- Kyiv School of Economics

- About the School

- News

- IMPACT OF FOREIGN COMPANIES SELF-SANCTIONING ON RF ECONOMY

IMPACT OF FOREIGN COMPANIES SELF-SANCTIONING ON RF ECONOMY

30 May 2022

Prepared by the KSE Institute team and KSE members of the Board of Directors; 23-29.05.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains 40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE DATABASE SNAPSHOT as of 29.05.2022

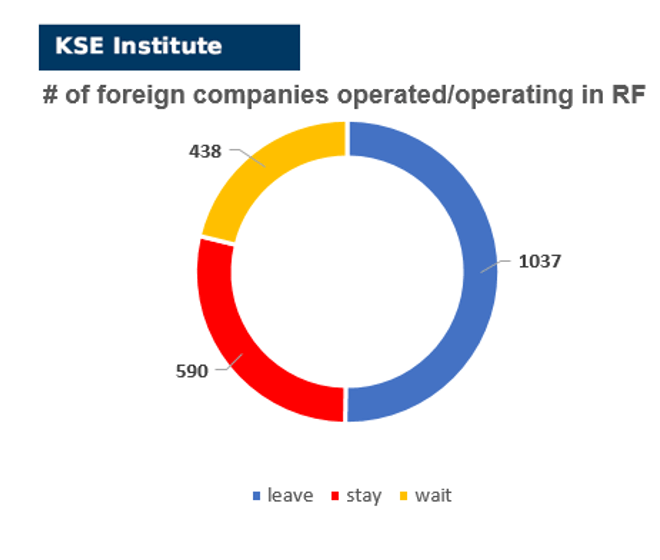

Number of the companies that continue Russian operations (KSE’s status “stay”¹ ) – 590 (+8 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status “wait”) – 438 (+8 per week)

Number of the companies that have curtailed Russian operations (KSE’s status “leave”) – 1 037 (+4 per week)

