- Kyiv School of Economics

- About the School

- News

- Financing Ukraine’s Victory

Financing Ukraine’s Victory

17 September 2022

Jacob Nell, Olena Bilan, Torbjorn Becker, Yuri Gorodnichenko,

Tymofiy Mylovanov and Nataliia Shapoval

Introduction

Ukraine has just achieved a stunning success on the battlefield in the Kharkiv counteroffensive, showing that it can win the war. However, we see a growing risk of a major setback on the economic front if donor disbursements continue to be slow and unpredictable and predominantly coming as loans rather than grants. Such a setback – posing a further risk to macroeconomic stability, weakening the currency and driving inflation higher – could make it difficult for Ukraine to win the war. It would be a completely unnecessary setback, since it can be easily avoided by clearer upfront commitments by donors.

Here, we do not set out a broad macroeconomic framework for Ukraine during the war – proposals on this topic were set out in the recent CEPR piece (CEPR, August 2022, Becker et al). This argued for macroeconomic policies to put Ukraine’s economy on a sustainable trajectory for the duration of the war, including financing the budget without relying on the central bank, moving to a managed float of the currency, tougher regulation of trade and capital flows, and flexibility and efficiency in the allocation of scarce resources.

Rather, in this paper we focus on the crucial first task of financing the budget, justifying why partner should fund Ukraine’s huge wartime deficit, and proposing how to do so sustainably, i.e. without recourse to the central bank. In particular, we propose donors provide $50 bn in financing to cover the 2023 budget deficit – sufficient to finance the budget even in a less favourable scenario without putting domestic stability at risk. In the best case, we would see a large scale IMF programme of perhaps $15 bn as the centrepiece of this financing effort. But at any rate the IMF should agree a programme, monitored by the Board, which will pave the way for other donors to participate, and provide enough financing to cover the $2.7 bn payments due to the IMF itself next year.

