- Kyiv School of Economics

- About the School

- News

- IMPACT OF FOREIGN COMPANIES SELF-SANCTIONING ON RF ECONOMY

IMPACT OF FOREIGN COMPANIES SELF-SANCTIONING ON RF ECONOMY

28 June 2022

Prepared by the KSE Institute team and KSE members of the Board of Directors; 20-26.06.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains 40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

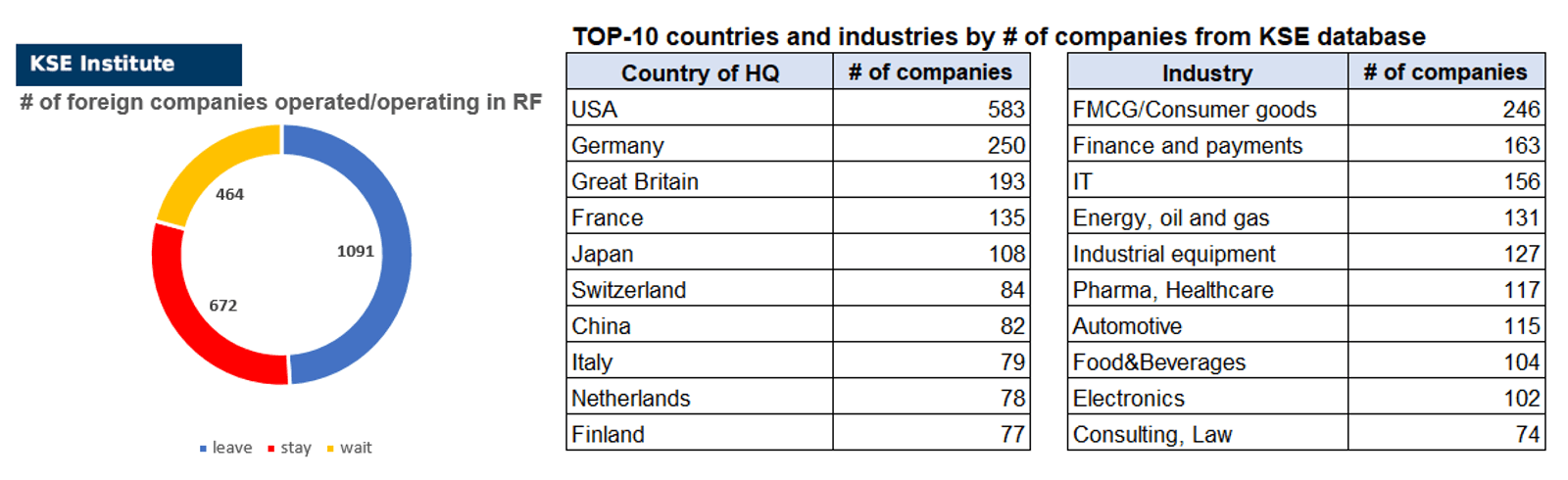

KSE DATABASE SNAPSHOT as of 26.06.2022

Number of the companies that continue Russian operations (KSE’s status “stay”¹ ) – 672 (-5 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status “wait”) – 464 (+7 per week)

Number of the companies that have curtailed Russian operations (KSE’s status “leave”) – 1 091 (-1 per week)

