- Kyiv School of Economics

- About the School

- News

- Impact of Foreign Companies Self-Sanctioning On RF Economy

Impact of Foreign Companies Self-Sanctioning On RF Economy

04 July 2022. Release №8

Prepared by the KSE Institute team and KSE members of the Board of Directors; 27.06-03.07.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains 40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce that we are in the process of merging with project leave-russia.org which was developed by a team of volunteers.

KSE DATABASE SNAPSHOT as of 03.07.2022

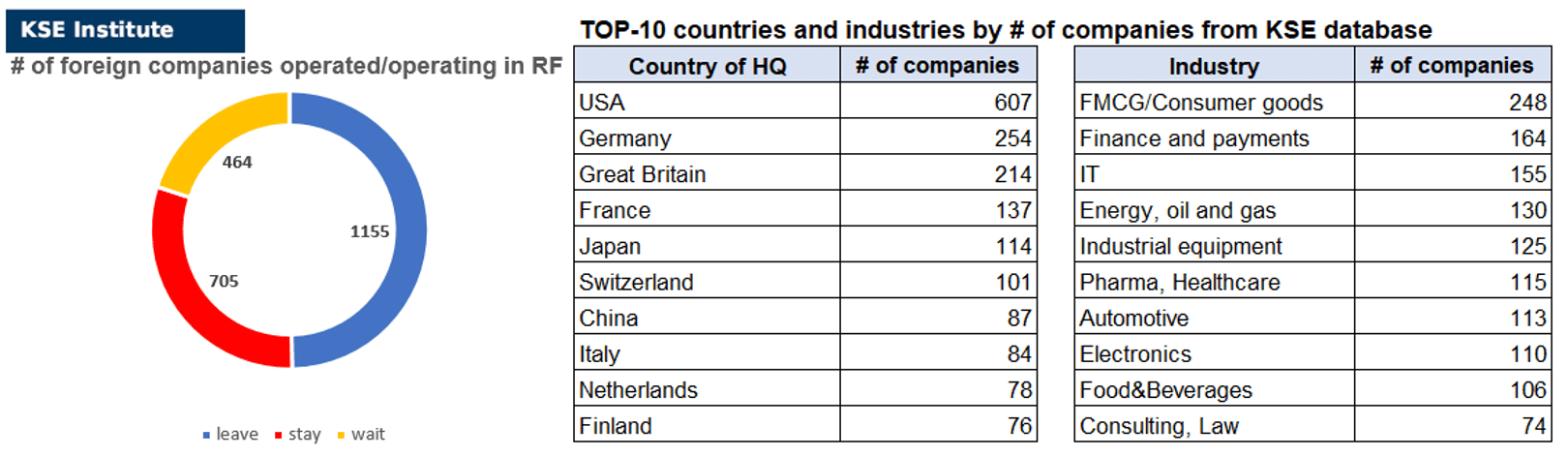

Number of the companies that continue Russian operations (KSE’s status “stay”¹ ) – 705 (+33 per week²)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status “wait”) – 464 (0 per week)

Number of the companies that have curtailed Russian operations (KSE’s status “leave”) – 1 155 (+64 per week)