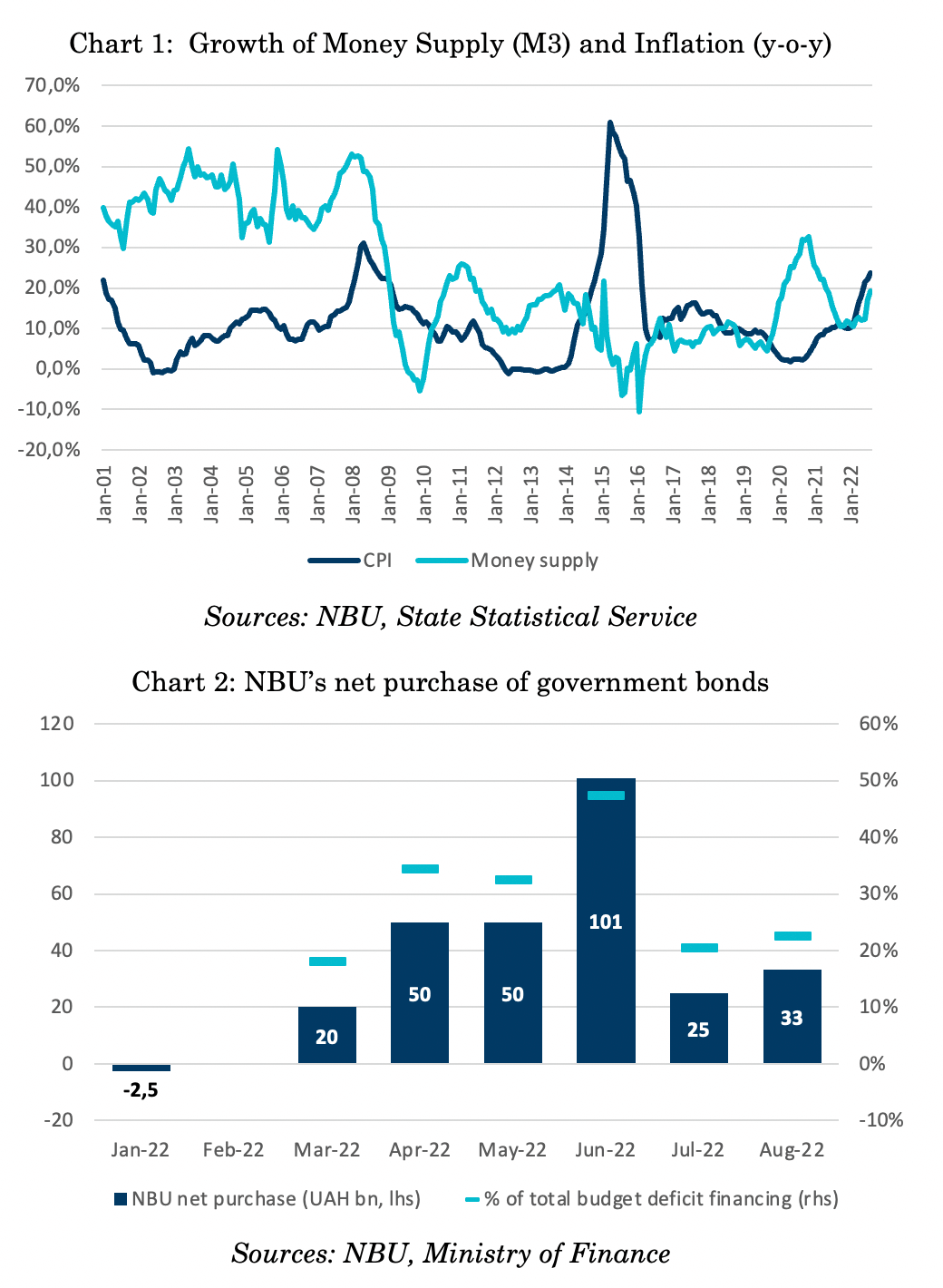

Danger of Deficit Monetization and Proposed Solution

Deficit monetization by the central bank, while being helpful in the first months of the war, puts Ukraine’s incipient and fragile macroeconomic stability at risk. In the first place, monetary financing could lead to a further decline in the currency and surge in inflation. But more generally, a further devaluation, after the 20% devaluation in late July, threatens a more widespread loss of trust in the currency, deeper dollarization and a de-anchoring of inflation expectations – which can then take an extended period of tight policy to rebuild confidence. Wars typically drive a sharp widening in the deficit, even as financing becomes less available, leading governments to resort to money printing. But this generally leads to high and persistent inflation, especially in emerging markets which lack access to external markets in a crisis, and domestically lack a developed financial system and pool of domestic savings, as in Ukraine.

The danger is insidious. There is no hard and fast link in the very short run between monetary financing – central bank financing of the budget deficit by buying ministry of finance bonds or making direct loans to or just crediting the account of the ministry of finance – and a weakening of the currency and increase in inflation. This can lull policymakers into thinking that a “moderate” level of monetary financing is permissible – and it may seem a relatively small risk to take in a war when the very existence of the country is under threat. In the initial aftermath of the invasion, there was no alternative. But over a somewhat longer period, the relationship between unbacked money creation and accelerating inflation is very strong, and substantial use of monetary financing will almost inevitably trigger an ongoing fall in the currency and an acceleration in inflation, which in turn risks de-anchoring inflation expectations, and can pave the way to very high and volatile levels of inflation. This would disrupt Ukraine’s economy and ability to finance the war, prolonging the conflict, and could require an extended period of tight policy – high real rates – to re-establish policy credibility, delaying the recovery.

In this paper we propose how to provide Ukraine with the financing needed to sustain the military, without putting financial stability at risk. In essence, Ukraine’s allies should step up and deliver on their broad political commitment to support Ukraine. There has been an impressive level of commitments made. However, actual disbursements have not come regularly, particularly from European donors. As a result, the Ukraine government is in a constant precarious state, not knowing which funds will be disbursed every month and often relying on monetary financing to bridge the gap.

We propose Ukraine’s international partners to allocate now a sum sufficient to finance the Ukraine budget for an extended period into a special fund. Disbursements from this fund to the Ukrainian budget would then be made on a regular and predicable schedule, likely monthly, against delivery of agreed data on the financing gap. This would make it possible to finance a budget which supports the Ukrainian military, while avoiding use of monetary financing and providing confidence that the deficit can be financed in a non-inflationary manner. This approach provides much needed predictability for Ukraine’s public finances.

Why Donors Should Fund the Deficit

We see three main reasons why Western governments should fund Ukraine’s deficit:

1. The first reason is simply that western governments have promised to support Ukraine, and failure to provide enough support in a timely way to avoid a loss of confidence would constitute a failure to deliver on this commitment. Commitment to a significant and sustained (rather than small and piecemeal) support will provide an additional signal that the allies are firmly behind Ukraine and thus accelerate Ukraine’s victory.

2. The second reason is the consequences of Ukrainian failure. This would demonstrate that a war of aggression like Russia’s invasion of Ukraine can be successful, and that the original crime of aggression, and subsequent acts, such as Russia’s war crimes, would go unpunished. Successful aggression, and impunity from justice, undermine the rule of law. Practically, success would encourage Russia to launch further acts of aggression, destabilising Europe and undermining peace.

3. The efficiency comes in two parts. First, Ukraine’s armed forces have been highly effective during the war with Russia, including by destroying huge amounts of Russian equipment – with for instance over 1000 Russian tanks and over 6000 items of Russian military equipment visually confirmed as destroyed – and inflicting heavy defeats on Russia, including Russia’s April defeat in the battle of Kyiv, and Russia’s September defeat in Ukraine’s Kharkiv counteroffensive. Moreover, these results have been achieved against the Russian army, which is a far more formidable adversary than the Taliban, the Iraqi army or ISIS.

