- Kyiv School of Economics

- About the School

- News

- 67th issue of the regular digest on impact of foreign companies’ exit on RF economy

67th issue of the regular digest on impact of foreign companies’ exit on RF economy

5 August 2024

We will continue to provide updated information on a monthly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 03.07.2024-05.08.2024

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed an application in the Apple Store which is available only for mobile devices in addition to our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

On February 24, 2024 KSE Institute merged KSE status “wait” with status “stay” as 2 years of the war gave enough time for companies to leave Russia

KSE DATABASE SNAPSHOT as of 05.08.2024

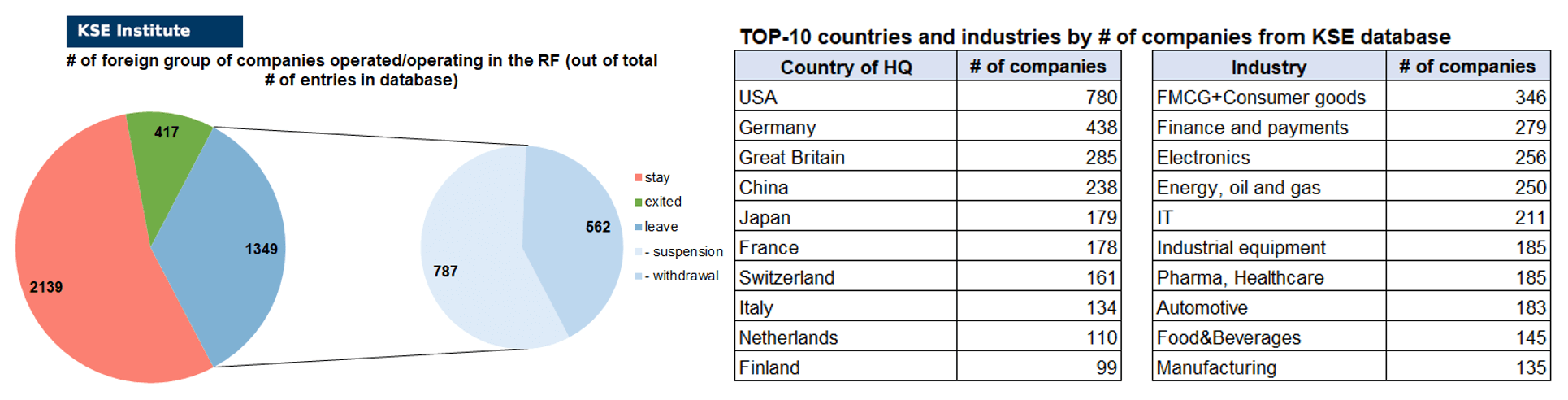

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 2 139 (+54² per month)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 349 (+5 per month)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 417 (+8 per month)