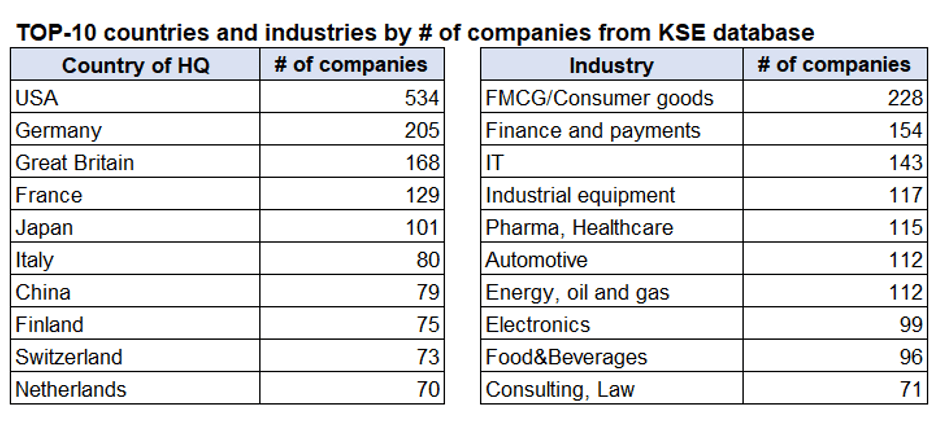

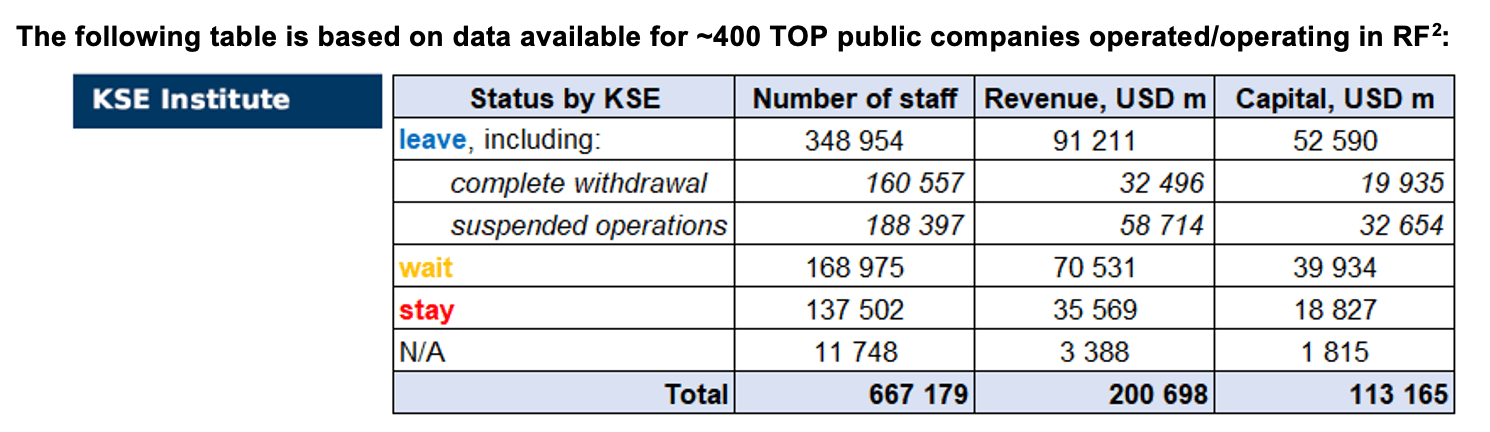

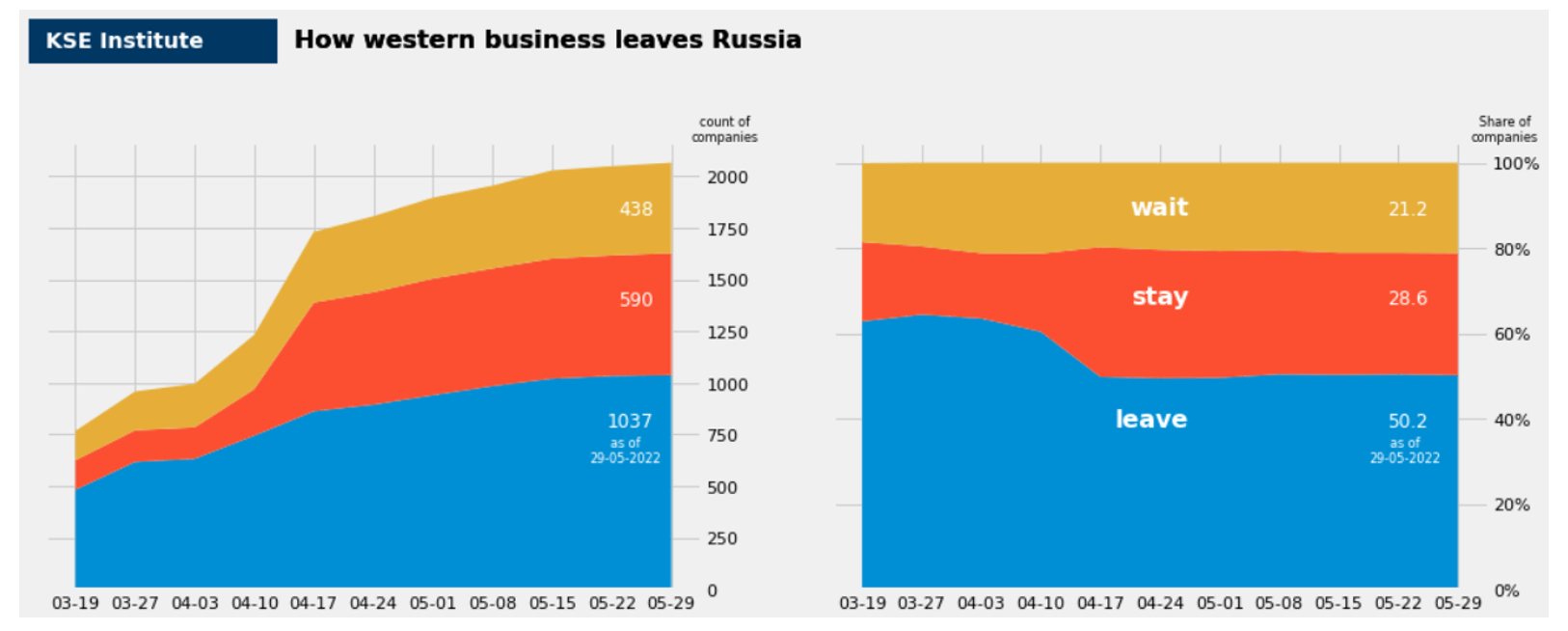

As of May 29, we have identified about 2,065 companies and organizations from 70 countries and 55 industries and analyzed their position on the Russian market. About half of them are public ones, for ~ 400 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity), which allowed us to calculate the value of capital invested in the country (about $113 billion), local revenue (about $200 billion), as well as staff (almost 0.7 million people). 1,475 foreign companies have reduced, suspended or ceased operations in Russia.

As can be seen from the tables below, As of May 29, companies that declared a complete withdrawal from Russia had $32.5bn in revenues and $19.9bn in capital; companies that suspended their operations on the Russian market had yearly revenue of $58.7bn and $32.7bn in capital. TOP-70 companies-the largest taxpayers paid ~ $20,2bn of taxes annually – haven’t completely withdrawn yet, although suspended or scaled back.