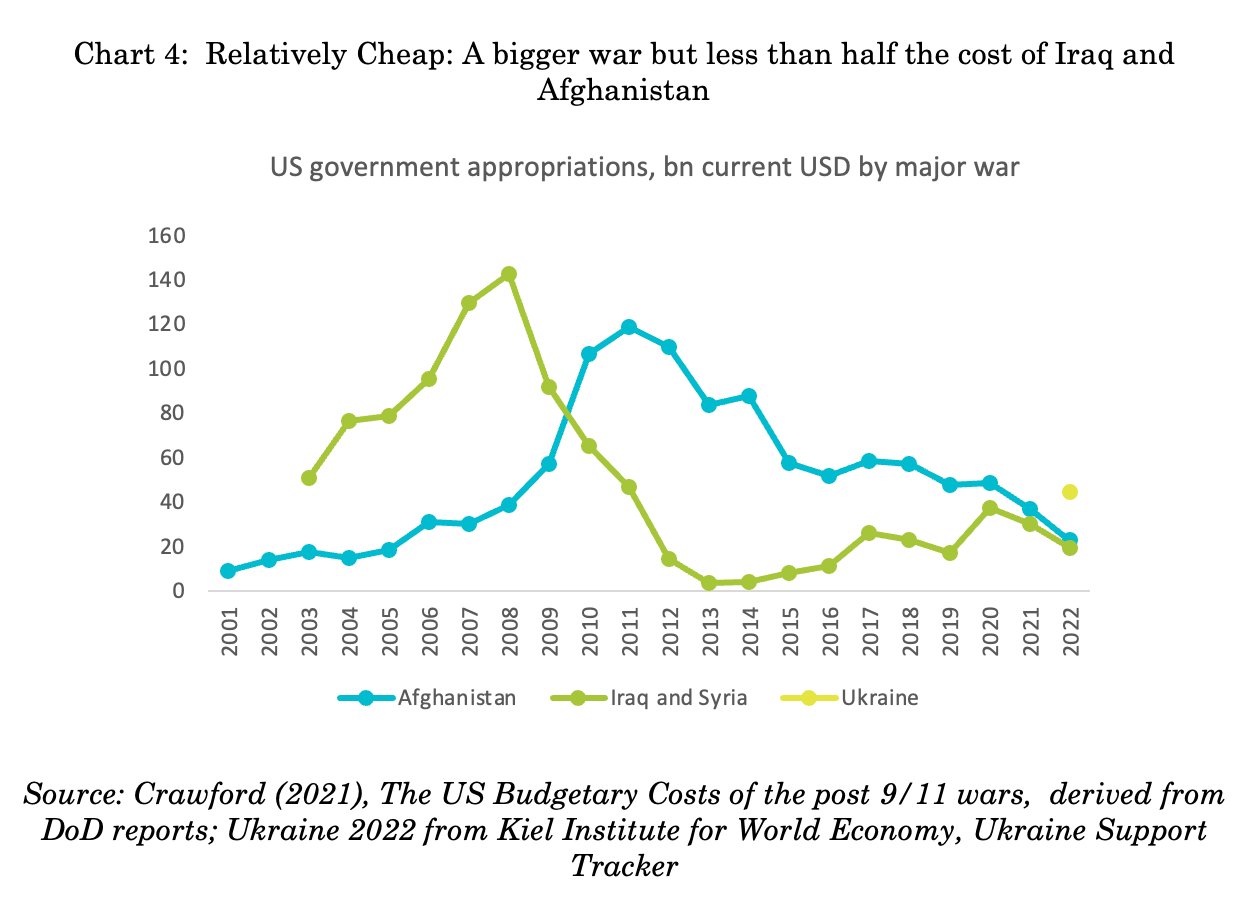

Second, these impressive results have been achieved at a low cost. This can be seen on several metrics. First, Ukraine is so far a much cheaper war for the allies than Iraq or Afghanistan, even though casualties and the scale of combat is higher. For instance, US spending on Ukraine this year will be less than half US spending in the peak years in Iraq or Afghanistan, which likely reflects that Ukrainian soldiers are paid far less than US or European soldiers. Similarly, official aid to Ukraine of all sorts – financial, military and humanitarian – so far is estimated at $85 bn (Ukraine Support Tracker), which is 7% of the 2022 defence budgets of NATO members ($1190 billion), and less than 15% of the cost of the support European governments have pledged to shield consumers from rising energy prices (Brueghel estimates as at end of July 2022 of €270 bn plus August-September packages in the UK, Germany, Italy and France of an equivalent aggregate amount) which are a result of Russia’s squeeze on gas supplies to Europe.

How to Fund the Deficit: Our Proposals

We now turn to discussing the key parameters of this proposed fund: duration, governance size, conditionality, grant/loan mix and country contributions.