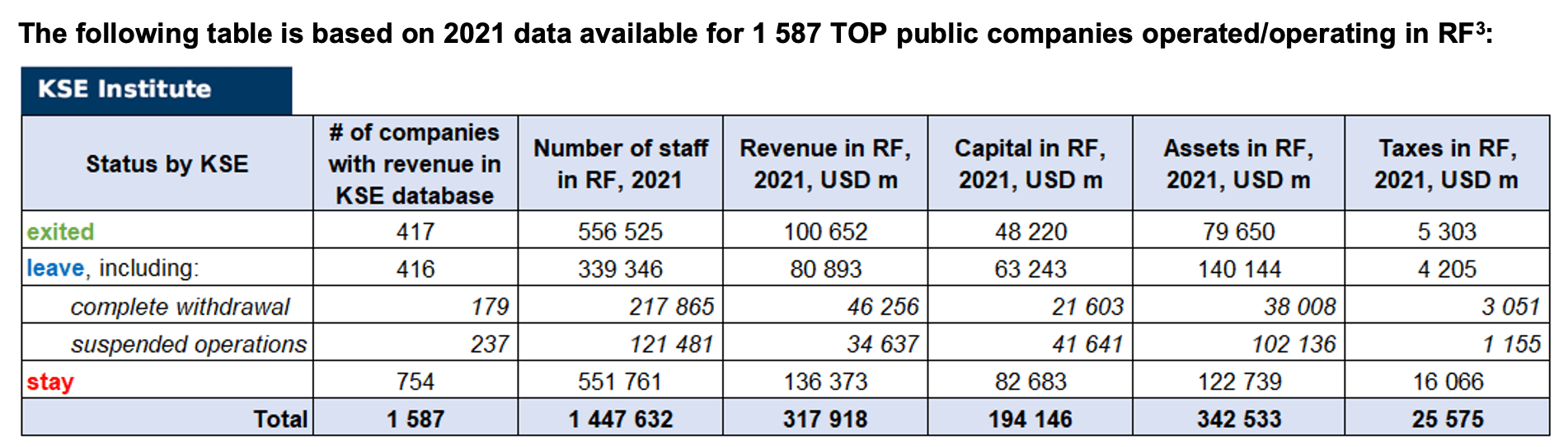

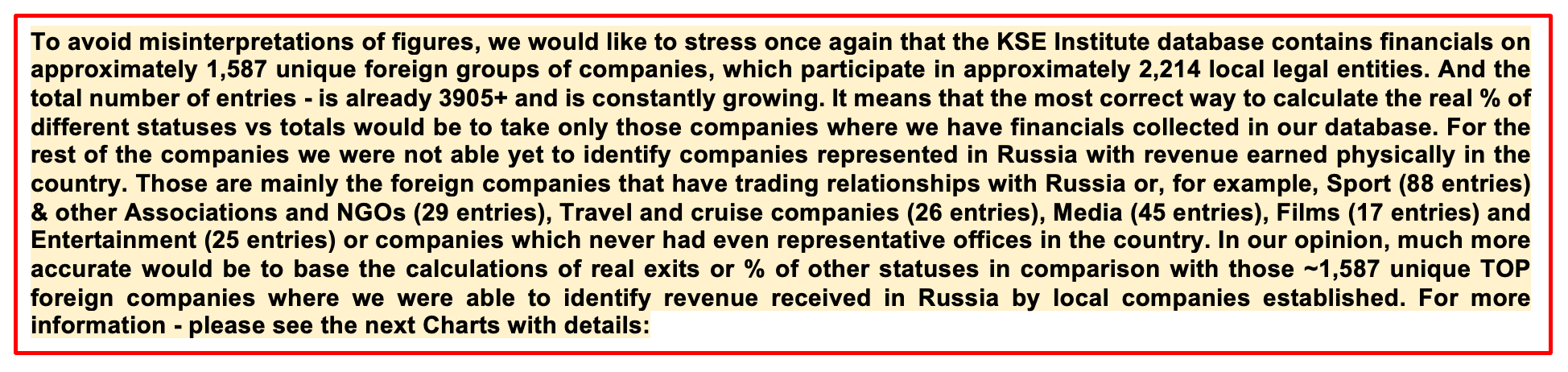

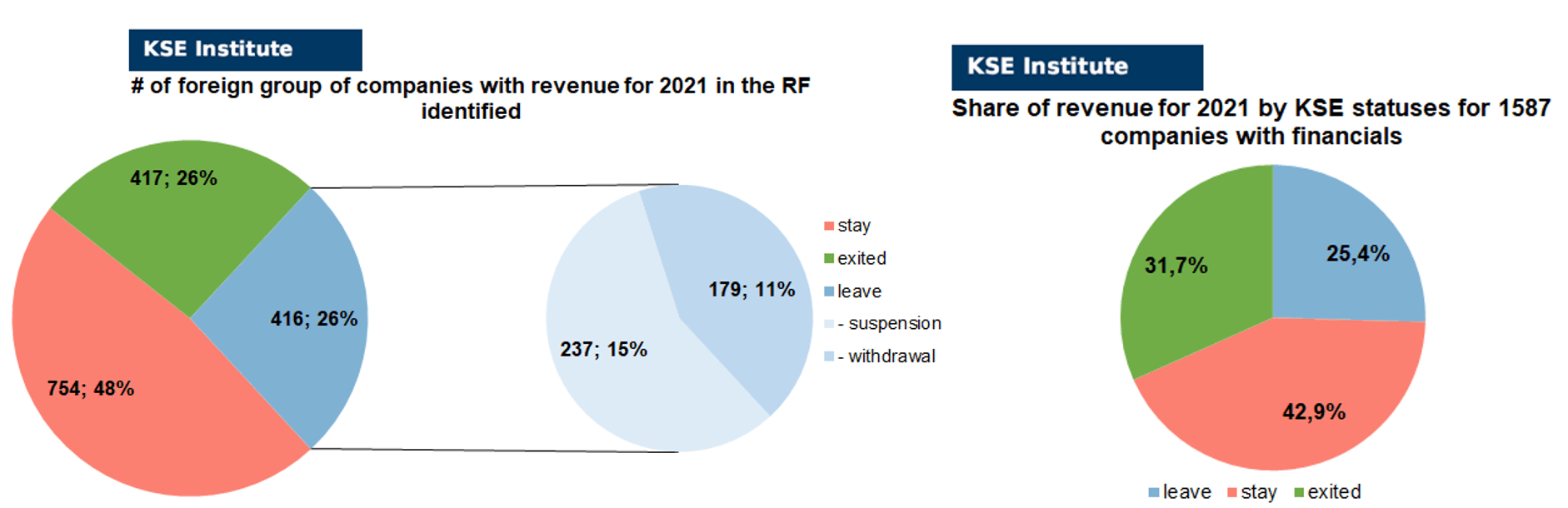

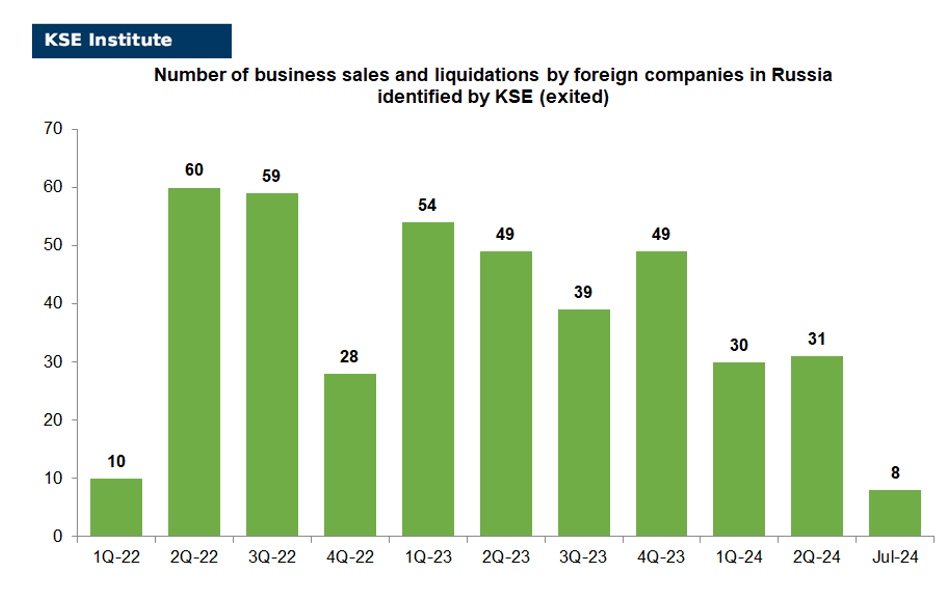

As of August 5, 2024, we have identified about 3,905 companies, organizations and their brands from 105 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 587 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $194.1 billion), local revenue (about $317.9 billion), local assets (about $342.5 billion) as well as staff (about 1.448 million people) and taxes paid (about $25.6 billion). 1,349 foreign companies have suspended or ceased operations in Russia. Also, we added information about 417 companies that have completed the sale/liquidation of their business in Russia based on the information collected from the official registers (5 full business liquidations and 3 business sales took place in July 2024).

As can be seen from the tables below, as of August 5, 2024, 417 companies which had already completely exited from the Russian Federation, in 2021 had at least 556,500 personnel, $100.7 bn in annual revenue, $48.2bn in capital and $79.7bn in assets; companies, that declared a complete withdrawal from Russia had 217,900 personnel, $46.3bn in revenues, $21.6bn in capital and $38.0bn in assets; companies that suspended operations on the Russian market had 121,500 personnel, annual revenue of $34.6bn, $41.6bn in capital and $102.1bn in assets.

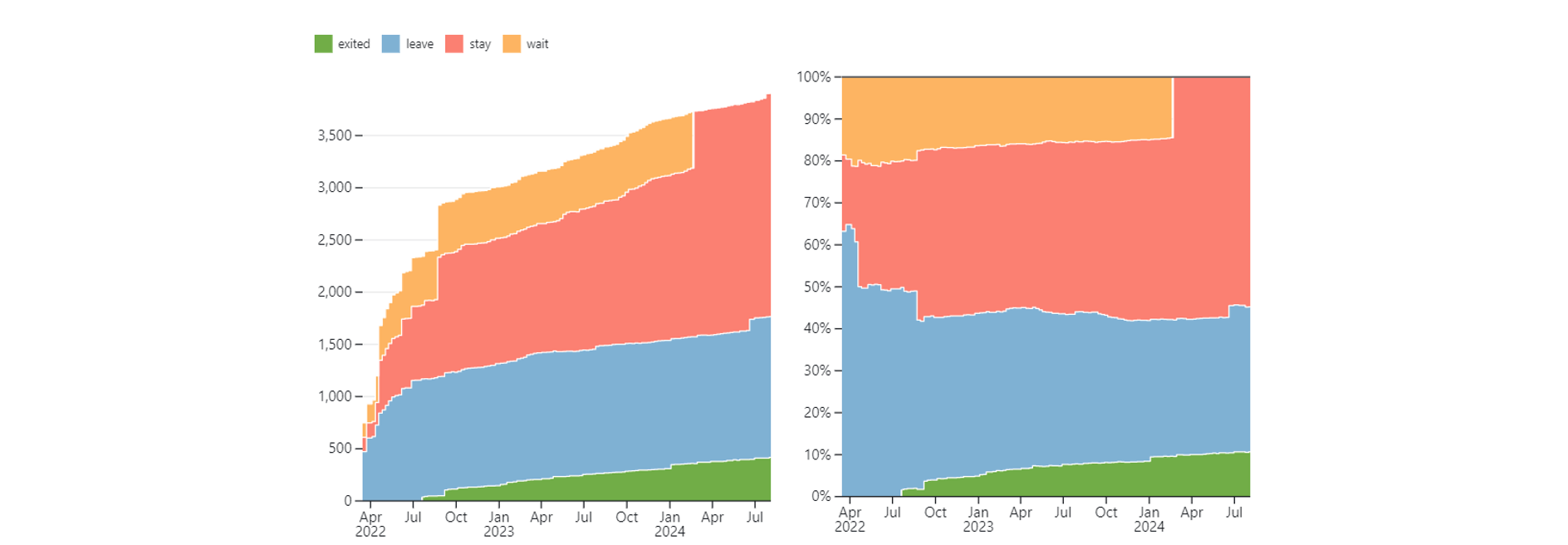

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 23 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 67 were added in July 2024, including ~30 from YouControl). However, if to operate with the total numbers in KSE database, about 34.5% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 54.8% are still remaining in the country and only 10.7% made a complete exit⁴.