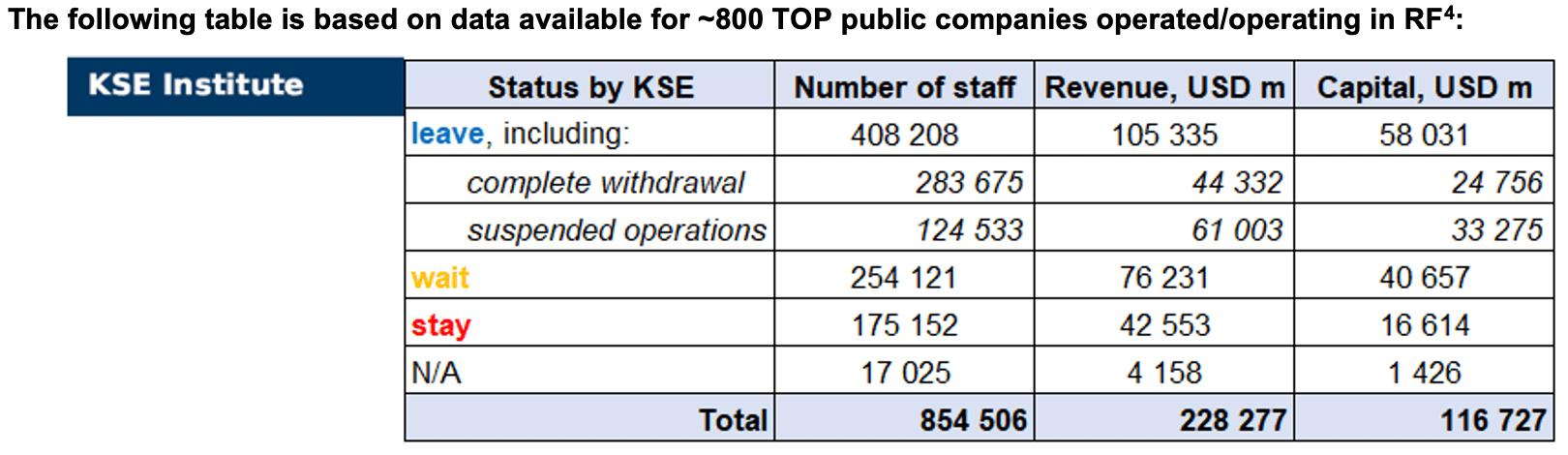

As of July 03, we have identified about 2,324 companies, organizations and their brands from 76 countries and 56 industries and analyzed their position on the Russian market. About half of them are public ones, for ~ 800³ public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity), which allowed us to calculate the value of capital invested in the country (about $116.7 billion), local revenue (about $228.3 billion), as well as staff (about 0.85 million people). 1,619 foreign companies have reduced, suspended or ceased operations in Russia.

As can be seen from the tables below, As of July 03, companies that declared a complete withdrawal from Russia had $44.3bn in revenues and $24.8bn in capital; companies that suspended their operations on the Russian market had yearly revenue of $61.0bn and $33.3bn in capital. TOP-70 companies-the largest taxpayers paid ~ $20,2bn of taxes annually – haven’t completely withdrawn yet, although suspended or scaled back.