Duration

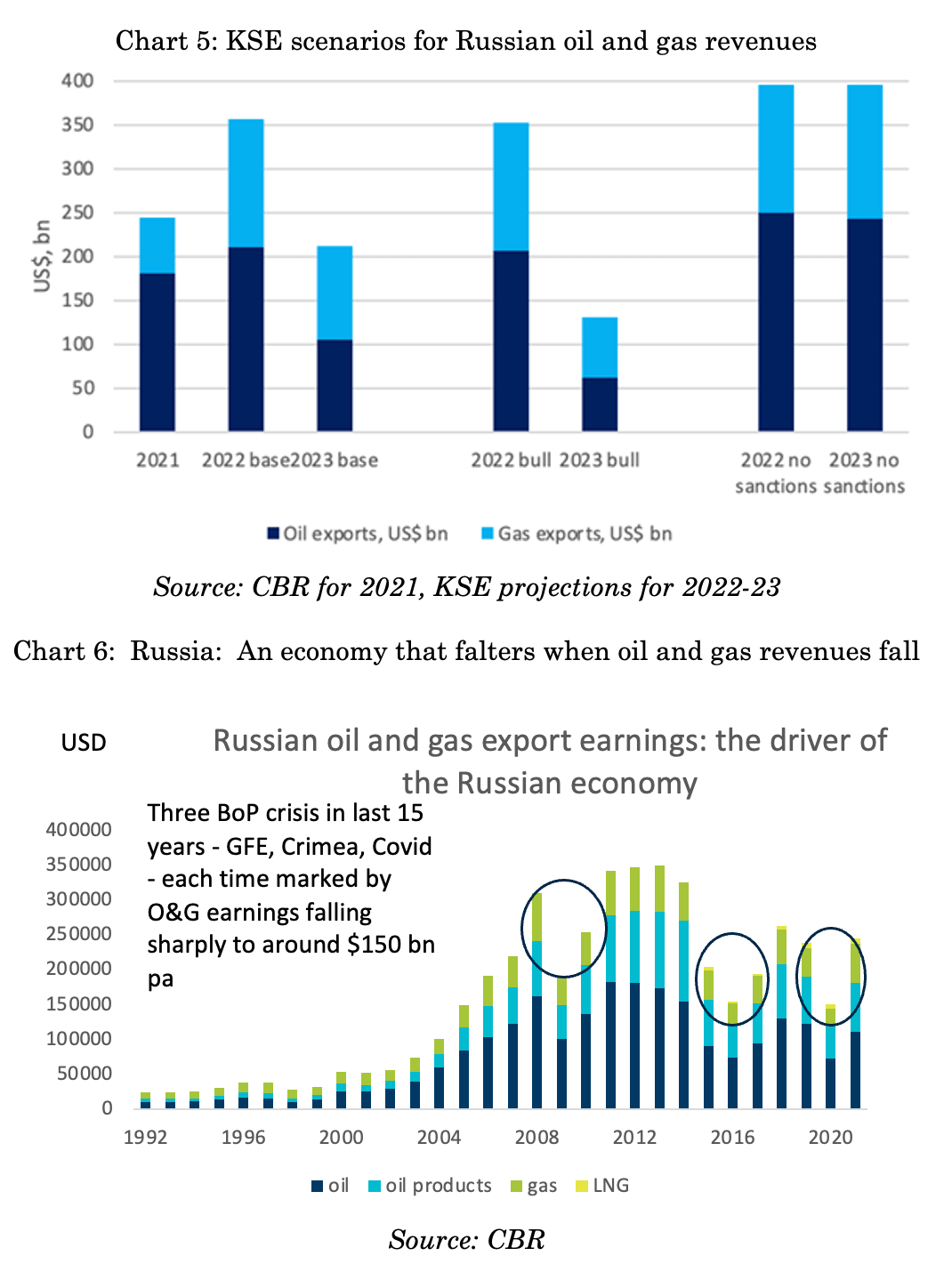

Up until now, Russia’s economy has performed much better than Ukraine’s. Ukraine’s economy looks set to contact by around 30% this year, with the war having a catastrophic impact in some areas. By contrast, while Russia’s economy will contract, it has to a large extent been shielded from the effect of sanctions by high oil and gas revenues. The initial March-April wave of sanctions did lead to a halving in the value of the RUB and signs of a run on banks, prompting the CBR to hike rates and impose capital controls. But the record current account surplus from surging hydrocarbon revenues and a collapse in imports allowed the CBR to reverse its rate hike and ease capital controls over the summer, as the RUB strengthened back through its pre-war parity.

However, by the middle of next year, we believe that the economic situation will shift strongly in Ukraine’s favour, making strong partner support particularly important over the period until that point.

In particular, as a result of the European oil embargo and price cap, and the fall in Russian gas sales to Europe to a modest amount, we expect Russia to see a sharp fall in oil and gas revenues, to a critical level – around $150n bn USD pa or about $12 bn a month. At this point in the past the Russian government has struggled to finance its budget, as well as its external account, where the surplus on oil and gas has financed deficits on other goods imports, services, and income payments. While the move to a floating currency and the clean-up of the banking system may have strengthened Russia’s resilience, we believe this is offset by the impact of broad sanctions on the Russian financial system. So we expect Russia’s financial fragilities to resurface as oil and gas revenues fall to this critical level, with an enhanced risk of a collapse in the currency and bank runs. In other words, we think that Russia will face financial constraints which will heavily constrain its ability to continue financing its war in the course of 2023.

However, Russia will still has sufficient resources to continue its military offensive into 2023 and we cannot project with confidence when the war will end. Even after the military fighting is over, Ukraine’s economy and budget will not normalize overnight. We view it reasonable for the fund to be established for the duration of next year – and if we end up in a good scenario where the war finishes before the end of 2023, and the budget financing need it reduced, then the donor funding could be re-directed to finance Ukraine’s reconstruction.

Governance

Allocating all resources in a single fund rather than running several funds would be a more efficient option. Currently, financial support is coming to Ukraine via various channels: (i) as direct support from partner countries, with each loan/grant even for a relatively small amount of $100-200m requiring dedicated diplomatic and bureaucratic work, (ii) from the IMF, the World Bank and other IFIs, (iii) via a specially created administered donor account at the IMF and (iv) via a multi-donor trust fund created by the World Bank. This complexity substantially reduces transparency and creates confusion as to the amount of pledged financing. Consolidating all financial support into a single fund will increase transparency and predictability.

If there is one donor fund, then there should one lead agency. Traditionally, the agency which takes the lead on behalf of the international community on agreeing a financial programme with a country in a crisis situation – providing some support itself and paving the way for wider donor support, which it helps to coordinate – is the IMF. It has the technical expertise and credibility, so many finance ministries look to the IMF for a green light before agreeing to disburse donor support.

However, for much of the conflict the IMF appears to be missing in action. Although the IMF has just now reportedly approved a $1.4 bn package of financial assistance to Ukraine (on top of $1.4bn in emergency financing provided in March), this will only be sufficient to cover Ukraine’s scheduled 2022 repayments to the fund in the amount of $2.4bn.

The IMF’s passive stance is reportedly for the technical reason that it cannot finance a programme in a country without a sustainable debt position, and it cannot say while the war continues that Ukraine has a sustainable debt position. It likely also reflects differences among the membership, with a Russian representative on the Board and many EMs likely broadly neutral on the conflict and unwilling to agree special treatment for Ukraine.