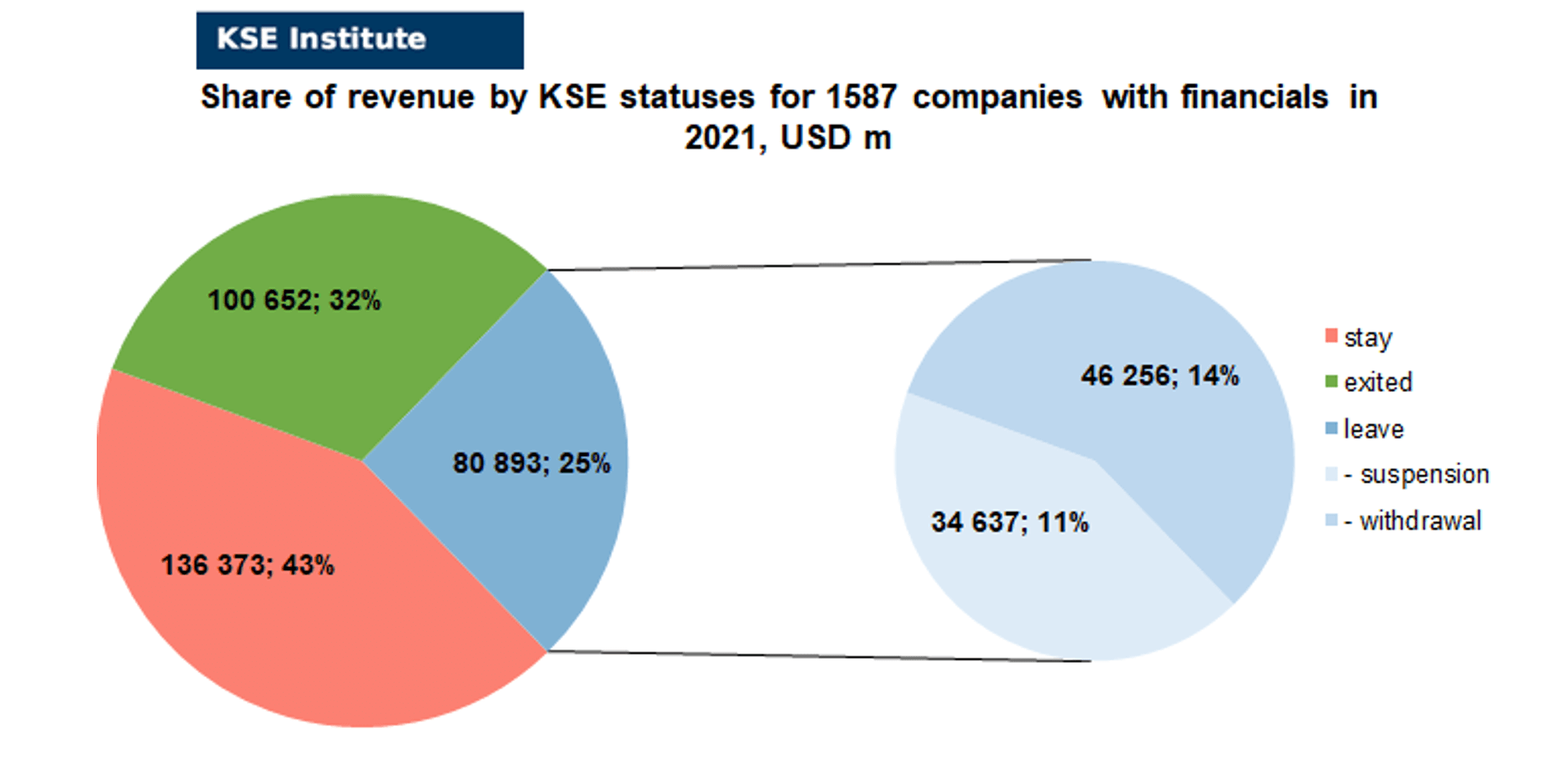

At the same time, it is difficult not to overestimate the impact on the Russian economy of 417 companies that completely left the country, since in 2021 they employed 38.4% of the personnel employed in foreign companies, the companies owned about 23.3% of the assets, had 24.8% of capital invested by foreign companies, and in 2021 they generated revenue of $100.7 billion or 31.7% of total revenue and paid ~$5.3 billion of taxes or 20.7% of total taxes paid by the companies observed. Data on 1,587 TOP companies is presented in the table above.

As it is visible on the charts based on data for 2021 above, % of exited is obtained based on number of companies (26%) and on share of revenue withdrawn (31.7%). At the same time, a bit different picture is for those who are still staying – 48% of companies represent 42.9% of revenue received in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit). Also, migration of statuses in June 2024 made its effect and adding of new companies in July 2024.