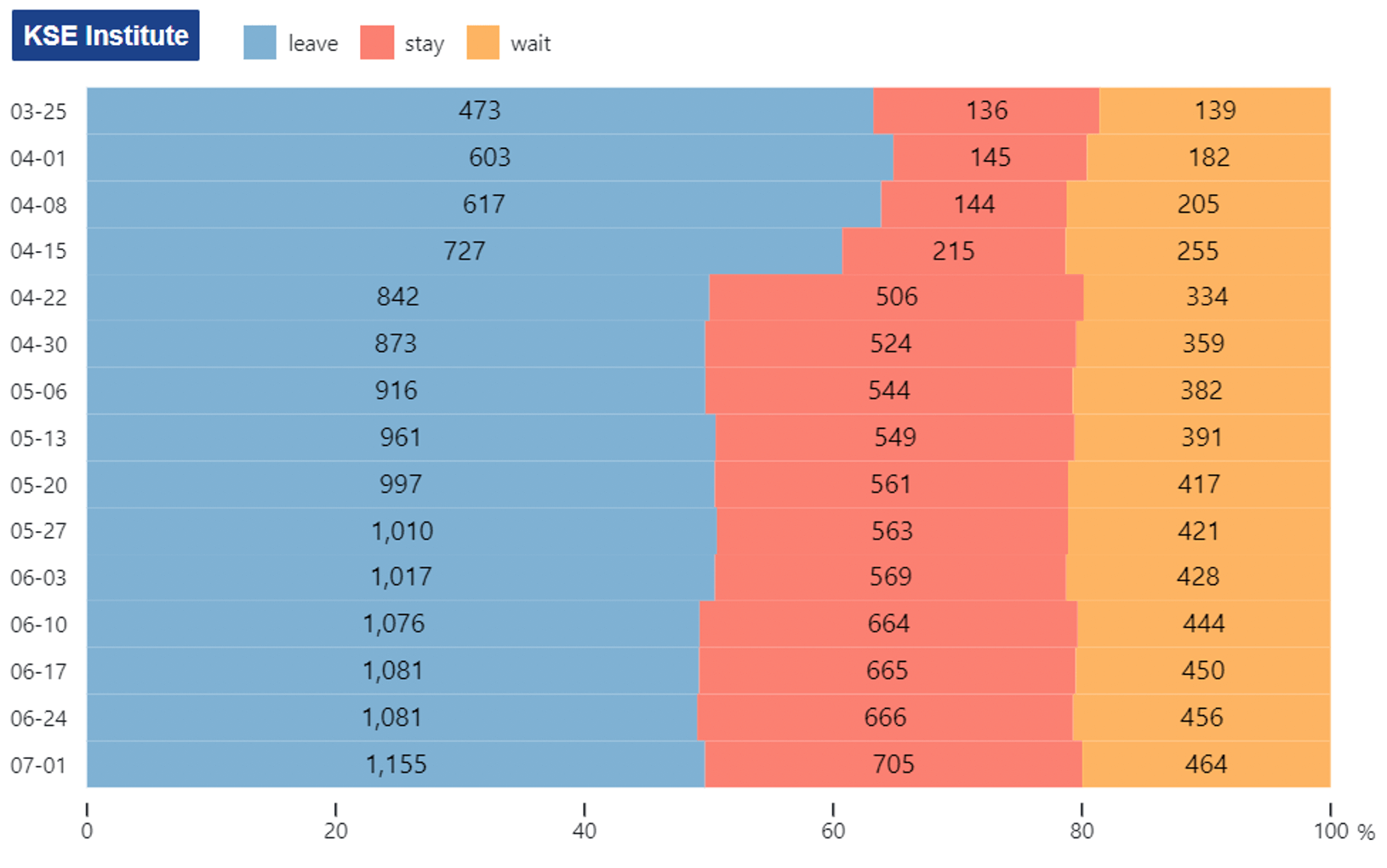

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about a half (49.7%) of foreign companies have already announced their withdrawal from the Russian market, but another 30.3% are still remaining in the country.