However, we think that the US and Ukraine’s allies, who are the most influential members of the Board, may be able to overcome this opposition, perhaps helped by a G7 commitment which can be seen as guaranteeing Ukraine’s debt sustainability. We see a large IMF programme of perhaps $15 bn USD as the centrepiece of the 2023 financing effort as the best outcome for Ukraine.

If this cannot be agreed, then the IMF should at least agree and monitor a programme, monitored by the Board, which can help support contributions from other donors, and provide enough financing to cover the $2.7 bn payment due next year, so it is at least not contributing to the financing challenge or providing some staff to support a separate fund.

Of course, if the IMF continues to sit on the sidelines, since it is too hamstrung by differences in views among the membership to play a coordinating role, then an alternative solution is possible. Ukraine’s allies could in theory set up another institution- an IFI of the democracies – able to create money, such as the IMF, or to borrow backed by a guarantee, such as the World Bank or other development banks, whose authority is ultimately derived from the backing of their membership, notably the advanced economies. However, given the urgency, and the long timeline required to set up a new institution, we think a solution with an IMF programme, preferably a full scale programme, is preferable.

Size

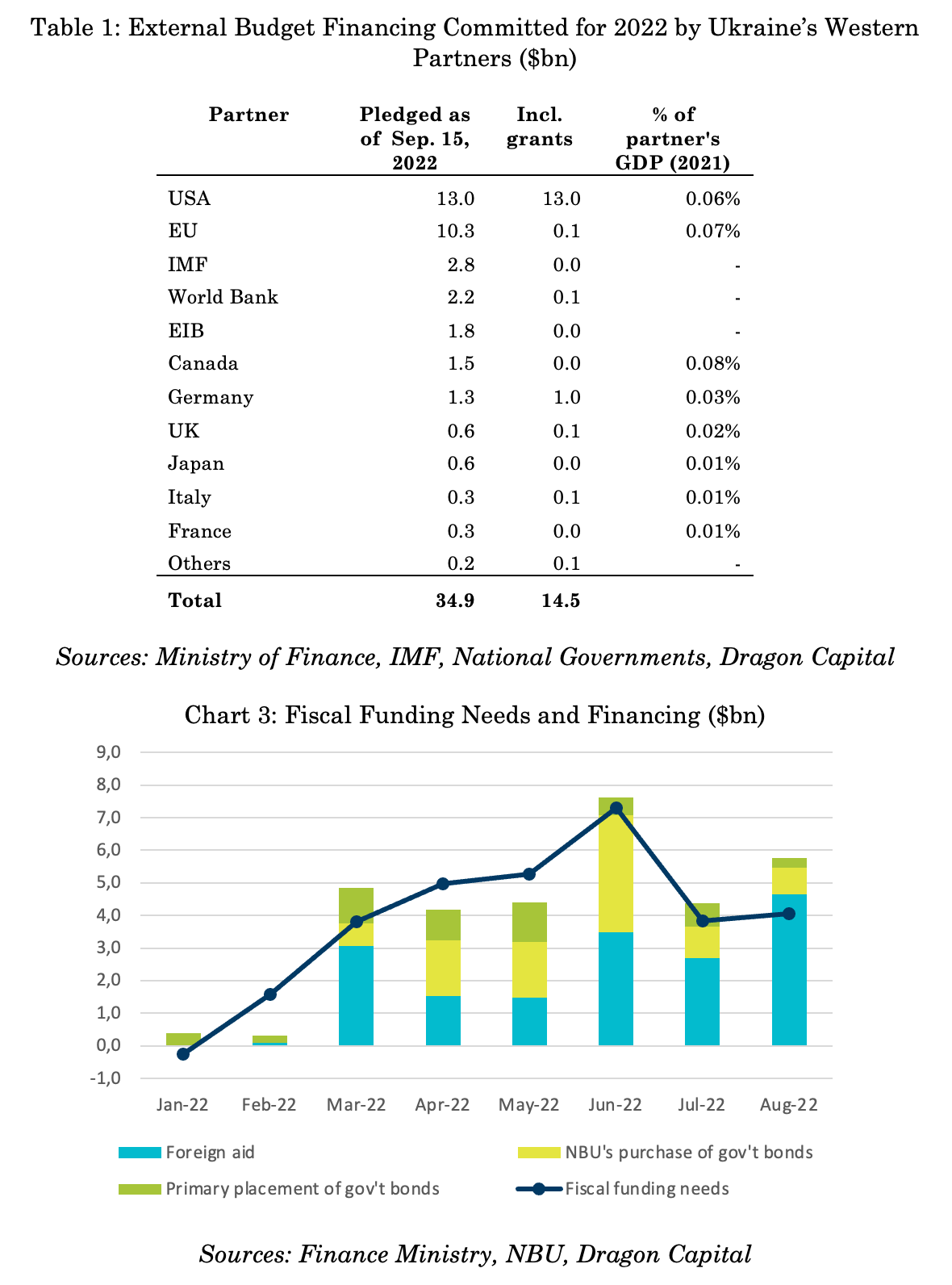

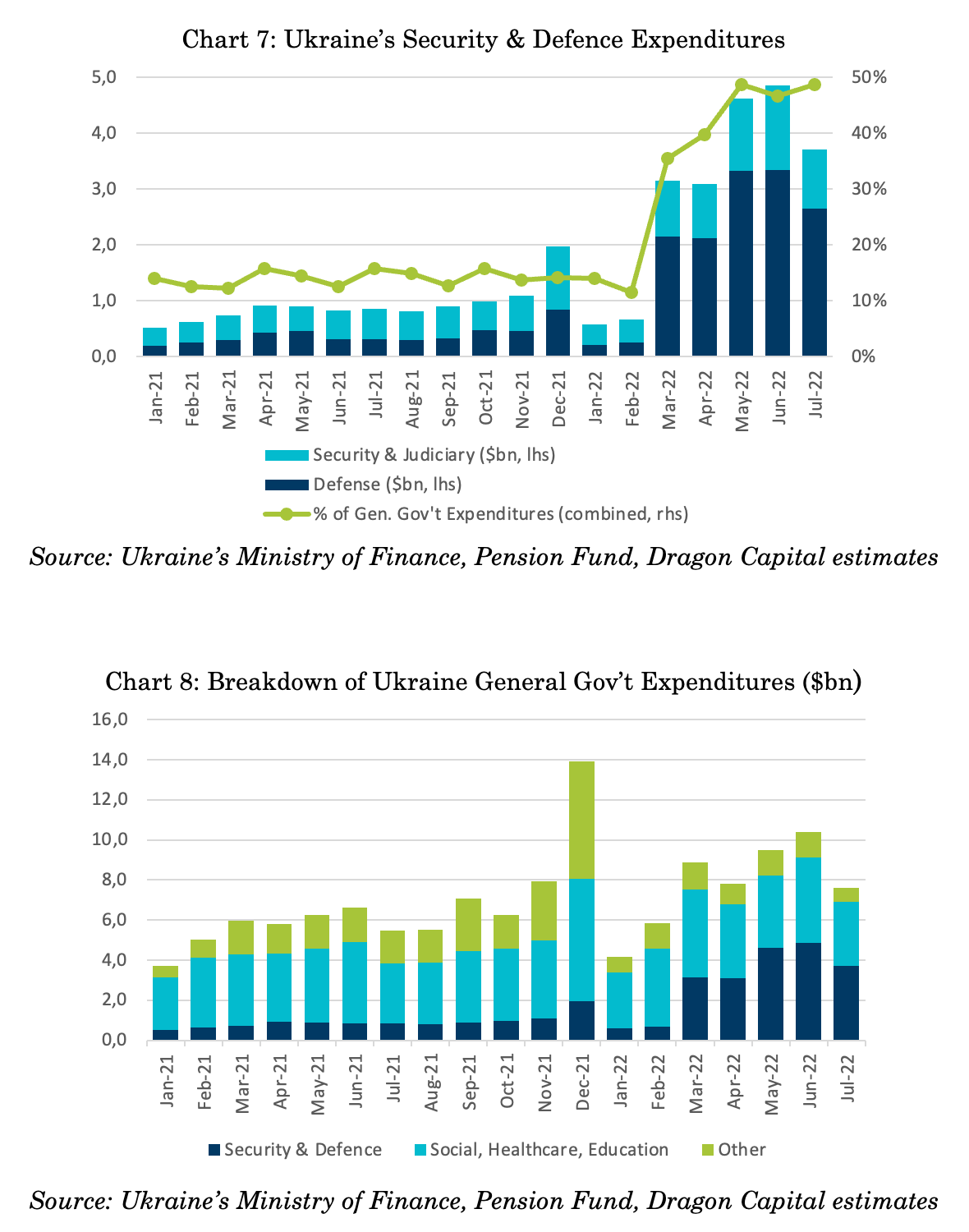

Western governments and IFIs have pledged $35bn of budget financing for Ukraine this year, of which $17bn had been disbursed as of the end of August 2022. This implies that Ukraine should receive another $18bn of financing by end-2022, or $4.5bn per month. While falling short of the official $5.0bn monthly funding gap, the pledged financing provides sufficient support until the end of this year, we think, assuming all partners stick to their promises and follow through with timely disbursement.

