of the departure of the former PwC firm in Russia have been completed and PwC no longer has a firm in Russia”.

06.07.2022

*KFC (USA, Public catering) Status by KSE – wait

Company is also in advanced stages of transferring ownership of its KFC restaurants, operating system and master franchise rights, including the network of franchised restaurants, to a local operator.

*Yum Brands (USA, Public catering) Status by KSE – leave

Announced the current process of exiting the Russian market. Last month, Yum! completed the transfer of ownership of all assets of the Pizza Hut franchise to a local operator. The company is also in the advanced stages of transferring ownership of its KFC restaurants.

https://www.yum.com/wps/portal/yumbrands/Yumbrands/news/company-stories/Update+on+Yum+Brands+Plan+to+Exit+Russia

*UniCredit Bank (Italy, Finance and payments) Status by KSE – stay

Still operating in Russia. UniCredit is considering leaving the Russian Federation, but with the possibility of returning after the war – Bloomberg

*Volvo (Sweden, Automotive) Status by KSE – leave

Automaker Volvo Group will reduce employees in the Russian Federation during the year. The company produced trucks at the plant in Kaluga, which is currently idle.

https://news.finance.ua/ua/volvo-protyahom-roku-provede-skorochennya-spivrobitnykiv-u-rosii

*BitMEX (Seychelles, Finance and payments) Status by KSE – wait

BitMEX (Crypto exchange) to Restrict Services to Russians in EU due to sanctions, Russians in Russia will not be affected

https://cryptobriefing.com/bitmex-to-restrict-services-to-russians-in-eu/

*Espersen (Denmark, Food & Beverages) Status by KSE – leave

Supplied fish to McDonalds, suspended operations 17.03.2022 after McDonalnds closed restaurants, 6.07.2022 decides to sell Russian business

*Women’s Tennis Association (USA, Sport) Status by KSE – wait

suspend Russian partnerships, bans participation under the name or flag of Russia or Belarus, but allows participation of individual athletes. Issued fines for the tournaments that banned participation of individual athletes from Russia and Belarus

*ArcelorMittal (Luxembourg, Metals and Mining) Status by KSE – leave

Resumed shipment of steal to Russia from its production in Kazakhstan

07.07.2022

*HSBC (Great Britain, Finance and payments) Status by KSE – wait

HSBC Is in Talks to Sell Russian Unit to Expobank.

*Total Energies (France, Energy, oil and gas) Status by KSE – wait

TotalEnergies quits Russia’s Kharyaga oil project in wake of sanctions

*Starbucks (USA, Food & Beverages) Status by KSE – leave

The coffee shops of the American chain Starbucks in Russia can be bought by a local restaurateur, the founder of the company Pinskiy&Co, Anton Pinsky.

https://www.epravda.com.ua/news/2022/07/7/688941/

*Volkswagen (Germany, Automotive) Status by KSE – leave

This week, the Volkswagen company will announce the liquidation of the production site in Nizhny Novgorod, says “Gazeta.ru” with reference to two sources, in particular – in the Russian office of the German company.

https://news.finance.ua/ua/volkswagen-likviduye-zavod-u-nyzhn-omu-novhorodi

*LPP (Poland, Consumer goods and clothing) Status by KSE – leave

The new owner of “RE Trading” LLC — the Russian division of the Polish retailer LPP — is the UAE-registered company “Farist Services-Fzco”. The record of this in the register is dated June 30.

08.07.2022

*Vilhelm Parfumerie (France, FMCG) Status by KSE – stay

In the first quarter, a mono-boutique Vilhelm Parfumerie was opened in the format of street retail

https://www.epravda.com.ua/rus/news/2022/07/7/688944/

https://www.forbes.ru/biznes/470827-kriticeskij-minimum-za-polugodie-na-rynok-retejla-vysli-lis-dva-inostrannyh-brenda

*Li-Ning (China, Consumer goods and clothing) Status by KSE – stay

in the second quarter, the first Chinese sportswear and footwear store of the Li-Ning brand was opened

https://www.epravda.com.ua/rus/news/2022/07/7/688944/

*Prisma (Finland, FMCG) Status by KSE – leave

close all business operations in Russia

https://s-ryhma.fi/en/news/s-group-will-close-all-business-operations-in-russ/1ryWAf2TE38Wo9OFv2BrUJ

https://www.esmmagazine.com/retail/russias-x5-to-buy-st-petersburg-chain-from-finlands-prisma-176842

*Four Season hotels (Canada, Hospitality, Real estate) Status by KSE – leave

Canadian Four Seasons has suspended direct management of hotels in Russia

https://news.finance.ua/ua/kanads-ka-four-seasons-pryzupynyla-pryame-upravlinnya-hotelyamy-v-rosii

*HDFC Bank (India, Finance and payments) Status by KSE – stay

HDFC Bank facilitated a domestic cement maker’s yuan trade purchase of Russian coal to avoid USD

https://www.asiafinancial.com/indias-hdfc-bank-aided-yuan-trade-in-russian-coal

*Koskinen (Finland, Manufacturing) Status by KSE – leave

Koskinen manufactures and markets wood products 7/07 has sold its sawing operations located in Russia to Cherepovetsles 8/03 discontinue its operations in Russia

*Hainan Airlines (China, Air transportation) Status by KSE – stay (sub-status – returned)

*BBK Electronics (China, Electronics) Status by KSE – stay

Xiaomi, Realme, Honor (a spinoff of smartphone maker Huawei), and Oppo now hold 61% of Russia’s smartphone market by sales as of May 2022

09.07.2022

*Turkish Airlines (Turkey, Air transportation) Status by KSE – stay

Still flying to Russia, extended suspension of flights to Minsk, Yekaterinburg, Rostov, and Sochi until the end of August.

https://twitter.com/turkiyenewsen/status/1544972798631739392

Get more details on a daily basis:

KSE Telegram bot on news monitoring @exit_ru_bot

Twitter of SelfSanctions project

¹ KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

² Including 1 company with sub-status “returned” – Hainan Airlines which resumes flights to Russia

³ +400 new public groups of companies added a total of approximately + $30 billion in annual revenue and +114 thousand staff as of 19/06/2022

⁴ As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. More details will be available soon once we analyze more data/information and find the reputable sources for verification.