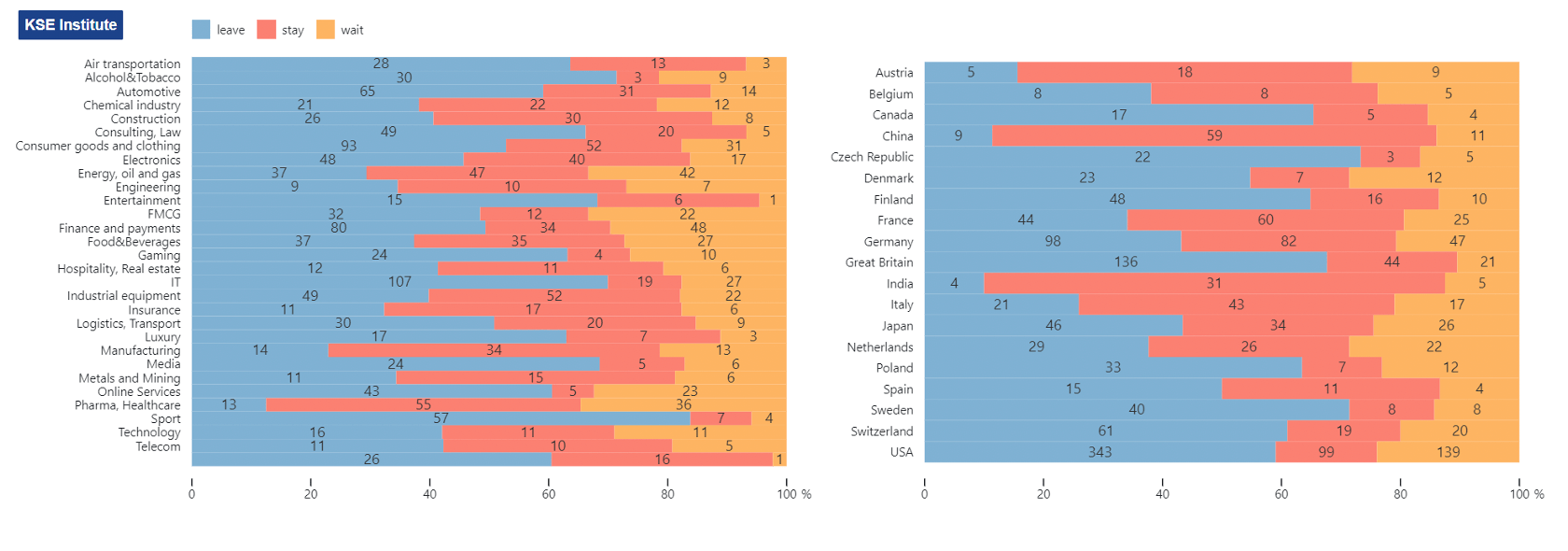

The actions of companies by sector (based on the KSE database, with at least 20 companies representing the industry or country) are shown in the graphs below.

Decisions of Western companies by country and sector:

WEEKLY FOCUS. GOLD MINING IN RUSSIA

UK, US, Japan and Canada will ban Russian gold imports. The United States has already imposed sanctions. The European Union is working on a new plan to ban imports of Russian gold. Boris Jonson wrote on Twitter that it “will directly hit Russian oligarchs and strike at the heart of Putin’s war machine.”

346 tons of gold were produced in Russia in 2021 (excluding Gold Concentrates), making Russia the 2nd (after China) the world’s largest gold producer with a share of about 9.5%.