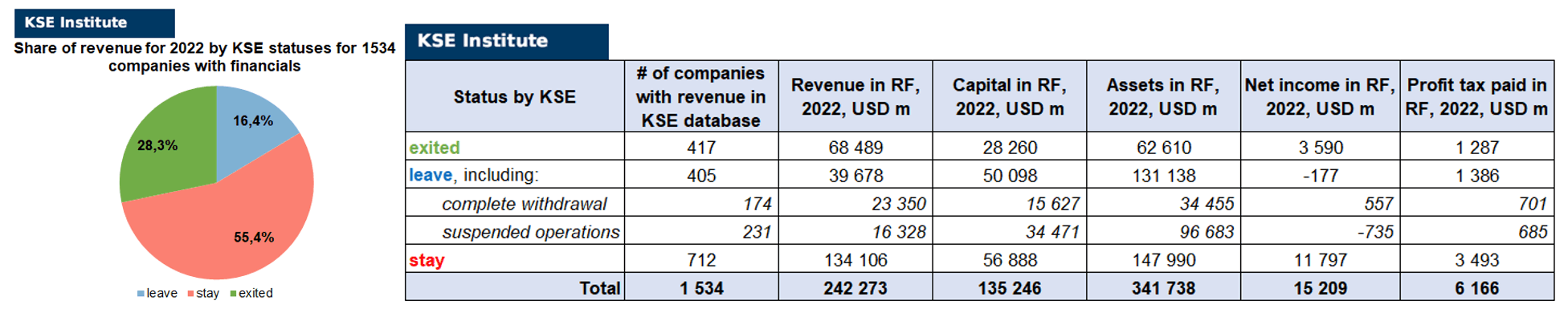

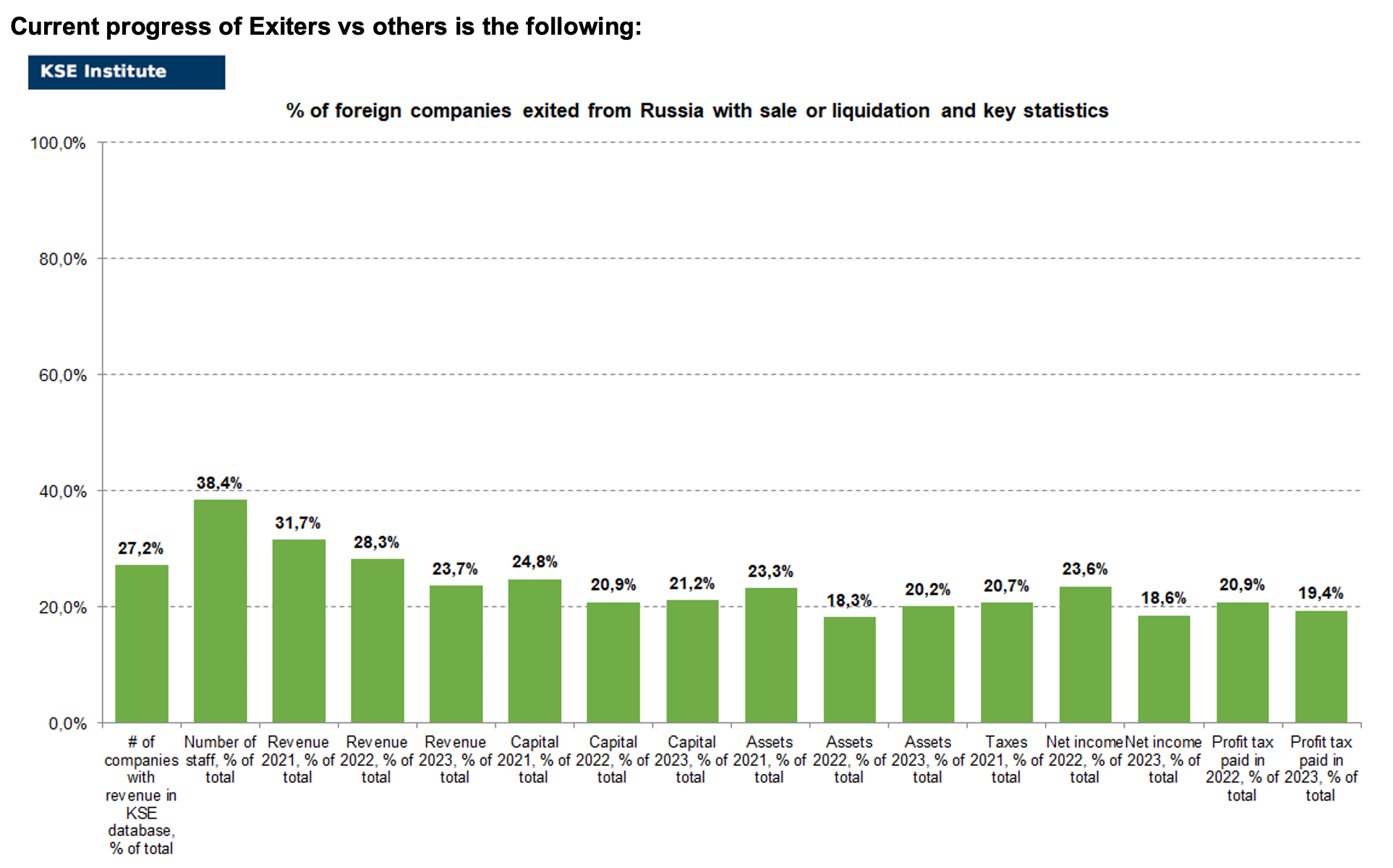

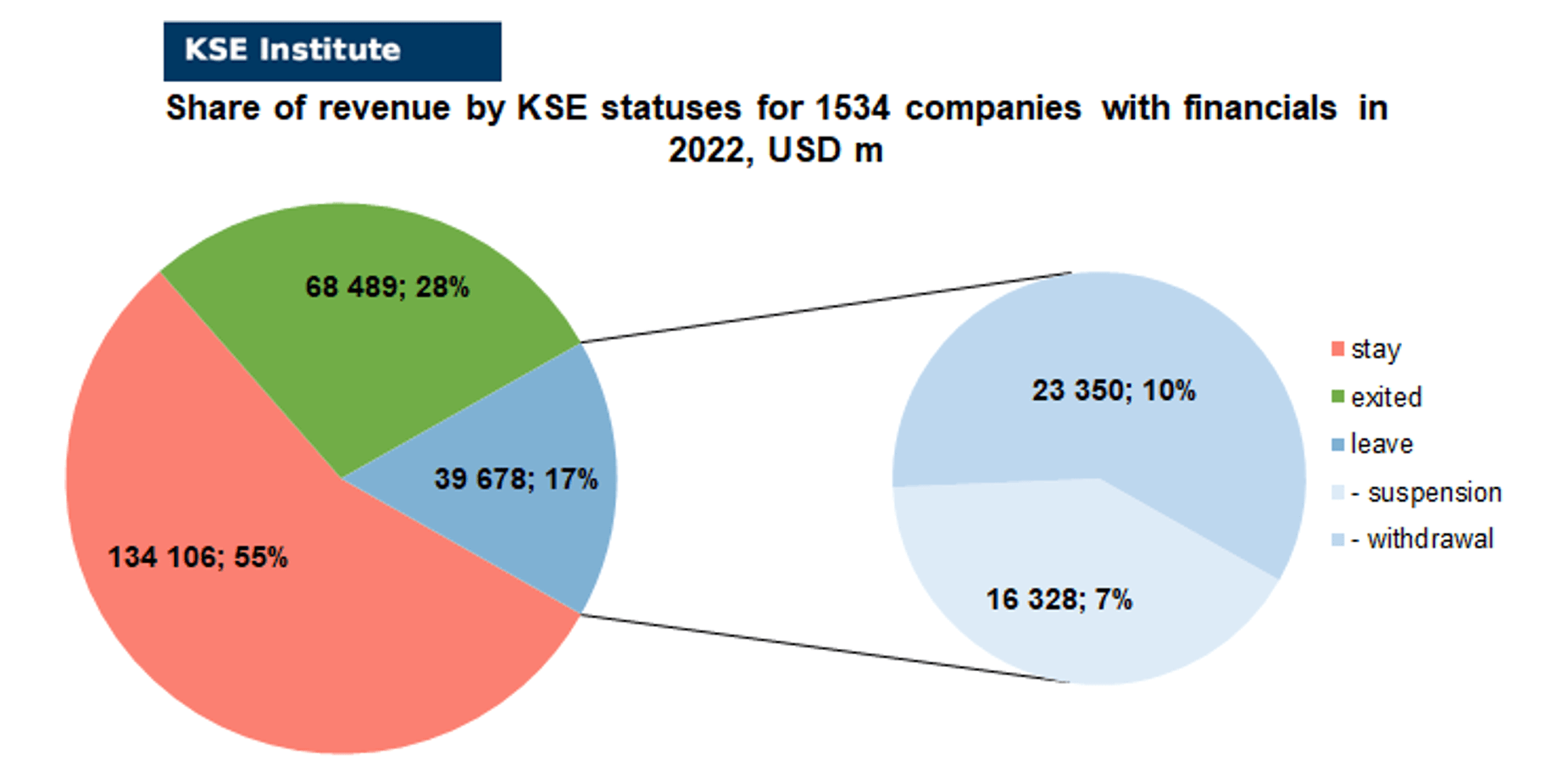

KSE Institute has also collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1534 companies (about 50 companies the data of which we have collected previously have not provided their reporting, we also added revenue data for about 30 banks) and provides below the detailed analysis.

As you can see from the charts above, companies which fully exited Russia were able to generate 3.4% less of revenue in 2022 (28.3% from total volume) than in 2021 (31.7% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-9.0%) revenue in 2022 (16.4% from total volume) than in 2021 (25.4% from total volume). At the same time, staying companies were able to generate much (+12.5%) more revenue in 2022 (55.4% from total volume) than in 2021 (42.9% from total volume). So the key conclusion is that money matters for those companies who are still tied with its local business in Russia and they were even able to gain more.

Summarizing the results of data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($341.7bn in 2022 vs $342.5bn in 2021) and would even probably increase if the remaining reporting for ~70-80 companies could be obtained (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, at the end of February 2024, the KSE Institute jointly with the B4Ukraine coalition partners published the report entitled “2024 Is the Year to Defund Russia’s War – The West Holds the Key” where, among other things, we estimated that the amount of taxes paid by foreign companies operating in Russia in 2022-2023 may amount to $20 billion annually. You can download its full text in English here: https://b4ukraine.org/pdf/b4u_report_2024.pdf

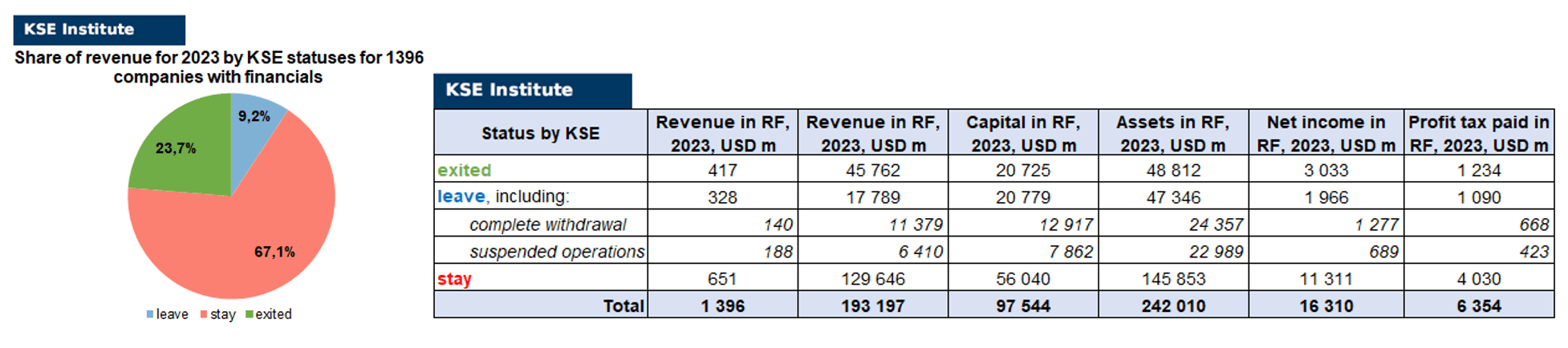

Analysis of data for 2023

KSE Institute has already collected and preliminarily analyzed data on revenue, capital, assets and net income (profit or loss) in 2023 for ~1396 companies (after it was allowed legally in 2023 about 200 companies the data of which we have collected previously have not provided their reporting and also about 260 companies reported 0 values in revenues). Also, it should be noted that as we convert RUB to USD – the devaluation effect was quite significant, Ruble depreciated in 2023 by more than 24%, from 68.4869 RUB/USD in 2022 to 85.163 RUB/USD in 2023). Please see below charts with the detailed analysis:

As you can see, there is a significant redistribution in revenue allocation based on KSE statuses happened in 2023: share of “exited” has dropped by -8,0% vs 2021 and -4,6% vs 2022 (from 31.7% in 2021 and from 28.3% in 2022 to 23.7% in 2023) which is explained by the fact that more and more companies are being liquidated and those one which were sold are usually not able to generate the previous level of revenue.

Share of companies with status “leave” has dropped even more, by -16,2% vs 2021 and -7,2% vs 2022 (from 25.4% in 2021 and from 16.4% in 2022 to 9.2% in 2023) which is explained by the fact that those companies which are leaving are not concentrated in revenue generation on the Russian market anymore.

