- Kyiv School of Economics

- About the School

- News

- 53rd issue of the regular digest on impact of foreign companies’ exit on RF economy

53rd issue of the regular digest on impact of foreign companies’ exit on RF economy

18 September 2023

We will continue to provide updated information on a bi-weekly basis

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 04.09-17.09.2023.

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed a barcode scanner, which is available here: https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

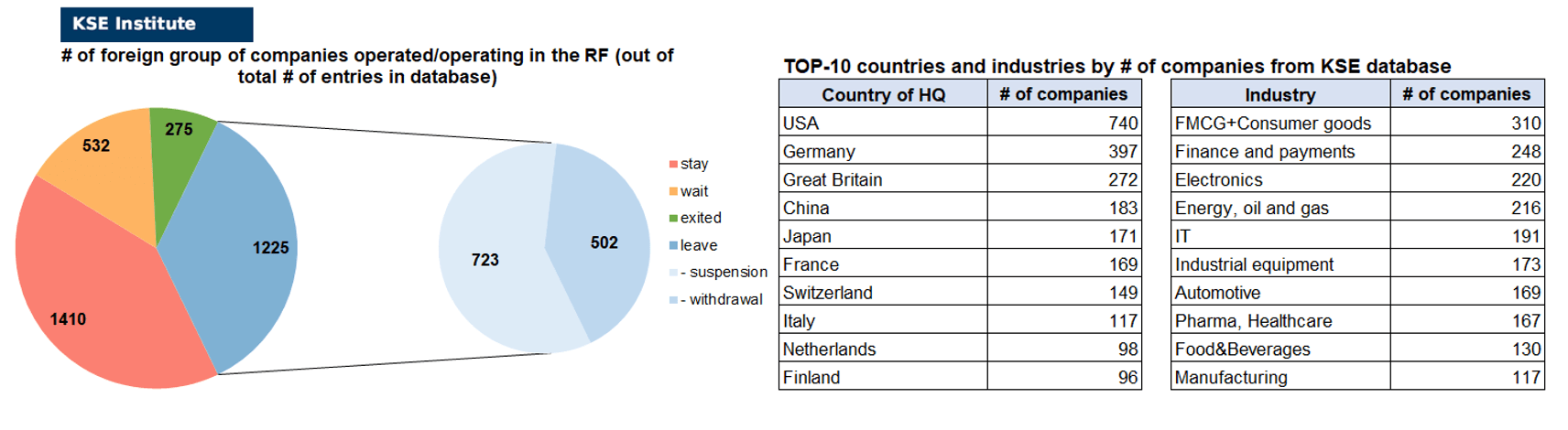

KSE DATABASE SNAPSHOT as of 17.09.2023

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 410 (+26 per 2 weeks)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 532 (+8 per 2 weeks)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 225 (-1 per 2 weeks)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 275 (+2 per 2 weeks)