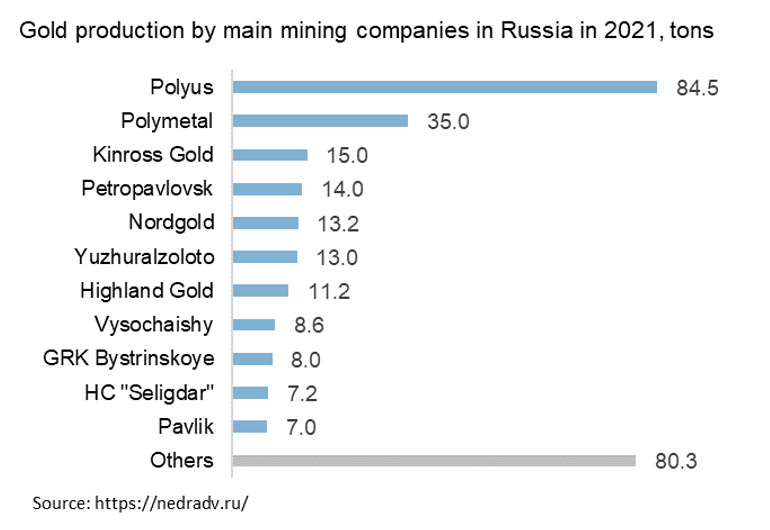

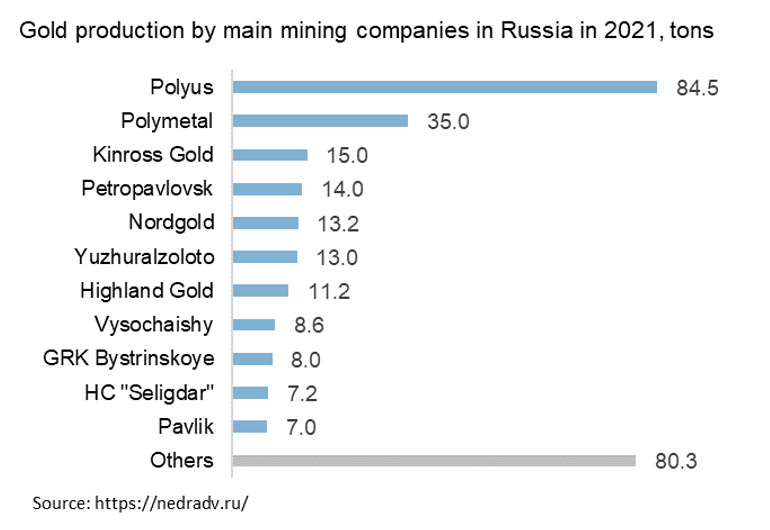

Gold production in Russia is consolidated, although not as strong as oil and gas or steel production. TOP-10 manufacturing companies account for 61% of the market⁵. In total, gold production is carried out by about 520 companies.

The most significant part of the gold produced in Russia is exported – 302 t in 2021 (87% of production). Russia mainly exported gold to the UK (266 t, 88% of exports) , the world’s largest gold hub. Some of the gold was shipped to Switzerland, the second-largest hub in the gold market. Deliveries to other countries were small as EU countries did not buy gold bars directly from Russia.

Russian export of gold has been severely limited since March. The London Stock Exchange no longer accepts Russian precious metals as the London Bullion Market Association (LBMA) suspended the Good Delivery status for all six accredited Russian refineries producing gold bars on March 7⁶.

Kinross Gold, the largest international gold mining company in Russia, has left the country

The largest gold mining companies in Russia are primarily Russian companies with one exception. In the 2000nds, international companies had been showing interest in Russian gold resources; however, most of them left in 2015. The imposition of sanctions, decline in gold prices, poor investor relations, non-transparent corporate governance have stopped investors⁷.

The largest company that remained in Russia was the Canadian Kinross Gold Corporation, the third-largest miner in Russia. Kinross announced its intention to leave the country in early April 2022 and completed the sale 100% of its Russian assets to the Highland Gold Mining group by June 15th⁸. The Sub-commission on the Control of Foreign Investments approved this transaction for a purchase price not exceeding $340 million. This is a substantial underpricing given that before the invasion of Ukraine, the value of KGC assets in Russia was estimated by investment banks at $1.5-2 bn .

There are still ways for Russia to sell gold

Russian gold miners can sell the metal to the Bank of Russia. The Central Bank of Russia has returned to buying gold on the domestic market since February 28, 2022. Russia can also export gold to countries that do not impose sanctions, including India and China, though It may require significant discounts⁹.

Meanwhile, according to data from the Swiss Federal Customs Administration, Switzerland imported more than 3 tons of gold from Russia in May for the first time since the invasion of Ukraine¹⁰.

This particular event shows that even though Russian exports of gold almost sank to zero since March 2022, introducing sanctions is essential. At the same time, export opportunities still remain and hitting Russian gold exports may require more effort.

WEEKLY FOCUS. GOLD MINING IN RUSSIA

UK, US, Japan and Canada will ban Russian gold imports. The United States has already imposed sanctions. The European Union is working on a new plan to ban imports of Russian gold. Boris Jonson wrote on Twitter that it “will directly hit Russian oligarchs and strike at the heart of Putin’s war machine.”

346 tons of gold were produced in Russia in 2021 (excluding Gold Concentrates), making Russia the 2nd (after China) the world’s largest gold producer with a share of about 9.5%.

Gold production in Russia is consolidated, although not as strong as oil and gas or steel production. TOP-10 manufacturing companies account for 61% of the market⁵. In total, gold production is carried out by about 520 companies.

The most significant part of the gold produced in Russia is exported – 302 t in 2021 (87% of production). Russia mainly exported gold to the UK (266 t, 88% of exports) , the world’s largest gold hub. Some of the gold was shipped to Switzerland, the second-largest hub in the gold market. Deliveries to other countries were small as EU countries did not buy gold bars directly from Russia.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

The most significant part of the gold produced in Russia is exported – 302 t in 2021 (87% of production). Russia mainly exported gold to the UK (266 t, 88% of exports) , the world’s largest gold hub. Some of the gold was shipped to Switzerland, the second-largest hub in the gold market. Deliveries to other countries were small as EU countries did not buy gold bars directly from Russia.