As for companies with status “stay” – we see the opposite picture there, they are using momentum to take market share of those who are leaving or left (especially in automotive sector) and are generating comparable with previous years level of revenue: +24,2% vs 2021 and +11,7% vs 2022 (from 42.9% in 2021 and from 55.4% in 2022 to 67.1% in 2023).

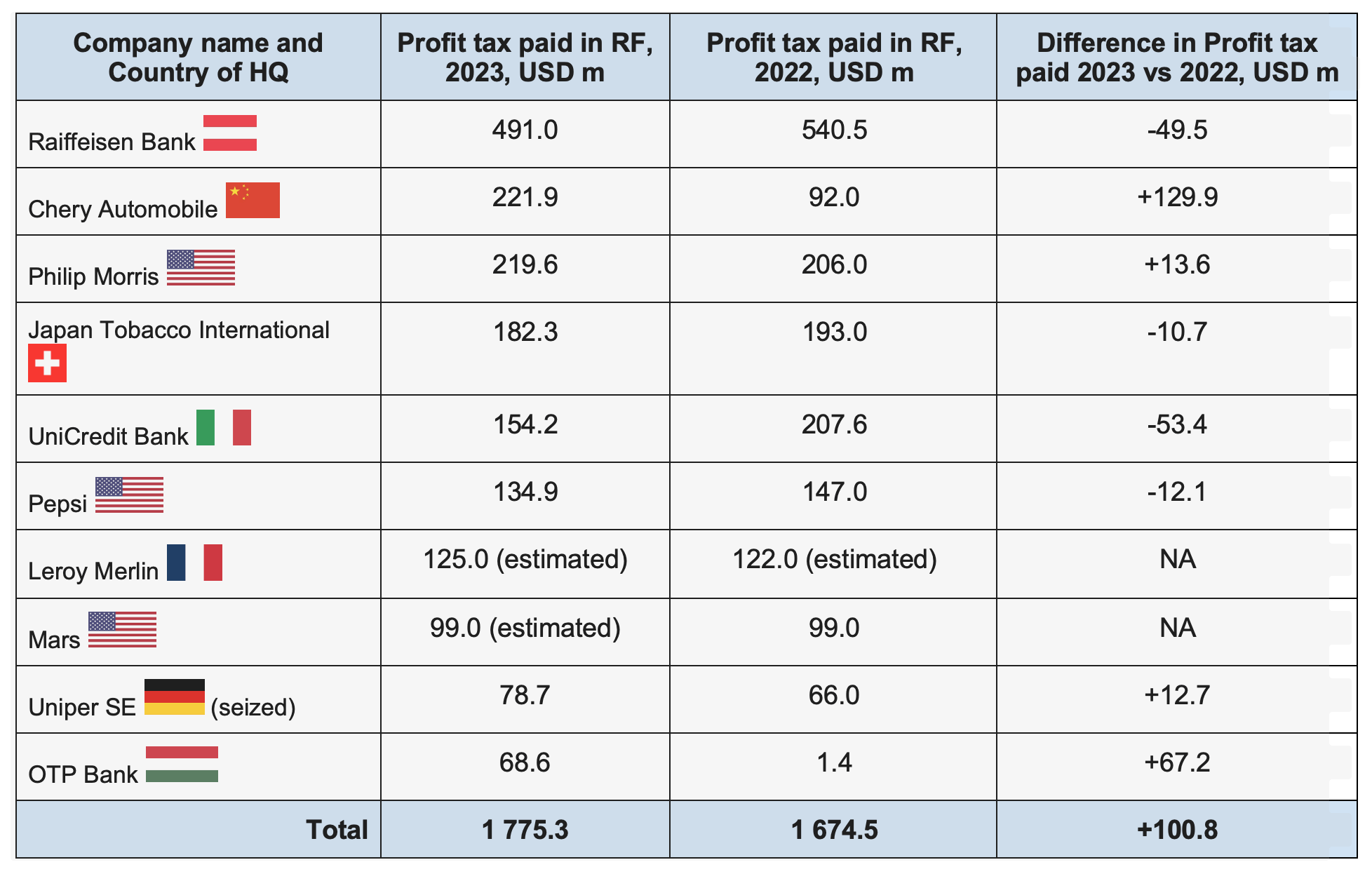

Some companies and banks were even able to generate significant profit and paid quite a lot of profit tax in 2023, here is the list of selected TOP-10 companies based on profit tax paid in 2023:

As you can see in the table above, TOP-10 companies and banks paid in 2023 ~USD 1.78 bn only in profit tax vs ~USD 1.6 bn in 2022 so tax expenditures and tax pressure on foreign business even increased (and will continue to increase in 2024 as Russia has recently significantly increased tax rates).

In total, according to KSE’s estimates ~1000 foreign companies which disclosed their local financial statements paid ~USD 6.4 bn of profit tax in 2023 vs USD 6.2 bn paid in 2022 (at that time we were able to identify ~1430 companies which disclosed that information earlier). Russian authorities classified most of the sensitive macroeconomic information including tax revenues. But we know that a year before the war started, in 2021, the total amount of taxes paid by foreign companies was at least $25.6bn. As Russia has classified data on taxes in 2022-2023 but, based on other indicators, one of which is decrease of companies revenues for ~20% in 2022, the estimated amount of taxes paid by foreign companies in 2022-2023 could be at the level ~$20bn annually. As we can see based on profit tax figures reported by companies in 2023 there was no decrease in profit tax payments so probably in 2023 total taxes paid were even higher than in 2022 despite decreasing number of economically active foreign businesses.

MONTHLY FOCUS: On leaving the Russian Federation. Results of July 2024

In this digest, we will summarize the results of July 2024 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies) or based on company’s liquidation.

There are about 1’587 companies identified in the KSE database with revenue data available of more than $317.9 billion in 2021 and $242.3 billion in 2022 (which dropped to ~$193.2 billion in 2023). And at least 417 of them have already been sold by local companies or were liquidated and left the Russian market. In July 2024 KSE Institute identified +8 new exits (3 business sales and 5 liquidations took place in July 2024)⁶, total number of exits observed since the beginning of Russia’s invasion reached 417.

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” it is also worth paying attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 32% based on revenue allocation, those who are leaving represent 25% of total revenue (with 43% share of suspensions and 57% of withdrawals sub-statuses), % of staying companies represent 43% of revenue based on revenue generated in Russia in 2021. So we observe the situation that % of staying companies is less than % of leaving ones (which means that about 57% (!) of pre-invasion revenue generated by foreigners is leaving or already left Russia).

If we take a look at the same chart based on revenue-2022 distribution – the picture will be a bit different:

% of exited is 28% based on revenue allocation, those who are leaving represent only 17% of total revenue (with 41% share of suspensions and 59% of withdrawals sub-statuses), % of staying companies represent 55% of revenue based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

Geography is the most important factor that explains companies’ decisions. Companies from “unfriendly countries” (a term coined by the Russian Federation to describe countries that joined the international sanctions policy against the Russian Federation in response to its invasion of Ukraine) are much more likely to exit.