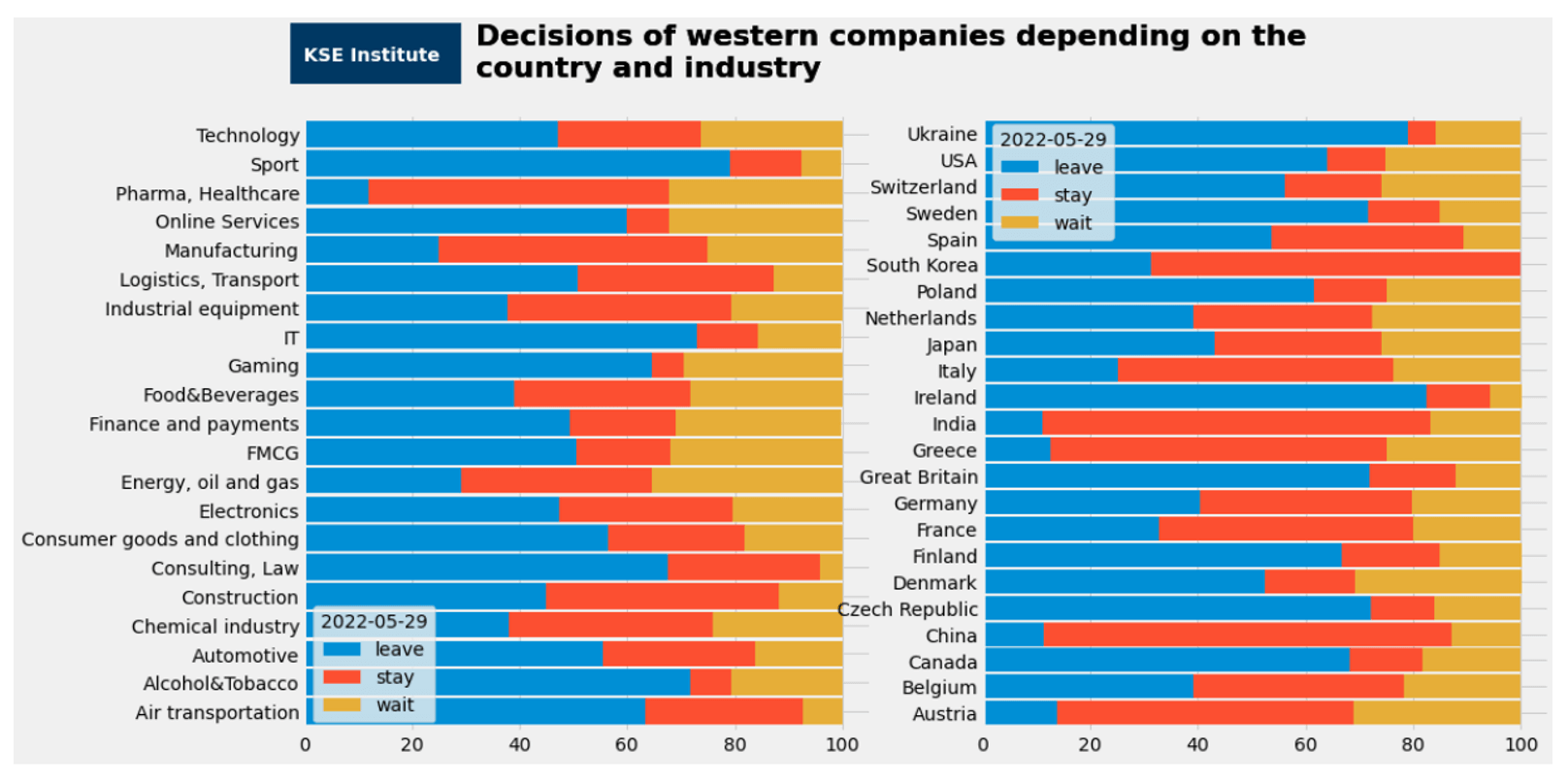

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, more than half (50.2%) of foreign companies have already announced their withdrawal from the Russian market, but another 28.6% are still remaining in the country.

The actions of companies by sector (based on the KSE database, with at least 50 companies representing the industry and with at least 40 companies per country) are shown in the graphs below.

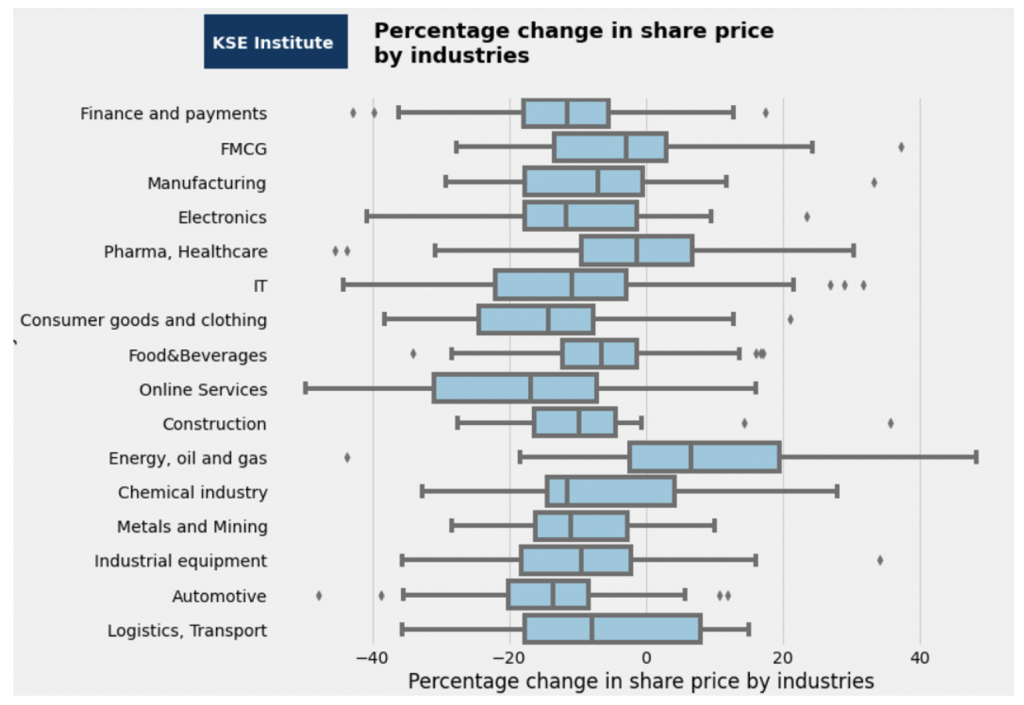

How the capitalization of the largest public companies changed during the war

The only industry that has shown steady growth is Energy, Oil and Gas.

WEEKLY FOCUS. AGRICULTURAL SECTOR

Western agricultural companies have remained in the market despite being pressured to leave Russia, citing humanitarian reasons.

Economic sanctions imposed by the EU, the US and other countries have not been applied to agricultural products due to humanitarian and food safety concerns. Russia is the largest wheat exporter globally, while Ukraine is the world’s fifth-largest exporter of wheat, fourth-largest exporter of corn and top exporter of sunflower oil and meal. The war will undoubtedly affect global food security.