However, there is no visibility over financing for 2023, while Ukraine’s fiscal funding needs will stay high and will be accompanied by the need to rebuild critical infrastructure. As long as military hostilities continue – and we think it is prudent to plan for them continuing through next year – we see limited scope to reduce the funding needs from the current $5.0bn month. The government has already cut all non-critical spending and will struggle to increase tax revenues materially, given the deep contraction in the economy of 37% y-o-y in 2Q22 and the sharp increase in loss-making enterprises due to Russia’s invasion. Still, lower scheduled debt domestic redemptions scheduled for next year and the impact of the recent restructuring of $22bn in sovereign bonds do provide some relief. Overall, we see it as reasonable to assume that the monthly fiscal funding gap will remain high next year, at around $4.0-4.5bn per month, or in the proximity of $50bn for the full year

We note that the 2023 draft budget prepared by the government assumes fiscal funding needs will be lower next year at $41bn, including a $31bn budget deficit. However, we see two problems with this projection – downside risks and macro stability – which lead us to propose a higher level of external financing. Firstly, risks are tilted to the downside in a war situation, and so the government needs to build in a much larger than normal contingency margin. For instance the draft budget assumption of nearly 5% real growth in GDP in 2023 may prove optimistic, and the ability to squeeze non-critical budget spending may be challenged, for instance if the cost of repairing and supporting the newly liberated territories proves high. Secondly, the budget assumes higher inflation and a further significant weakening in the currency. Arithmetically, this helps the public finances, allowing FX funding to finance more hryvnia spending, and squeezing budget spending, as government wages, pensions and spending lag inflation. But this is precisely the risky path, which flirts with a currency crisis and risks entrenching high inflation, which could undermine the war effort and we believe Ukraine should avoid. In addition, we believe that providing enough funding to cope with a less favourable scenario will boost credibility, and strengthen financial stability.