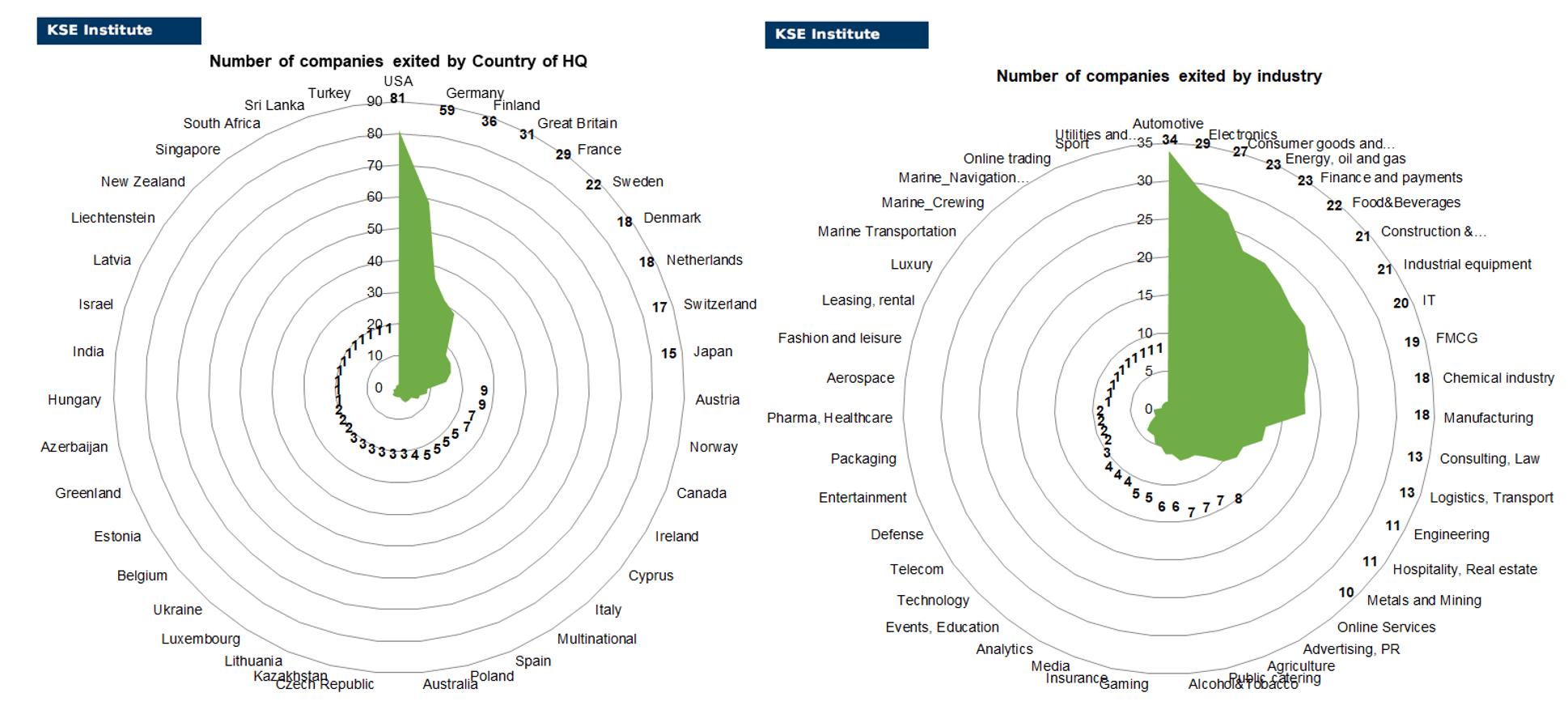

Here are also the breakdowns by countries and by industries of the companies which already exited:

So, as of the end of July 2024, companies from 38 countries and 43 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Germany, Finland, Great Britain, France and Sweden and operated in the “Automotive”, “Consumer goods and closing”, “Electronics”, “Energy, oil and gas”, “Finance and payments” and ““Construction&Architecture” industries.

For a more accurate explanation of the behavior of companies, it is necessary to take into account several factors at the same time. According to our analysis, companies in the technological and communication sector are most prone to exit (as opposed to those who remain in the Russian Federation). Partially due to the fact that they have fewer physical assets in the Russian Federation than in the production sectors. Companies that produce products for the daily consumption of the population in the Russian Federation are less likely to leave (this is one of their key explanations why they do not leave). Pharmaceutical companies that explain their decisions by concern for public health tend to be the “staying” companies.

Companies with larger local revenue and public companies are also inclined to leave the market: presumably, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that the exit of the largest multinationals from the Russian Federation is not as painful for them for global business as it is for smaller companies, for which the share of the Russian market can be significant.

Here is the list of “exiters” that we were able to identify recently: Banijay Group (liquidation), Candy (liquidation), Fujitsu (liquidation), UPS (liquidation), YouScan (liquidation). Also, 3 business sales took place in July 2024: Knorr-Bremse (09.2023: HOLDING TRANSPORT COMPONENTS LLC becomes the new founder of the organization. 07.2024: TOLVO INVEST LLC becomes the new founder of the organization KNORR-BREMSE SYSTEMS FOR COMMERCIAL TRANSPORT LLC), Osram Licht AG (DAKTRAM LLC becomes the new founder of the organization OSRAM LLC, renamed to NOBIUM LLC), and Roshen (business seizure: the shares of the well-known Lipetsk Confectionery Factory Roshen JSC, owned by former Ukrainian President Petro Poroshenko, have been transferred to the ownership of the Russian Federation. In February, the court declared Petro Poroshenko and his son extremists, banning their activities in Russia).

Most of these exits were identified before in their preparation phase. Also, we are not in a hurry to assign “exited” status to many companies that are literally on the verge of exit, although they have not yet finalized this process (even though some of them have already been nationalized, partly sold their business or initiated bankruptcy procedures).

Here are just some of them: American Express (The Russian American Express Bank filed for liquidation in July 2024, and actually stopped conducting transactions for Russian clients in 2022. Before this, the American Express company left Russia almost 100 years ago, after the revolution), Avia Solutions Group (Terminated its operations in Russia. ASG doesn’t have any business operations or interests in Russia, nor have any direct or indirect subsidiaries in that country. ASG maintains a zero-tolerance policy towards conducting any business with Russia, Belarus, Iran, North Korea, Syria, Cuba, Afghanistan and other sanctioned countries or any related entities and natural persons), Bright Security (Website tadviser.ru mentioned that in addition to the Check Point, the distributor Fortis offers on the Russian market solutions from the second Israeli manufacturer Bright Security, which develops software for dynamic security testing of corporate applications. On the updated webpage of Fortis vendors in Russia, there is no information about the Israeli manufacturer Bright Security, and the company itself stated in a letter to the KSE Institute that Bright Security does not conduct business, not only in Russia, but in any territory or with any companies or individuals that are under any kind of international sanctions. The company does not conduct business activities with Fortis in Russia, nor does it intend to pursue any such activities as per the policy mentioned above), Silgan Holdings (Russian President Vladimir Putin signed a decree on the transfer of the Russian assets of the Austrian metal packaging manufacturer Silgan Holdings Austria to the temporary management of the Federal Property Management Agency), Yukon Advanced Optics Worldwide (Lithuanian optics manufacturer yet to complete exit from Russia. Yukon Advanced Optics Worldwide, a Lithuania-based manufacturer of night vision devices, says it is planning to withdraw from Russia and Belarus this year).

The next review of deals for August 2024 will be available in a month.

What’s new last month – key news from Daily monitoring

(updated on a monthly basis) ⁷

01.07.2024

*GlaxoSmithKline (Great Britain, Pharma, Healthcare) Status by KSE – stay

FAS suspended the purchase of generics

https://www.kommersant.ru/doc/6805011

*Google (USA, Online Services) Status by KSE – exited

The court upheld the claim of the bankruptcy trustee of Google against Google for 10 billion rubles

https://www.vedomosti.ru/technology/news/2024/07/01/1047260-sud-vziskal-google

*NHL (USA, Sport) Status by KSE – stay

Clubs of the National Hockey League (NHL) selected 27 Russian players based on the results of all stages of the 2024 draft.

https://www.forbes.ru/sport/515859-kluby-nhl-vybrali-27-rossijskih-hokkeistov-na-drafte-2024-goda

*Animoca (China, IT) Status by KSE – leave

Animoca Brands Corp. Ltd, one of the biggest and most visible blockchain gaming companies, is cutting its service to Russian customers in response to the invasion of Ukraine.

*Spotify (Sweden, Online Services) Status by KSE – exited

Music service Spotify has removed the pages of Russian artists supporting the war in Ukraine

02.07.2024

*Roshen (Ukraine, Food & Beverages) Status by KSE – exited

The shares of the well-known Lipetsk Confectionery Factory Roshen JSC, owned by former Ukrainian President Petro Poroshenko, have been transferred to the ownership of the Russian Federation. In February, the court declared Petro Poroshenko and his son extremists, banning their activities in Russia.