Russian export of gold has been severely limited since March. The London Stock Exchange no longer accepts Russian precious metals as the London Bullion Market Association (LBMA) suspended the Good Delivery status for all six accredited Russian refineries producing gold bars on March 7⁶.

Kinross Gold, the largest international gold mining company in Russia, has left the country

The largest gold mining companies in Russia are primarily Russian companies with one exception. In the 2000nds, international companies had been showing interest in Russian gold resources; however, most of them left in 2015. The imposition of sanctions, decline in gold prices, poor investor relations, non-transparent corporate governance have stopped investors⁷.

The largest company that remained in Russia was the Canadian Kinross Gold Corporation, the third-largest miner in Russia. Kinross announced its intention to leave the country in early April 2022 and completed the sale 100% of its Russian assets to the Highland Gold Mining group by June 15th⁸. The Sub-commission on the Control of Foreign Investments approved this transaction for a purchase price not exceeding $340 million. This is a substantial underpricing given that before the invasion of Ukraine, the value of KGC assets in Russia was estimated by investment banks at $1.5-2 bn .

There are still ways for Russia to sell gold

Russian gold miners can sell the metal to the Bank of Russia. The Central Bank of Russia has returned to buying gold on the domestic market since February 28, 2022. Russia can also export gold to countries that do not impose sanctions, including India and China, though It may require significant discounts⁹.

Meanwhile, according to data from the Swiss Federal Customs Administration, Switzerland imported more than 3 tons of gold from Russia in May for the first time since the invasion of Ukraine¹⁰.

This particular event shows that even though Russian exports of gold almost sank to zero since March 2022, introducing sanctions is essential. At the same time, export opportunities still remain and hitting Russian gold exports may require more effort.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)

27.06.2022

*Netflix (USA, Online Services) Status by KSE – leave

The company said it lost 200,000 subscribers in its first quarter, short of its forecast of adding 2.5 million subscribers. Suspending service in Russia after the Ukraine invasion has also cost Netflix 700,000 members.

28.06.2022

*Ponsse PLC (Finland,Automotive) Status by KSE – leave

On 28 June 2022, Ponsse signed the deed of sale, according to which Ponsse’s operations in Russia will transfer to OOO Bison once the conditions of the transaction have been met.

*Whirlpool (USA,Electronics) Status by KSE – leave

The American company Whirlpool sold its Russian assets to the Turkish Arcelik.

https://www.interfax.ru/business/849191

*Michelin Tire (France,Automotive) Status by KSE – leave

Michelin announces its intention to transfer its activities in Russia to local management by the end of 2022

After suspending its manufacturing activities in Russia on March 15, Michelin now confirms that it is technically impossible to resume production, due in particular to supply issues, amid a context of general uncertainty.

*Kone (Finland, Construction) Status by KSE – leave

The share purchase agreement with local management is subject to approval by the relevant regulatory authorities in Russia and is expected to close during the fourth quarter of 2022. The value of the planned transaction is not disclosed.

Following the closing of the deal, the business will operate independently under a different brand

*IHG Hotels & Resorts (Great Britain,Hospitality, Real estate)Status by KSE – leave

We are now in the process of ceasing all operations in Russia consistent with evolving UK, US and EU sanction regimes and the ongoing and increasing challenges of operating there. We also closed our corporate office in Moscow.

https://www.ihgplc.com/en/news-and-media/news-releases/2022/ihg-update-on-russia

*Xbox (Microsoft) (USA, Gaming) Status by KSE – wait

Microsoft has closed its Xbox office in Russia. An official statement on this issue is expected to be published in the coming days – probably on June 30.

https://news.finance.ua/ua/microsoft-zakryla-ofis-xbox-v-rosii

29.06.2022

*CEZ (Czech Republic, Energy, oil and gas) Status by KSE – wait

Czech state-controlled energy company CEZ has signed a contract with US nuclear power technology company Westinghouse and French Framatome for the supply of fuel assemblies for the Temelin Nuclear Power Plant.The contract is part of a shift by nuclear power station operators away from reliance on Russian nuclear fuel supplies.