Thus, we propose a fund size of $50bn to provide certainly over budget financing until the end of next year, and through what will likely be the most difficult period of the war. In addition, the government has indicated that it needs $17bn in 2023 to rebuild critical infrastructure. Although over time this reconstruction funding is likely to be separately administered, we see the budget as likely the most convenient arrangement for financing reconstruction while the war continues. If managed together, the fund including urgent reconstruction financing could increase to $65-70 bn.

While the amount sounds large, it represents only one tenth of one percent of the GDP of Ukraine’s allies, 4% of NATO’s annual budget, and 9% of the spending announced so far by European countries on supporting consumers with energy costs.

In addition, we note that the financing need can be met with only a modest call on government’s budgets. In particular, Ukraine’s allies can make contributions in the form of SDRs (special drawing rights), the IMF’s special currency. G7 countries’ combined SDR holdings stood at $410bn as of end-August. Moreover, the G7 committed in 2021 to allocate $100 bn of those SDRs to countries in need, and have only committed a small fraction of that amount so far. For instance, if Ukraine’s G7 allies provided 10% of their stock of SDRs to Ukraine, it would cover 80% of Ukraine’s 2023 fiscal funding needs.

Conditionality

In normal times, donors seek to add requirements or conditions to programmes – typically politically unpopular decisions which have the objective of restoring fiscal and external balance, often through fiscal consolidation. And recipients – while perhaps dreaming of money without strings and typically seeking to ease the difficult measures – often in practice work closely with the donors to design the conditionality so that it is effective at tackling the imbalance which has contributed to the crisis. However, we think that in this case, where Ukraine is in a war – an existential struggle for survival – and fiscal resources are overwhelming directed at funding this effort, normal conditionality is largely redundant and can be dispensed with. We would make three points here.

First, while Ukraine should do its bit towards financing the war, by raising some additional revenue by reversing the tax cuts announced at the start of the war and by raising more financing from domestic sources, this is of secondary importance. In other words, the key source of funding during the war will be external.

Second, Ukraine is already prioritising expenditure aggressively and cutting everything which does not directly contribute to the war effort, and the imperative of survival gives it the incentive to continue with this approach while the war continues.

Third, the key anchor for Ukraine’s reform and modernisation is EU integration, which should over time improve governance and create a framework for competitive markets, as it has across Central and Eastern Europe. Here, the government is moving fast to implement the conditions required even during the war.

Of course, once victory is achieved, the incentives change, since the imperative of existential survival no longer takes precedence. At that point, some “normal” conditionality may be needed as part of a package where Ukraine takes difficult but important decisions which restore fiscal and external balance, and receives exceptional support from donors and reparations from Russia to rebuild the country.

Grant/loan mix

Grants are more helpful to Ukraine than loans, given that Ukraine is having to fund a huge deficit for several years. Ukraine’s debt to GDP ratio will rise to an estimated 85% this year, from 50% in 2021, even though grants account for a sizable 41% of foreign budget support ($15bn out of $35bn) this year. At the moment, Ukraine in effect has no market access abroad, since its ability to service its debt in full is dependent on a number of conditions, such as winning the war and a fast and successful reconstruction, which are not fully under Ukraine’s control. However, Ukraine’s government will need to regain market access as rapidly as possible after the war, to be able to raise sufficient financing for reconstruction. If the whole amount of required financing for next year ($50bn) comes in the form of loans, Ukraine’s debt-to-GDP ratio will surge to 100%, assuming a stable exchange rate and GDP and slowing inflation. To keep Ukraine’s debt-to-GDP ratio in double-digit territory and ensure it is sustainable over the medium-term despite high reconstruction costs , donors should provide as much financing as possible in the form of grants.