*LG Electronics (South Korea, Electronics) Status by KSE – stay

A South Korean company has launched a Russian service for watching TV channels

03.07.2024

*Mega Fast Cargo (United Arab Emirates, Air transportation) Status by KSE – stay

The USA imposed sanctions on the US company Mega Fast Cargo for the delivery of goods of American origin to Russia.

https://www.epravda.com.ua/news/2024/07/3/716160/

*DMG Mori Seiki (Japan, Industrial equipment) Status by KSE – leave

The machines of the German company apparently continue to trade in Russia

https://www.mdr.de/nachrichten/welt/politik/russland-deutsche-maschinen-dmg-mori-100.html

*Hongqi (China, Automotive) Status by KSE – stay

Hongqi announced the start of cooperation with Sovcombank

04.07.2024

*Beretta Holding (Italy, Defense) Status by KSE – stay

*Camozzi Group (Italy, Industrial equipment) Status by KSE – stay

*Fiocchi Munizioni (Italy, Defense) Status by KSE – leave

Which Italian companies do business in Russia even after the embargo

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – stay

Military-linked Russians remain in IOC despite athlete prohibitions

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisenbank was ordered to urgently present a plan for leaving Russia and threatened to cut off from dollars

05.07.2024

*World Anti-Doping Agency (WADA) (Canada, Association, NGO) Status by KSE – leave

Russia paid part of 2023 dues to WADA

https://www.insidethegames.biz/articles/1146436/russia-paid-part-of-2023-dues-to-wada

*Apple (USA, Electronics) Status by KSE – leave

Russia threatens Apple to remove VPN from App Store

https://www.themoscowtimes.com/2024/07/04/russia-forces-apple-to-remove-vpns-from-app-store-a85608

06.07.2024

*Nordea (Finland, Finance and payments) Status by KSE – exited

Nordea has been charged with money laundering for 26 billion Danish kroner

https://www.dr.dk/nyheder/penge/nordea-tiltalt-i-hvidvasksag-omhandlende-26-milliarder-kroner

08.07.2024

*Seapeak Maritime (Scotland, Marine Transportation) Status by KSE – stay

Seapeak Maritime Limited, based in Glasgow, owns and operates five giant icebreakers carrying fuel from Siberia.

https://www.epravda.com.ua/news/2024/07/8/716346/

*American Express (USA, Finance and payments) Status by KSE – leave

In Russia, they decided to liquidate the “daughter” of American Express. Interfax reports on the decision of American Express Bank to apply for closure of a credit institution, with reference to the data of the Unified State Register of Legal Entities.

09.07.2024

*Indo-Russian Rifles Private Limited (India, Defense) Status by KSE – stay

Indo-Russian joint venture delivers 35,000 AK-203s to Indian Army

*Airbus (Netherlands, Aircraft industry) Status by KSE – stay

Russia’s S7 Airlines plans to withdraw some of its Airbus A320neo-family aircraft from service due to issues with their Pratt & Whitney GTF engines

*Wison New Energies (China, Energy, oil and gas) Status by KSE – leave

Due to sanctions, China decided to return equipment sent to the largest Russian LNG project

*Volkswagen (Germany, Automotive) Status by KSE – exited

The Arbitration Court of the Nizhny Novgorod Region partially satisfied the claim of the Gorky Automobile Plant (GAZ) against the structures of the German automaker Volkswagen for 16.9 billion rubles.

https://www.kommersant.ru/doc/6820956

*Telegram (United Arab Emirates, Online Services) Status by KSE – stay

The Tagansky Court of Moscow fined Telegram 3 million rubles. for failure to remove prohibited information.

https://tass.ru/proisshestviya/21303187

*Bridgestone Corporation (Japan, Automotive) Status by KSE – exited

Gislaved (Sweden, Automotive) Status by KSE – stay

The tire plant in Ulyanovsk, a former Bridgestone asset in the Russian Federation, will resume operations in November under the Gislaved brand

10.07.2024

*Soufflet Group (France, Agriculture) Status by KSE – leave

The Chairman and controlling shareholder of Hong Kong-listed LET Group, Andrew Lo, has resumed plans to sell off the company’s entire interest in Russian integrated resort Tigre de Cristal, located in the Primorye Economic Zone near Vladivostok.

*Airbus (Netherlands, Aircraft industry) Status by KSE – stay

*Boeing (USA, Aircraft industry) Status by KSE leave

Detailed collection: an industrial complex for the production of spare parts for Airbus and Boeing will be launched in August

*China Copper (China, Metals and Mining) Status by KSE – stay

Nornickel, opens new tab is in talks with China Copper to form a joint venture that would allow the Russian mining giant to move its entire copper smelting base to China

*Bulgargaz (Bulgaria, Energy, oil and gas) Status by KSE – leave

The Bulgarian state gas company Bulgargaz announced the start of an arbitration process against the Russian Gazprom

11.07.2024

*Harrods (Great Britain, Luxury) Status by KSE – stay

Secret Hotel Tape Foils Harrods Supplier’s Russian Perfume Sales

12.07.2024

*YouTube (USA, Online Services) Status by KSE – stay

“Lockdown will begin in September.” In Russia, YouTube began to slow down

*Silgan Holdings (USA, Manufacturing) Status by KSE – leave

Russian President Vladimir Putin signed a decree on the transfer of the Russian assets of the Austrian metal packaging manufacturer Silgan Holdings Austria to the temporary management of the Federal Property Management Agency.

13.07.2024

*Dieseko Group (Netherlands, Construction & Architecture) Status by KSE – stay

In the Netherlands, the construction equipment supplier Dieseko Group BV, which illegally participated in the construction of the Crimean Bridge, was fined almost 1.8 million euros.

*UniCredit Bank (Italy, Finance and payments) Status by KSE – leave

ECB has gone too far in pushing UniCredit to quit Russia, Italy minister says

15.07.2024

*Kraft Heinz (USA, Food & Beverages) Status by KSE – leave

The Chernogolovka company decided to stop the production of Heinz baby food in September 2024 and begin producing products under the Gipopo brand.

https://adindex.ru/news/marketing/2024/07/12/324245.phtml

*Meta (USA, Online Services) Status by KSE – leave

In Russia, the WhatsApp messenger began to slow down

https://www.dw.com/ru/v-rossii-nacali-zamedlat-rabotu-whatsapp/a-69648615

*World Boxing Association (Panama, Sport) Status by KSE – stay

Russian boxer Muslim Gadzhimagomedov defeated Chinese Zhang Zhaoxin and won the WBA world title in the weight category up to 101.6 kg. Another Russian, Albert Batyrgaziev, defeated Jono Carroll from Ireland and received the title of interim WBA world champion.

https://www.kommersant.ru/doc/6834815

*University of Delhi (India, Events, Education) Status by KSE – stay

Delhi University Introduces Russian Language UG Program and Dual Degree Provision

*Budějovický Budvar (Czech Republic, Alcohol & Tobacco) Status by KSE – leave

*Budvar (Czech Republic, Alcohol&Tobacco) Status by KSE – leave

Czech brewer Budvar’s net profit up 46.3% in 2023 as it recovers from loss of the Russian market

16.07.2024

*Google (USA, Online Services) Status by KSE – exited

Roskomnadzor demanded that Google unblock more than 200 YouTube accounts of the Russian Federation

https://tass.ru/obschestvo/21372313

*Haval Motor (China, Automotive) Status by KSE – stay

AvtoVAZ will switch to Chinese engines

https://www.moscowtimes.ru/2024/07/16/avtovaz-pereidet-nakitaiskie-dvigateli-a136854

*Caterpillar (USA, Automotive) Status by KSE – stay

American Caterpillar equipment continues to be supplied to Russia bypassing sanctions through a British dealer

https://www.epravda.com.ua/news/2024/07/15/716666

*Hellmann Worldwide Logistics (Germany, Logistics, Transport) Status by KSE – leave

Exclusive: German-linked logistics firm helped sanctioned Russian manufacturers

17.07.2024

*Nissan (Japan, Automotive) Status by KSE – exited

Employees of the former Nissan plant in Russia were sent on vacation. The former Nissan site in Russia, Avtozavod St. Petersburg, will stop assembling Xcite cars from July 22. Interfax reports on sending employees of the enterprise on vacation with reference to the company’s press service.

*Nukem Technologies (Germany, Energy, oil and gas) Status by KSE – leave

The German structure of Rosatom, Nukem Technologies Engineering Services, announced on its website that it had signed an agreement to sell the business to the Japanese IT company Muroosystems Corp.

18.07.2024

*SEFE Securing Energy for Europe (Germany, Energy, oil and gas) Status by KSE – stay

Germany Earned €275 Million From Shareholding in Former Unit of Gazprom

*Global Spirits (Multinational, Alcohol & Tobacco) Status by KSE – exited

Bailiffs transferred shares of companies associated with Global Spirits to the Russian Federation

19.07.2024

*Transpetrol (Slovakia, Energy, oil and gas) Status by KSE – stay

Transpetrol, the Slovak oil transporter, said that supplies from Russia’s Lukoil are being stopped, but supplies from other Russian exporters are arriving in Slovakia via Ukraine.