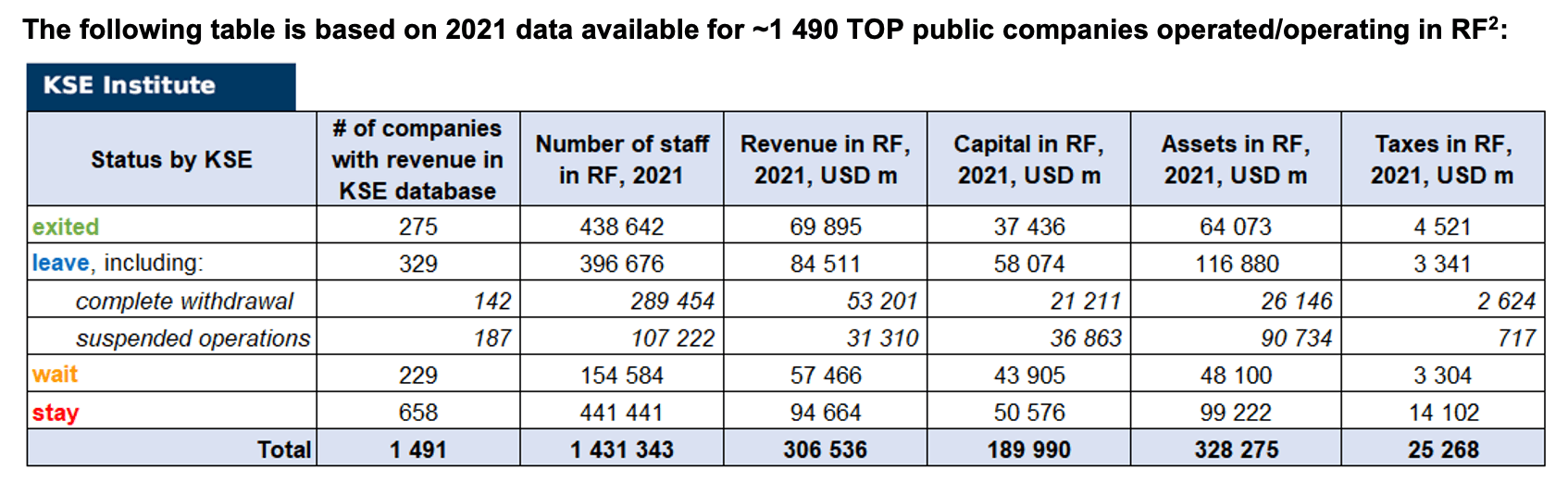

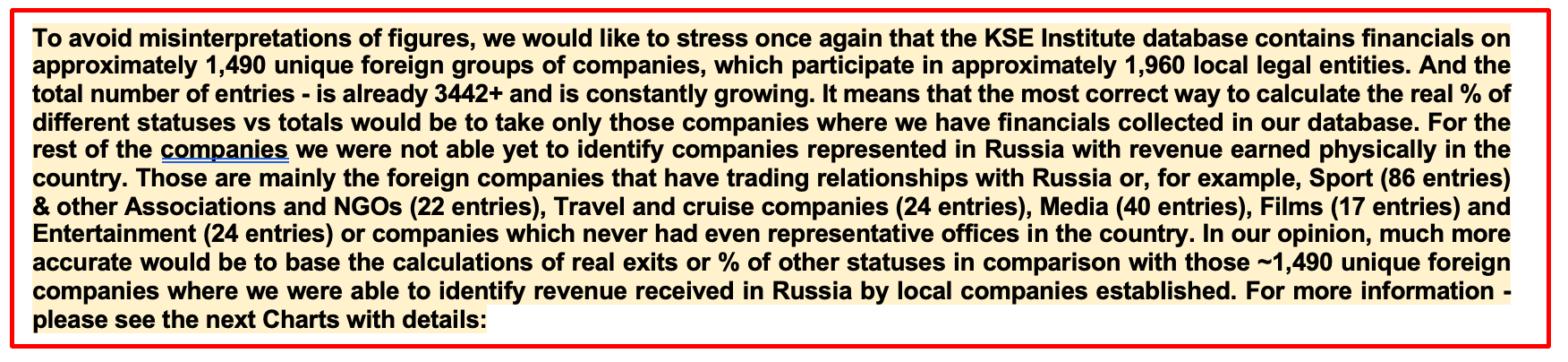

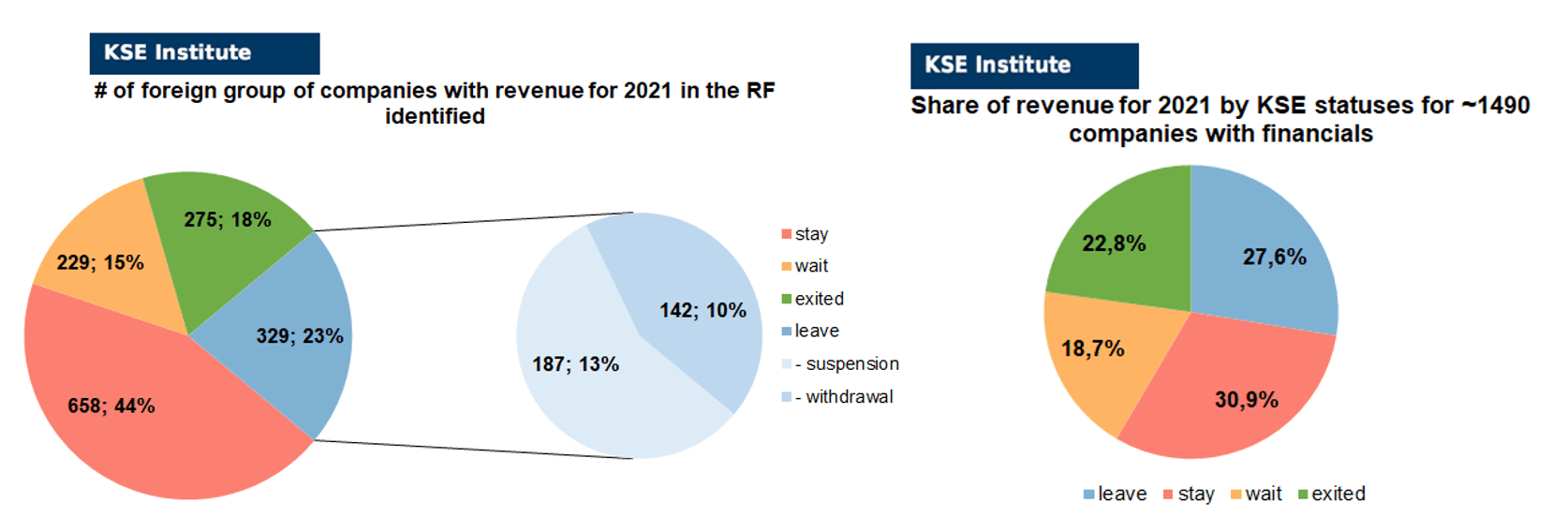

As of September 17, we have identified about 3,442 companies, organizations and their brands from 94 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 490 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $190.0 billion), local revenue (about $306.5 billion), local assets (about $328.3 billion) as well as staff (about 1.431 million people) and taxes paid (about $25.3 billion). 1,757 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 275 companies that have completed the sale/liqudation of their business in Russia based on the information collected from the official registers.

As can be seen from the tables below, as of September 17, 275 companies which had already completely exited from the Russian Federation, in 2021 had at least 438,600 personnel, $69.9 bn in annual revenue, $37.4bn in capital and $64.1bn in assets; companies, that declared a complete withdrawal from Russia had 289,500 personnel, $53.2bn in revenues, $21.2bn in capital and $26.1bn in assets; companies that suspended operations on the Russian market had 107,200 personnel, annual revenue of $31.3bn, $36.9bn in capital and $90.7bn in assets.