Companies themselves are announcing scaling back operations but remain in Russia, including the largest western agricultural companies such as Archer Daniels Midland (ADM), Bunge, Cargill, and Louis Dreyfus (also known as the “Big 4 of World Agriculture” or as the “ABCDs”).

International companies in grain exports

Russia imposed a strict quota on grain export, 11 million tonnes from February 15 till June 30, 2022. Three foreign companies out of this top-10 list are supposed to ship 1.83 million tonnes, 16.6% of the total export. If they leave, their volume can be easily absorbed by other traders. The largest foreign traders are:

Viterra (#4, 8.5% of planned quota), a large global trader of Canadian origin, said it had suspended any new development and expansion projects within the region. However, it continued to operate its existing businesses in Russia in compliance with all current sanctions.

Cargill (#6, 4.7%), the American global commodity trader, declared the termination of new investments in Russia and claims to “scale down activities” without any additional details.

Louis Dreyfus (#7, 3.45%), a French global commodity trader, suspended its operations in Russia.

Seeds suppliers show a very similar trend.

BASF SE and Bayer AG (Germany) wind down all non-essential business in Russia and Belarus, but not the support of agricultural production.

Syngenta Group (Switzerland) continues to support Russian farmers. KWS SAAT SE (Germany) has decided not to invest in expanding or launching new business activities in Russia but will continue operations and seed supply for farmers.

Only a few announced their plans of withdrawal in the future. For example, Corteva (USA)has decided to withdraw from Russia and, having already paused new sales, is initiating a plan to stop production and business activities.

Please also read: Food security and policy publication series of the Center for Food and Land Use Research (KSE C4FLUR): https://kse.ua/wp-content/uploads/2022/05/Food-security-and-policy-in-Ukraine_issue-1_merged.pdf

What’s new last week – key news from Daily monitoring (updated on a weekly basis)

23.05.2022

*Levi Strauss (Levi Strauss & Co) (USA, Consumer goods and clothing) Status by KSE – leave.

The Levi Strauss & Co denim chain has decided to leave the Russian market after 29 years of operation: the company has stopped supplying goods and is looking for buyers for the retail business.

https://www.epravda.com.ua/news/2022/05/23/687330/

*Starbucks (USA, Food & Beverages) Status by KSE – leave.

The world’s largest chain of coffee shops Starbucks announced on Monday that it will leave the Russian market after almost 15 years of operation.

24.05.2022

*Sulzer (Switzerland, Industrial equipment) Status by KSE – leave.

Sulzer to exit the Russian market/ The sales process will begin with immediate effect and follows Sulzer’s announcement earlier in the year that it had already significantly reduced business activities in Russia.

https://www.sulzer.com/en/shared/news/220524-sulzer-to-exit-the-russian-market

*Coinbase (USA, Finance and payments) Status by KSE – wait.

The Coinbase cryptocurrency exchange restricts Russian users’ access to accounts.

https://news.finance.ua/ua/kryptobirzha-coinbase-blokuye-rahunky-rosiyan

25.05.2022

*Nike (USA, Consumer goods and clothing) Status by KSE – leave.

American sportswear brand Nike has decided to leave the Russian market. The company did not extend the franchise agreement with Inventive Retail Group (IRG), which owns the country’s largest monobrand chain of Nike stores.

*Marks & Spencer (Great Britain, FMCG) Status by KSE – leave.

British retailer Marks & Spencer (MKS.L) will pull out of Russia altogether and join rivals in warning about the outlook for the current year amid a worsening cost-of-living crunch.

https://www.reuters.com/business/retail-consumer/britains-ms-warns-outlook-profit-jumps-2022-05-25/

*Autogrill (Italy, public catering) Status by KSE – leave.

Italian transport caterer Autogrill is selling its operations in RussiaItalian transport caterer Autogrill is selling its operations in Russia (HMSHost)

*Shell (Great Britain, Energy, oil and gas) Status by KSE – leave.

Shell completes sale of retail and lubricants businesses in Russia

26.05.2022

*Equinor (Norway, Energy, oil and gas) Status by KSE – leave.