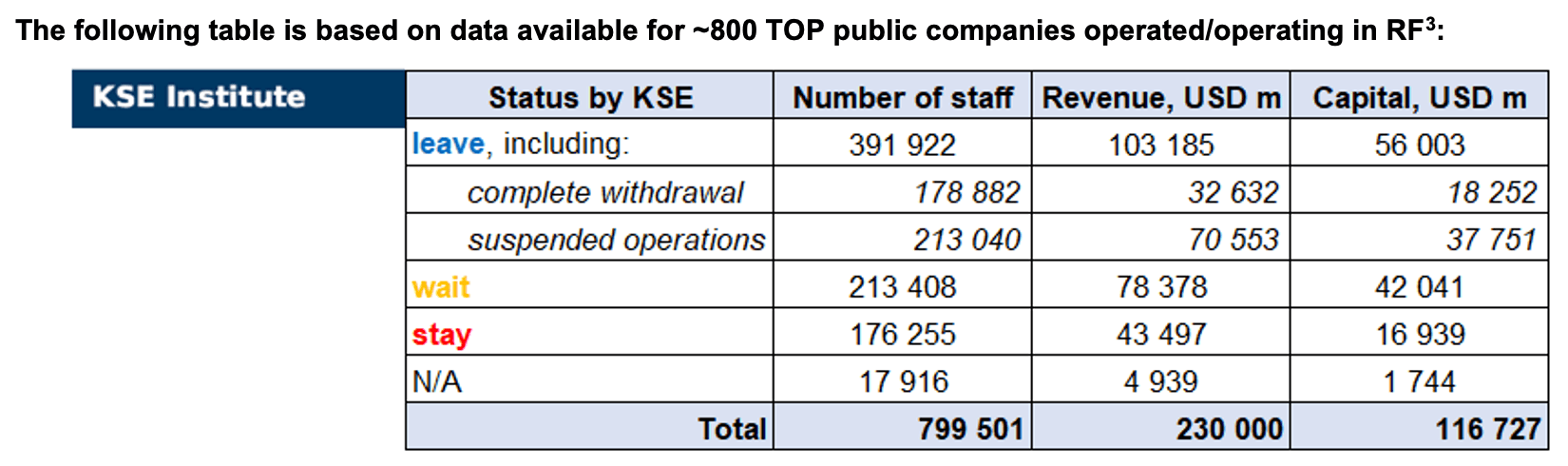

As of June 26, we have identified about 2,227 companies, organizations and their brands from 75 countries and 55 industries and analyzed their position on the Russian market. About half of them are public ones, for ~ 800² public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity), which allowed us to calculate the value of capital invested in the country (about $116.7 billion), local revenue (about $230 billion), as well as staff (almost 0.8 million people). 1,555 foreign companies have reduced, suspended or ceased operations in Russia.

As can be seen from the tables below, As of June 26, companies that declared a complete withdrawal from Russia had $32.6bn in revenues and $18.3bn in capital; companies that suspended their operations on the Russian market had yearly revenue of $70.6bn and $37.8bn in capital. TOP-70 companies-the largest taxpayers paid ~ $20,2bn of taxes annually – haven’t completely withdrawn yet, although suspended or scaled back.