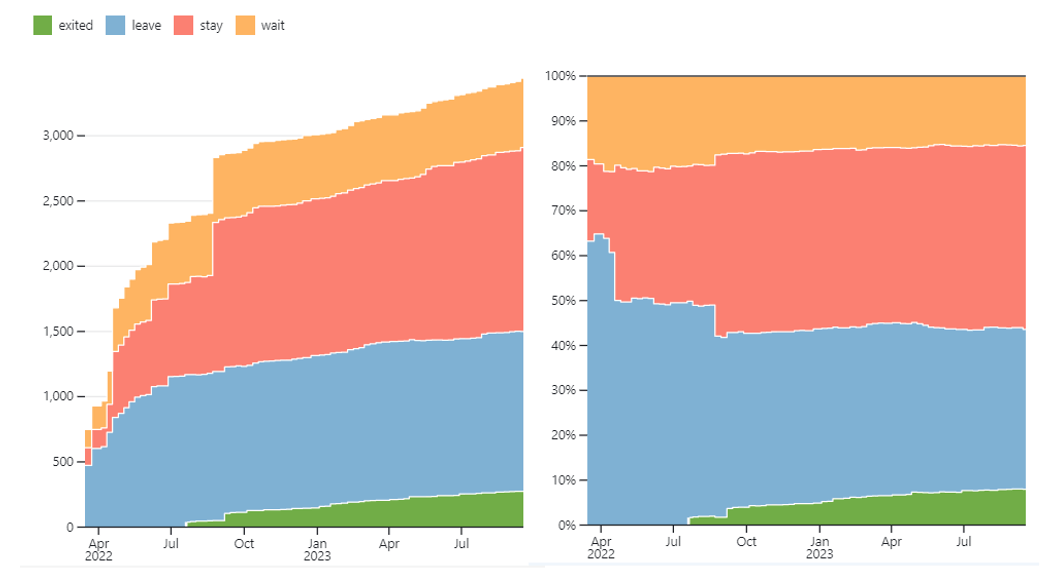

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 12 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 36 were added in September 2023). However, if to operate with the total numbers in KSE database, about 35.6% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 41.0% are still remaining in the country, 15.5% are waiting and only 8.0% made a complete exit³.