*Diageo (Great Britain, Food & Beverages) Status by KSE – leave

The company-owner of the brands Smirnoff, Guinness, Baileys and Captain Morgan leaves Russia.

30.06.2022

*Honor (China, Electronics) Status by KSE – wait

The Chinese electronics manufacturer Honor suspended the official supply of devices to the Russian Federation

https://www.epravda.com.ua/news/2022/06/30/688697/

*Amway (USA, Consumer goods) Status by KSE – leave

Winding down operations in Russia 29.06.2022, suspended operations 14.03.2022

https://www.amwayglobal.com/newsroom/amway-winding-down-operations-in-russia/

*GC Rieber Shipping (Norway, Logistics, Transport) Status by KSE – leave

GC Rieber Shipping Exits Russian Market, takes ice-breaking tug out of country, leaves crew transfer vessel in Russia. GC Rieber Shipping is a Norwegian shipping company that operates offshore subsea support vessels, marine seismic vessels and polar logistics and research expeditions.

https://www.hellenicshippingnews.com/gc-rieber-shipping-exits-russian-market/

*Baker McKenzie (USA, Consulting, Law) Status by KSE – leave

Moscow partner Vladimir Efremov presented on a panel at the Putin-hosted Conference.

Plus, “Baker & McKenzie” trademark in Russia is owned by Baker & McKenzie LLP, based in Chicago. While the firm is organized globally as a Swiss verein, this filing indicates the U.S. partnership that is part of the verein continues to allow the Russian firm to operate using the Baker McKenzie name.

*Bunge (USA, Food & Beverages) Status by KSE – leave

Bunge denies plans to scale back in Russia and sell its Russian subsidiary. Previously they suspended export from Russia

01.07.2022

*Nvidia (USA, IT) Status by KSE – leave

The American company stopped selling and renewing licenses for its software

https://www.kommersant.ru/doc/5436894

https://www.epravda.com.ua/news/2022/07/1/688745/

*Mitsui & Co (Japan, Conglomerate) Status by KSE – stay

*Mitsubishi Corporation (Japan,Automotive) Status by KSE – stay

Shares of Japan’s Mitsui & Co and Mitsubishi Corporation declined about 5% on Friday as Russia announced plans to set up a new company to take control of the Sakhalin-2 oil and gas project.

https://www.asiafinancial.com/mitsui-mitsubishi-shares-fall-as-russia-takes-over-sakhalin-2

02.07.2022

*Universal Pictures (USA, Films) Status by KSE – leave

The parent company decided to cease operations in the Russian Federation

*Nokian Tyres (Finland, Automotive) Status by KSE – leave

NOKIAN TYRES PLC initiates a controlled exit from Russia

*Thales/Gemalto (Thales Group) (France, Electronics) Status by KSE – wait

After the scandal, the French giant Thales will sell its business in Russia.

The French Thales Group refused to provide security for Russian banks

More details on daily basis:

KSE Telegram bot on news monitoring @exit_ru_bot

Twitter of SelfSanctions project

¹ KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

² About 100 companies have been added to the KSE Institute database in the last week as a result of synchronization with the website https://leave-russia.org , aslo the database was cleaned and few duplicates were removed

³ +400 new public groups of companies added a total of approximately + $30 billion in annual revenue and +114 thousand staff as of 19/06/2022

⁴ As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. More details will be available soon once we analyze more data/information and find the reputable sources for verification.

⁵ https://www.statista.com/statistics/1058919/largest-gold-producers-by-volume-russia/

⁶ https://www.lbma.org.uk/articles/good-delivery-list-update-gold-silver-russian-refiners-suspended/

⁷ https://www.ft.com/content/8fc7038c-f81f-11e6-9516-2d969e0d3b65/

⁹ https://quote.rbc.ru/news/article/62b9a21a9a79472a31213195