- Kyiv School of Economics

- About the School

- News

- China’s automotive sector thrives in Russia, other companies face risks — KSE Institute research

China’s automotive sector thrives in Russia, other companies face risks — KSE Institute research

12 June 2024

Last year, foreign companies, mainly from the Chinese automotive sector, significantly increased their revenues in the Russian market. However, for others, staying in Russia is becoming increasingly risky due to economic instability and the risk of business confiscation.

These are the conclusions reached by KSE Institute experts, who analyzed the financial performance of more than 1,300 foreign companies in 2023 as part of the Self-Sanctions/LeaveRussia project.

Last year, revenues were redistributed among international businesses in the Russian market, which was also affected by the ruble’s devaluation by more than 24% compared to 2022.

The share of those companies that exited decreased from 27.7% in 2022 to 23.5% in 2023. This is due to the fact that more and more companies are being liquidated, and those that have been sold are usually unable to generate the same level of revenue.

Instead, the remaining companies have taken advantage of the situation to take market share from those who are “leaving” or have left, and increased their revenues by 21.9% compared to 2021 and by 9.7% compared to 2022.

Some companies, such as Chery Automobile (+$4.377 billion), Haval Motor (+$2.584 billion), Raiffeisen Bank (+$937 million), Geely (+$1.372 billion), Great Wall Motor Co. (+$1.054 billion), Haier (+$651 million), Mars (+$295 million), FAW Group (+$1.204 billion), Changan (+$1.380 billion), and Gorenje (+$257 million), even significantly exceeded their 2022 revenues.

Nevertheless, researchers note a steady downward trend in the Russian market’s share of multinational companies’ global revenues, which fell from 3.31% in 2021 to 2.06% in 2023. The data show that the Russian market is becoming less attractive to foreign investors, while those who were the first to enter were able to compensate for the losses by raising share prices and increasing market capitalization.

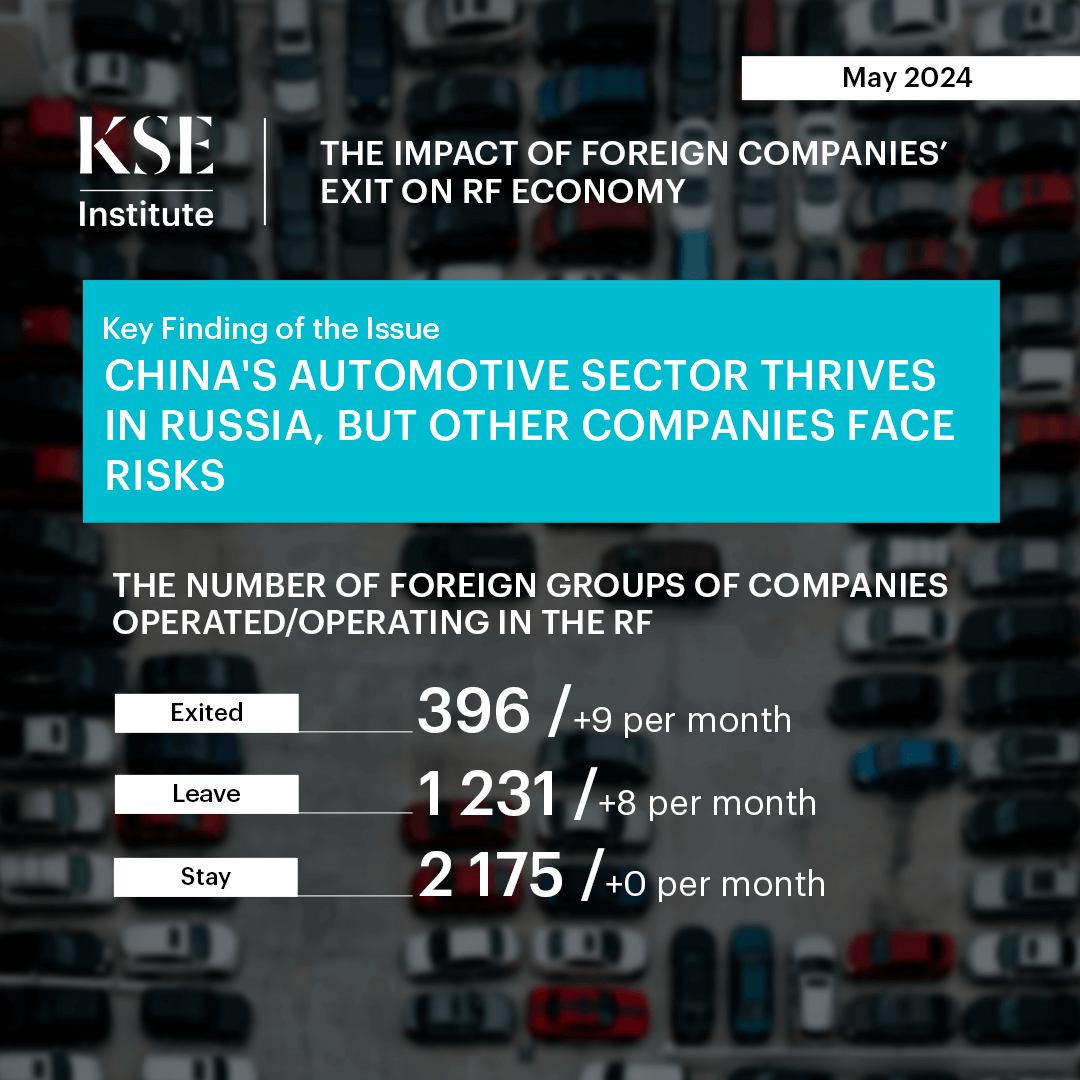

According to the Kyiv School of Economics, 2,175 international companies continue to do business in Russia, 1,231 are “leaving,” and only 396 have finally completed their exit.

In May 2024, nine companies were added to this list, including Danone (which completed the sale of Russian assets after the interim administration introduced earlier), Jack Wolfskin (liquidation), Chemours (liquidation), KAZ Minerals (liquidation), HI-LEX (sale), HSBC (sale), Ipackchem (sale), Metsä Group (sale), and SRV Yhtiöt Oyj (SRV) (sale).