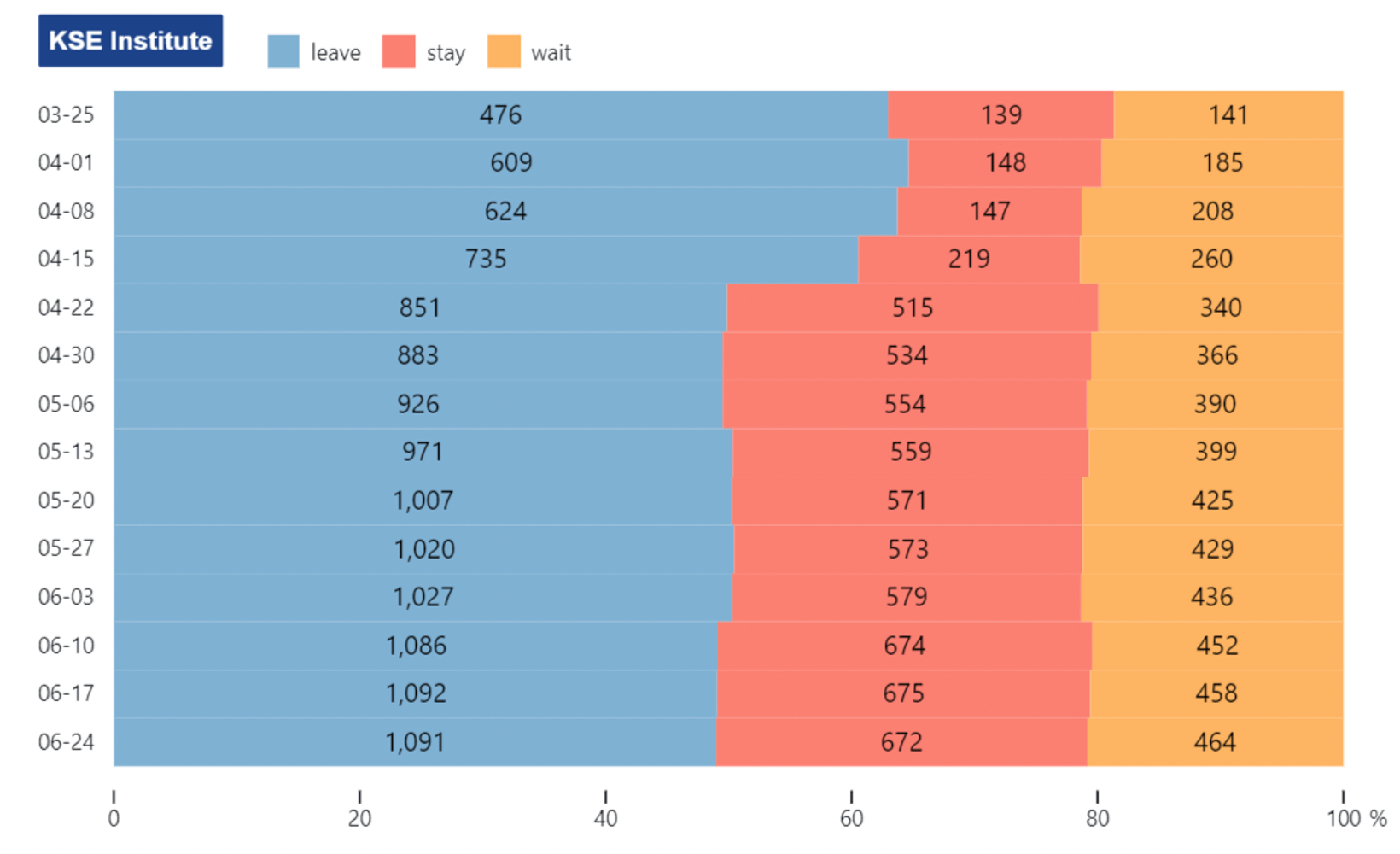

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about a half (49.0%) of foreign companies have already announced their withdrawal from the Russian market, but another 30.2% are still remaining in the country.