Country contributions

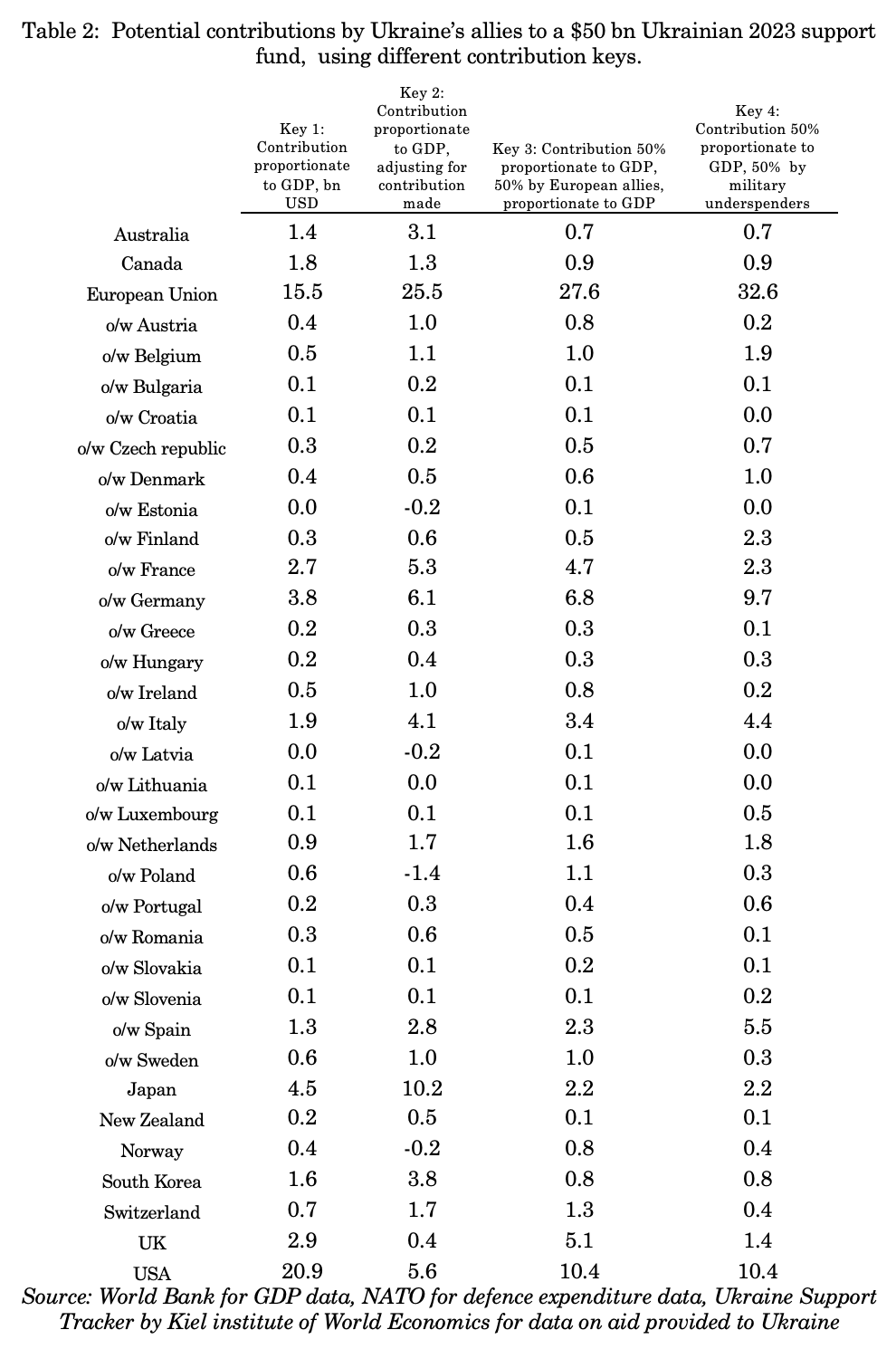

There are a number of different ways of calculating a fair approach to sharing the burden of financing Ukraine’s budget. For instance, one simple approach would be to allocate the financial cost proportionally to GDP. Another way would be to take the same approach, but also take account of aid already provided. A third approach would be to look for a disproportionate response from European countries which are particularly at risk from an aggressive Russia, and propose for instance that they take sole responsibility for half of the support provided to Ukraine. A fourth approach would be require a higher financial contribution from NATO members who are not meeting their commitment to spend 2% of GDP on defence, with half of the total funding to be raised from such NATO members in proportion to the shortfall in their military spending.

The general picture from the data is clear. The US is providing significantly more support than Europe, even though the security risk for Europe from Russian aggression is much higher, and the Europeans are the main underspenders on defence. However, within this overall picture, there are nuances with many eastern European countries, notably Poland and the Baltics, providing proportionately even more support than the US.

Conclusion

Ukraine’s victory is unnecessarily at risk from a disorganised approach to financing Ukraine’s war effort. There is a live risk that central bank financing of the deficit will drive a weaker currency and higher inflation, and disrupt the war effort.

This is a wholly avoidable scenario. Donors have the resources to finance Ukraine, and they should step up. They have already committed in principle to do so, would face far higher security and economic costs and risks if Russia is successful and are getting extraordinary value for money, as Ukraine’s armed forces are proving remarkably effective in their use of resources to degrade Russian military capability, at comparatively low cost.

To provide certainty about the financing of Ukraine’s war effort and avoid a currency crisis, we propose that donors:

• Commit to fully covering the 2023 financing gap with external financing, sufficient to provide a contingency against downside risks and ensure macroeconomic stability;

• Organise donor financing through a single fund with a single administrative interface;

• In the best case, agreement on a large scale IMF programme of $15 bn US as the centrepiece of this financing effort. But at any an IMF programme, monitored by the Board, which will pave the way for other donors to participate, and provide enough financing to cover the $2.7 bn payments due to the IMF itself next year.

• Use a transparent contribution key to ensure that the cost of financing Ukraine is fairly shared across Ukraine’s allies;

• Subject to further discussion and analysis of Ukraine’s financing needs, transfer $50 bn USD in value to the fund before the start of 2023– sufficient to finance the budget even in a less favourable scenario without putting domestic stability at risk;

• Allocated as much as possible financing in the form of grants

• Commit to regular and predictable monthly disbursements to prevent any further emergency recourse to monetary financing

We believe this will allow Ukraine’s wartime needs to be financed in full without recourse to monetary financing through the whole of 2023. It will provide a stable economic platform to support Ukraine’s armed forces in liberating the country, even as the decline in oil and gas revenues as sanctions bite will put Russia under severe economic strain. Acting promptly and comprehensively to cover Ukraine’s financing needs should shorten the war, and reduce the overall cost of the conflict, compared to the alternative scenario of inadequate and partial Western support.