On 27 February 2022, Equinor decided to start the process of exiting the company’s Joint Ventures in Russia.

https://www.equinor.com/news/20220525-exits-joint-ventures-russia

*YouTube (USA, Online Services) Status by KSE – wait.

YouTube залишився в Росії, щоб служити джерелом незалежних новин, за словами генерального директора Сьюзен Войчіцкі, яка виступила на Всесвітньому економічному форумі в Давосі у вівторок, де вона також розповіла про рішення компанії видалити російські державні ЗМІ з платформи.

https://www.zdnet.com/article/youtube-remains-in-russia-to-be-an-independent-news-source-ceo/

*REHAU (Switzerland, consumer goods( polymer processing) Status by KSE – leave.

The REHAU Group will sell its business in Russia to the local management and will withdraw completely from the country.

https://www.rehau.com/group-en/rehau-sells-its-business-in-russia

*Equinor (Norway, Energy, oil and gas) Status by KSE – leave.

Equinor confirms exit from all Russian joint ventures. Equinor said it has now fully exited all joint ventures in Russia, concluding a process begun in February following the country’s invasion of Ukraine.

https://www.equinor.com/news/20220525-exits-joint-ventures-russia

*Auchan (France, FMCG) Status by KSE – stay.

French retailer Auchan does not plan to change its strategy in Russia or the structure of its local operations.

27.05.2022

DP Eurasia (Netherlands, Public catering) Status by KSE – stay.

DP Eurasia which runs the Domino’s Pizza brand in Turkey and Russia, said on Thursday its business in Russia remained sustainable despite tensions

*Cisco Systems Inc (USA, IT) Status by KSE – leave.

Cisco WebEx video conferencing service has stopped serving customers in Russia

*Nvidia (USA,IT) Status by KSE – leave.

Nvidia (NVDA) shares took a hit following the graphics card giant’s Q1 earnings on Wednesday, as the chip maker reported lighter than expected revenue projections for Q2. COVID lockdowns in China and Nvidia’s decision to stop selling products in Russia contributed to the revised guidance, CEO Jensen Huang told Yahoo Finance.

*Netflix (USA, Online Services) Status by KSE – leave.

Netflix users from Russia on the night of May 26-27 began to report the complete unavailability of the service without a VPN

https://www.epravda.com.ua/news/2022/05/27/687517/

*Huawei (China, Electronics) Status by KSE – wait.

Huawei has not officially left the Russian market, but has stopped supplying equipment and is not responding to inquiries.

*Shell (Great Britain, Energy, oil and gas) Status by KSE – leave.

Shell is in talks with a consortium of Indian energy companies to sell its stake in a major liquefied natural gas plant in Russia, three sources told Reuters, highlighting India’s willingness to step into the space left by Western companies following Moscow’s invasion of Ukraine.

28.05.2022

*Wella (Germany, Consumer goods and clothing) Status by KSE – leave.

In Russia, it is reported that the German cosmetics company Wella is leaving the country

*Nestle (Switzerland, FMCG) Status by KSE – wait.

“Nestle is not sponsoring the war.” The Swiss company has stated that it will not pay taxes in Russia

More details on daily basis:

KSE Telegram bot on news monitoring @exit_ru_bot

Twitter of SelfSanctions project

¹- KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

²We started to collect information for more companies and will update the database with extended information soon. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. More details will be available soon once we analyze more data/information and find the reputable sources for verification.

³ https://mcx.gov.ru/upload/iblock/9cc/9ccb4ca68b04d6012b56ca1f74bfb531.pdf

⁴ https://www.ft.com/content/cf2c7515-6076-454b-b94f-23827dff2ef4

⁵ https://www.cargill.com/story/statement-on-cargill-operations-in-eastern-europe

⁶ https://www.reuters.com/article/ukraine-crisis-grains-louisdreyfus-idINL2N2V72M3

⁷ https://www.basf.com/global/en/media/news-releases/2022/04/p-22-215.html

⁸ https://www.bayer.com/en/ukraine

¹¹https://www.corteva.com/resources/media-center/corteva-decides-to-withdraw-from-russia.htm