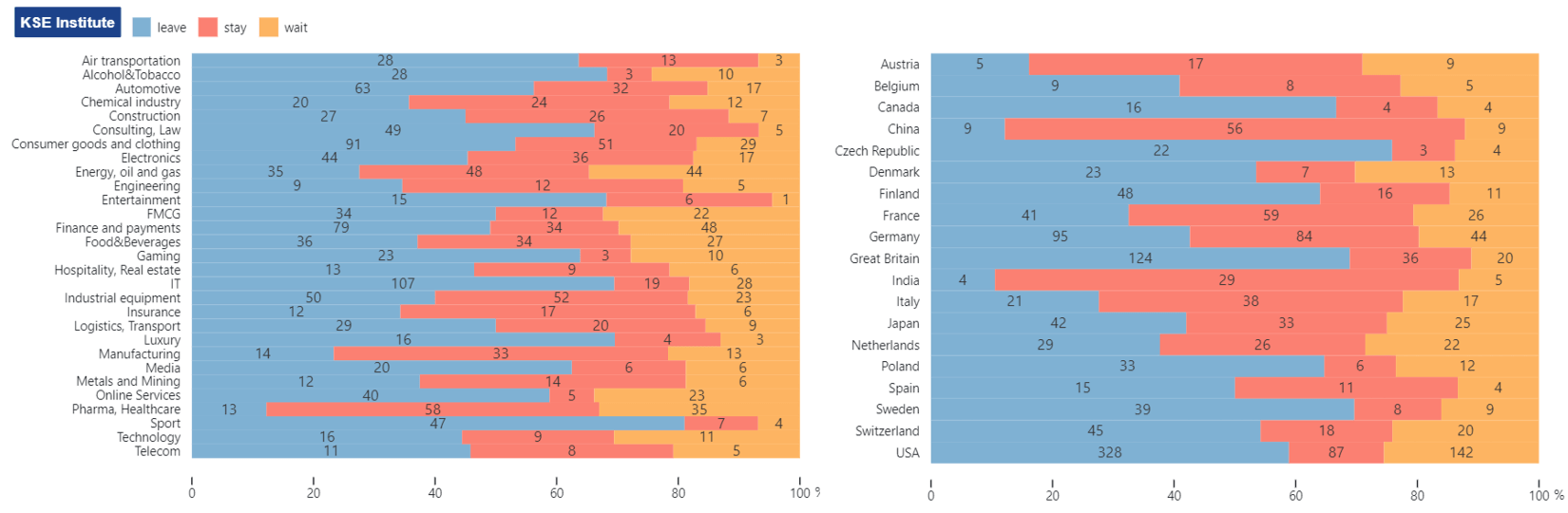

The actions of companies by sector (based on the KSE database, with at least 20 companies representing the industry or country) are shown in the graphs below.

Decisions of Western companies by country and sector:

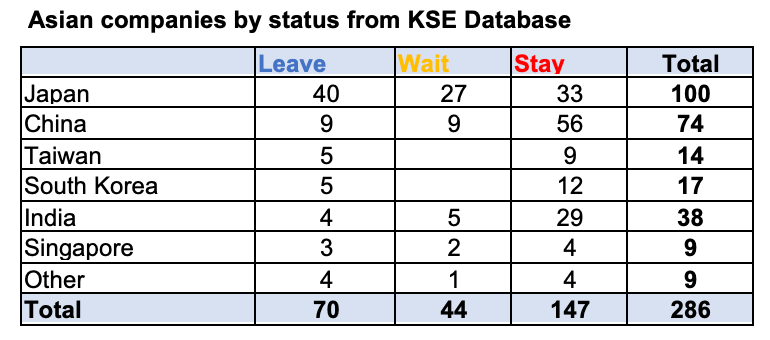

WEEKLY FOCUS. ASIAN COMPANIES (NOT) EXITING RUSSIA

While Western companies exit Russia massively, Asian companies are reluctant to leave the market. The only country with somewhat higher exit rates is Japan, while China and India are looking to benefit from the situation.

Japan has a more significant number of companies that left Russia or curtailed their operations compared to other Asian countries. Most of those that halted their operations in Russia are automotive and electronics companies. Automotive brands that had to stop production in Russia include Nissan, Toyota, Mitsubishi, Komatsu, Mazda, Isuzu, and Bridgestone Tires.

Still, only a few Japanese companies left the market completely; most of the suspension of operations is temporary. Japanese companies do not mention details of leaving the market and rather avoid clear statements. For instance, Stellantis and Mitsubishi Motors, which have a joint venture in Kaluga, made slightly different announcements.

Mitsubishi Motors Corporation has stopped production at its Kaluga plant in Russia until further notice. Due to logistical difficulties, vehicle exports and parts supply to Russia have been suspended since March⁴

Given the rapid daily increase in cross sanctions and logistical difficulties, Stellantis has suspended its manufacturing operations in Kaluga to ensure full compliance with all cross sanctions and to protect its employees.