*Litgrid (Lithuania, Energy, oil and gas) Status by KSE – leave

Baltics inform Moscow, Minsk of their exit from Russian power system

*Sodexo (France, Food & Beverages) Status by KSE – exited

Sodexo’s discreet operations in Russia

20.07.2024

*Centrus Energy (USA, Energy, oil and gas) Status by KSE – stay

Centrus got a waiver from the US Department of Energy to import low-enriched uranium from Russia for deliveries committed by the company to US customers, including nuclear plants, for this year and 2025, said the filing dated July 18.

https://www.mining.com/web/centrus-gets-waiver-on-uranium-imports-from-russia/

22.07.2024

*Wio Bank P.J.S.C. (United Arab Emirates, Finance and payments) Status by KSE – stay

The neobank Wio operating in the UAE, which until recently accepted money transfers in dirhams from individuals from Russia, has stopped doing so

https://www.rbc.ru/finances/19/07/2024/669931a99a794747d1834cc8

*Oracle (USA, IT) Status by KSE – exited

Oracle’s bankrupt subsidiary in Russia did not pay any creditor. How much does the former IT leader owe to Russian business?

https://www.rbc.ru/technology_and_media/22/07/2024/669a74c69a794757876a6041?from=newsfeed

23.07.2024

*Centrus Energy (USA, Energy, oil and gas) Status by KSE – stay

US nuclear company Centrus Energy has received DOE approval to import enriched uranium from Russia in 2024-2025, despite the current ban.

https://energynews.pro/en/centrus-energy-obtains-waiver-to-import-russian-uranium/

*Pertamina (Indonesia, Energy, oil and gas) Status by KSE – stay

Indonesian state-controlled refiner Pertamina has added Russian oil grades to its tender lists to buy September crude, three traders said on Monday.

*Warner Bros (USA, Entertainment) Status by KSE – leave

A branch of Warner Bros. is closing in Russia, according to a document posted in the Unified State Register of Legal Entities database. According to the document, the decision to liquidate the legal entity of the film company was made on July 19.

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – stay

*International Boxing Association (Switzerland, Sport) Status by KSE – stay

The International Olympic Committee (IOC) at its 142nd session in Paris decided to exclude the International Boxing Association (IBA) from the list of recognized federations.

*Antares Vision (Italy, Finance and payments) Status by KSE – stay

*Intesa Sanpaolo (Italy, Finance and payments) Status by KSE – leave

The Russian structure of the Italian Antares Vision, which supplies equipment for product labeling, has encountered a blocking of transactions in the Moscow representative office of Intesa Bank.

https://www.kommersant.ru/doc/6850271

*Industrial and Commercial Bank of China (ICBC) (China, Finance and payments) Status by KSE – stay

*Bank of China (China, Finance and payments) Status by KSE – stay

Moscow Exchange has changed its main clearing bank for settlements in Chinese yuan. Bank of China, which had previously suspended operations with sanctioned banks, has been replaced by Bank ICBC.

24.07.2024

*GfK (Germany, Consulting, Law) Status by KSE – leave

*Global Vox Populi (India, Consulting, Law) Status by KSE – stay

*Ipsos Group (France, Technology) Status by KSE – stay

Top Market Research Companies in Russia: In-Depth Analysis by digitGaps

*UniCredit Bank (Italy, Finance and payments) Status by KSE – leave

The Italian bank Unicredit, one of the last Western banks continuing to operate in Russia, has announced plans to wind down its business in the Russian Federation due to pressure from the European Central Bank.

26.07.2024

*Enütek Makina (Turkey, Defense) Status by KSE – stay

Since the beginning of 2023, the Turkish company Enütek Makina has exported to Russia equipment worth more than 7 million euros, mainly intended for enterprises of the “Promtech” group.

27.07.2024

*Gasum (Finland, Energy, oil and gas) Status by KSE – leave

Finnish energy company Gasum said on Friday it has ceased LNG purchases from Russia as the Nordic country gears up for a total ban on Russian gas.

*YG-1 (South Korea, Industrial equipment) Status by KSE – stay

South Korean firm YG-1 supplies metal-cutting equipment to Russia’s defense industry — and to two plants producing nuclear weapons

28.07.2024

*Google (USA, Online Services) Status by KSE – exited

Roskomnadzor explains reasons for deterioration in video upload quality on YouTube

*Shandong Oree Laser Technology Co (China, Defense) Status by KSE – stay

Oree Laser was one of dozens of Chinese companies sanctioned by the US Treasury Department last month in an effort to limit “Russia’s ability to benefit from access to foreign technology, equipment, software and IT services.

https://www.washingtonpost.com/world/2024/07/26/russia-china-military-drones-ukraine-war/

29.07.2024

*Framatome (France, Energy, oil and gas) Status by KSE – stay

France may build a new power unit of the Armenian Nuclear Power Plant (ANPP) instead of Russia.

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – stay

More than 20 Russian athletes will compete at the Olympics under the flags of other countries

*Otis Worldwide (USA, Industrial equipment) Status by KSE – exited

*Kone (Finland, Construction & Architecture) Status by KSE – exited

Old equipment is slowly being replaced by new equipment

https://www.kommersant.ru/doc/6862354

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – exited

Carlsberg to buy UK drinks maker Britvic for £3.3bn

30.07.2024

*Mondelez (USA, Food & Beverages) Status by KSE – stay

The American company Mondelez International — a manufacturer of Oreo, Milka, Toblerone, Barny, and Tuc chocolate and cookies — has decided not to publish the financial statements of its Russian business for 2023.

https://www.epravda.com.ua/news/2024/07/30/717324/ ; https://www.pravda.com.ua/eng/news/2024/07/30/7468083/

*MyGames (Netherlands, Gaming) Status by KSE – leave

My.Games divests creator platform allegedly used to violate Russia sanctions

https://venturebeat.com/games/mygames-boosty-creator-platform-sold-allegations-russian-sanctions/

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisen reports profit growth and business contraction in Russia

https://www.kommersant.ru/doc/6864026

Austria’s Raiffeisen sees sale of 60% of Russia business as likeliest option

*Sony PlayStation (Japan, Gaming) Status by KSE – leave

Console sales grow on Chinese imports and Russian adaptations

31.07.2024

*Haval Motor (China, Automotive) Status by KSE – stay

*Chery Automobile (China, Automotive) Status by KSE – stay

*Exeed (China, Automotive) Status by KSE – stay

Sales of spare parts for cars from China are growing

https://www.kommersant.ru/doc/6864589

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Russia still brings Raiffeisen half its profit as it drags feet on exit

*Gasum (Finland, Energy, oil and gas) Status by KSE – leave

Gasum ceases all LNG purchases from Russia

https://www.lngindustry.com/liquid-natural-gas/31072024/gasum-ceases-all-lng-purchases-from-russia/

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 7500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

In September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, at the end of February 2024, the KSE Institute jointly with the B4Ukraine coalition partners published the report entitled “2024 Is the Year to Defund Russia’s War – The West Holds the Key” where, among other things, we estimated that the amount of taxes paid by foreign companies operating in Russia in 2022-2023 may amount to $20 billion annually. You can download its full text in English here: https://b4ukraine.org/pdf/b4u_report_2024.pdf

In January 2024, KSE Institute with support of volunteers developed a new application for Apple Store in addition to our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market.

Leave Russia App allows you to find any international brand or foreign company that is operating and paying taxes in Russia. Additionally, you can find out such statistics (if a company has local entity/ies in Russia): number of staff, revenue generated, amount of capital, assets etc. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public news that can confirm this information. Click to download Leave Russia from the App Store!

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business On February 24, 2024 KSE status “wait” was merged with status “stay”

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² In June 2024 KSE Institute reviewed statuses of companies based on new revenue data for 2023, about 100 companies moved from status “stay” to status “leave” due to significant drop of revenue (60%+), usually the same trend took place in 2022 as well

³ When we analyze # of local companies, # of staff and local financials (such as revenue, capital, assets, taxes paid) – KSE Institute uses data according to Russian Accounting Standards (or RAS) from the official EGRUL register, all steps how we do it are explained in detail in the Methodology we published here. The key source for local financials is data from the Federal Tax Service of Russia. The latest available consolidated data for each group’s largest Russian units reported in line with local accounting standards excluding intragroup eliminations and other IFRS or GAAP adjustments. More details are available here.

⁴ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁵ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before, as well as the addition of several new companies from the TOP-50 largest foreign companies rating by Forbes Russia.

⁶ It needs to be mentioned that open access to Russia’s EGRUL register was partly classified recently, so KSE Institute could miss some of the exits but we found the new solution allowing us to get the proper access to the registers in the future.

⁷ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website