Stellantis condemns violence and supports all actions capable of restoring peace.⁵

Chinese and Indian companies have done the least to cut ties with Russia compared to businesses from other countries. By far, they mostly have not left Russia (except for a few banks in China and their activity is limited by sanctions). Moreover, these countries (China and India) have significantly (several times more) increased their import of oil and gas by tankers from Russia while other countries are trying to limit it due to sanctions imposed.

For Russia, Asia and in particular, China may be the source of replacement for western companies that left the market. This is especially true for machinery production and electronics. Chinese companies avoid public statements on the war in Ukraine and are under fire for reportedly exiting Russia⁶. However, there are reports that some Chinese companies are silently curtailing operations in Russia, including Lenovo and Xiaomi⁷. Huawei closes some of its sale points in Russia due to the supply shortage and reviews its products in Russia to avoid US sanctions⁸. DJI suspended operations in both Russia and Ukraine to prevent the use of its drones for military purposes

Several Korean companies suspended Russian operations as well. Hyundai suspended production in Russia, and Samsung and LG Electronics suspended shipping products to Russia. However, these are rather exceptions. Russian projects for liquefied natural gas (LNG) are substantially dependent on ships from Korea. Korea Shipbuilding & Offshore Engineering (former Hyundai Heavy Industries), Samsung Heavy Industries and Daewoo Shipbuilding & Marine Engineering are South Korea’s leading three shipbuilders. They are reported to have contracts with Russian entities valued at around $6.5 billion. On 21 April 2022, Samsung Heavy Industries delivered one of two ice-class ships to Sovcomflot; on May 19, Daewoo Shipbuilding canceled a Russian LNG order after the customer failed to pay.

Asian companies do not rush to exit Russia. Japan can be considered an exception with somewhat higher exit figures, though even in the case of Japan, companies have been temporarily halting their operations. China and India are looking for ways to benefit from Western companies’ departure, including larger oil and gas purchases. China also increases machinery exports to Russia as it can become a source of replacement for products unavailable to Russia from Western countries.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)

20.06.2022

*Mango (Spain, Consumer goods and clothing) Status by KSE – leave

Mango refuses direct sales in Russia 23 years later due to the war

https://cincodias.elpais.com/cincodias/2022/06/18/companias/1655553463_690888.html

21.06.2022

*Tata Steel (India, Metals and Mining) Status by KSE – leave

India’s top steelmaker Tata Steel imported about 75,000 tonnes of coal from Russia in the second half of May, two trade sources and one government source said, weeks after pledging to stop doing business with Russia.

*Microsoft (USA, IT) KSE status – wait

Windows 10 and Windows 11 downloads blocked in Russia

*Pyxus (USA, Alcohol & Tobacco) Status by KSE – stay

The Morrisville-based tobacco company does tens of millions in sales in Russia, which is facing global economic backlash amid the war in Ukraine. In an annual financial report, Pyxus reported revenue of $57.8 million through direct sales to entities in Russia.

https://spotonnorthcarolina.com/nc-business/2178832/sanctions-jeopardize-pyxus-58m-in-russian.html

*The International Ski Marathon Federation (Worldloppet) (Estonia, Sport) Status by KSE – leave

18/06/2022 The International Ski Marathon Federation (Worldloppet) banned Russian and Belarusian athletes from its competitions.

https://www.worldloppet.com/annual-general-meeting-in-mora-with-extensive-decisions/

*Idexx Labs (USA, Pharma, Healthcare) Status by KSE – leave

IDEXX has decided to wind down and liquidate our sole Russian subsidiary, as well as its direct Russian operations, starting immediately. These discontinued operations consist of marketing and selling diagnostic products for veterinary clinics in Russia.

22.06.2022

Siemens Energy AG (Independent) (Germany, Energy, oil and gas) Status by KSE – wait

Canada Working With Germany on Options to Restore Vital Gas Flow.

Penalties on Russia for invading Ukraine left a turbine needed to help run the Nord Stream pipeline stranded in Canada. Soon after, Russia’s state-run gas giant Gazprom PJSC slashed supplies through the pipeline, the biggest gas link to the European Union, to just 40% of capacity.

*Philip Morris (USA, Alcohol&Tobacco) Status by KSE – wait.

Philip Morris has not been able to find a buyer for its assets in Russia for three months

https://www.rbc.ua/ukr/news/philip-morris-tri-mesyatsa-nayti-pokupatelya-1655893549.html

*FIFA (Switzerland, Sport) Status by KSE – leave

FIFA extends rules allowing foreigners to suspend employment contracts with Russian clubs till June 30, 2023

23.06.2022

*Linde (Germany, Chemical industry) Status by KSE – wait

Germany’s Linde may withdraw from a project with Gazprom to build an LNG plant

https://www.epravda.com.ua/news/2022/06/21/688393/

*S Group (Suomen Osuuskauppojen Keskuskunta) (Finland, Hospitality, Real estate) Status by KSE – leave

S Group announced the decision to exit the Russian market on 4.3.

22,6,2022 S Group says that it will sell 3 hotels to Alexander Ermakov and Yury Shumakov till June 30, 2022 and 16 Prisma supermarkets to X5 Group.

https://s-ryhma.fi/en/news/sok-sells-hotel-business-in-st-petersburg/BTpgc7zQGyCMYEAGjX3re

https://s-ryhma.fi/en/news/sok-sells-retail-stores-in-st-petersburg-to-x-5-gr/MPGtccp9RIGS8SfOGXJG4

*Siemens Mobility (Germany, Logistics, Transport) Status by KSE – wait

Siemens’ parent company announced its exit on May 12. Siemens Mobility has already announced the termination of contracts with Russian Railways for the maintenance of Sapsans and a contract worth 1.1 billion euros for the supply of Sapsans. In addition, Russian Railways is suing them – the St. Petersburg Arbitration Court took away equipment for servicing trains in favor of Russian Railways. There is still a joint venture with Sinara for the production of trains.

https://www.rbc.ru/business/16/05/2022/628252e79a79471533a8fc28

https://www.dp.ru/a/2022/05/25/RZHD_prosit_zapretit_Siem

*Viciunai group (Lithuania, Food & Beverages) Status by KSE – wait

Announce that they sell business in Russia but resumed production claiming that it is for the sale’s sake

24.06.2022

*Cisco Systems Inc (USA, IT) Status by KSE – leave

June 23 2022 Cisco Systems said Thursday it’s starting to wind down its business operations in Russia and Belarus nearly four months after the networking giant said it was stopping business there for “the foreseeable future” over Russia’s invasion of neighboring Ukraine.

https://www.cisco.com/c/m/en_us/crisissupport.html

Nike (USA, Consumer goods and clothing) Status by KSE – leave

“Nike has made the decision to leave the Russian marketplace. Our priority is to ensure we are fully supporting our employees while we responsibly scale down our operations over the coming months,”

https://www.reuters.com/business/exclusive-nike-make-full-exit-russia-2022-06-23/

25.06.2022

*Microsoft (USA, IT) Status by KSE – wait

Microsoft has revealed plans to completely wind down operations in Russia due to Western sanctions, The Press United reported.

*Wimbledon (Great Britain, Sport) Status by KSE – leave

Wimbledon’s decision to ban players from Russia and Belarus may not last beyond this year, says All England Lawns Tennis Club CEO Sally Bolton.

More details on daily basis:

KSE Telegram bot on news monitoring @exit_ru_bot

Twitter of SelfSanctions project

¹ KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

² +400 new public groups of companies added a total of approximately + $ 30 billion in annual revenue and +114 thousand staff as of 19/06/2022

³ As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. More details will be available soon once we analyze more data/information and find the reputable sources for verification.