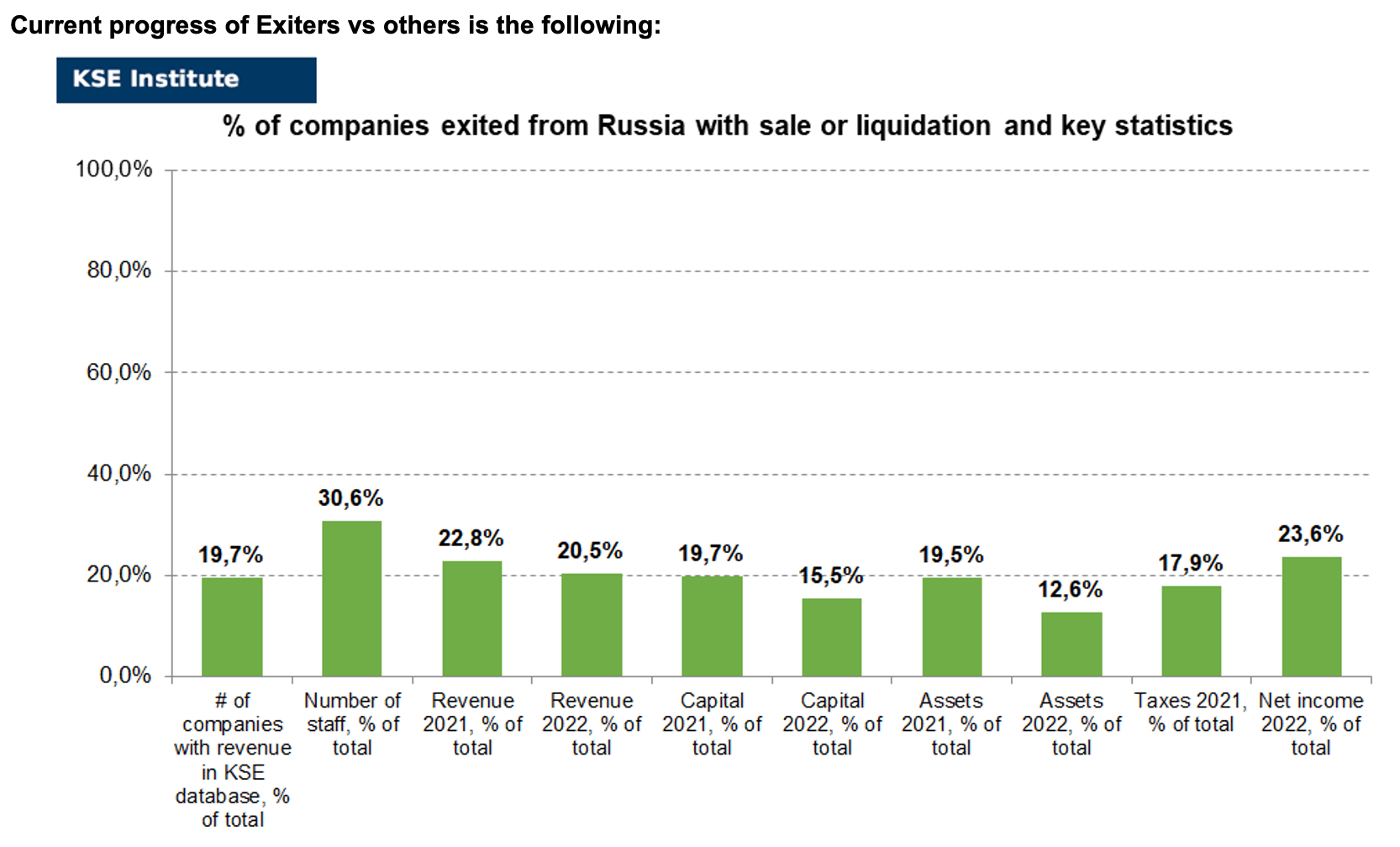

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 275 companies that completely left the country, since in 2021 they employed 30.6% of the personnel employed in foreign companies, the companies owned about 19.5% of the assets, had 19.7% of capital invested by foreign companies, and in 2021 they generated revenue of $69.9 billion or 22.8% of total revenue and paid ~$4.5 billion of taxes or 17.9% of total taxes paid by the companies observed. Data on 1,490 TOP companies is presented in the table above.

As it is visible on the charts based on data for 2021 above, roughly similar % of exited is obtained based on number of companies (18%) and on share of revenue withdrawn (22.8%). At the same time, a totally different picture is for those who are still staying – 44% of companies represent 30.9% of revenue and 15% of waiting companies represent 18.7% of revenue generated in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

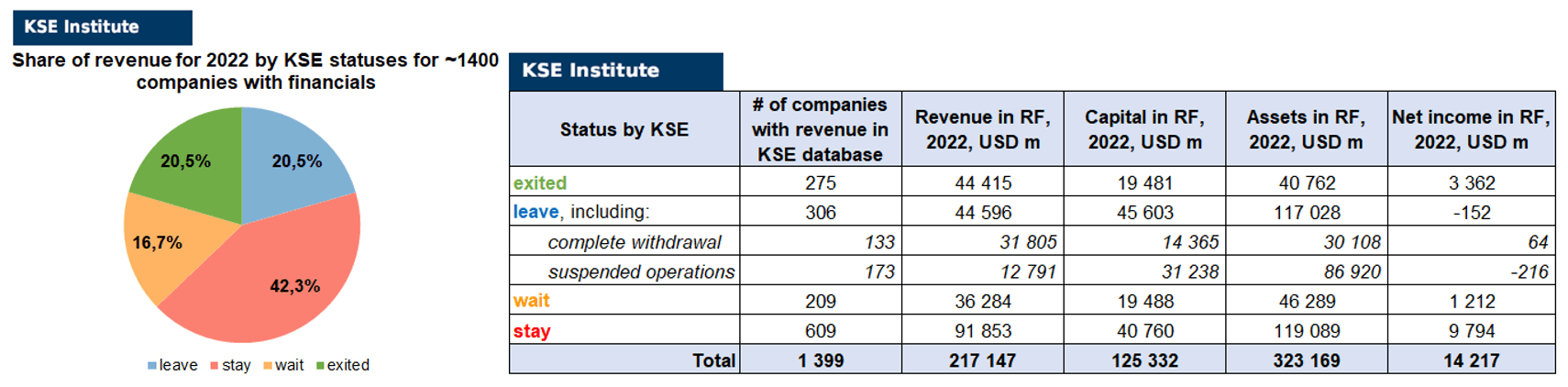

KSE Institute has already collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1400 companies (about 90 companies the data of which we have collected previously have not provided their reporting) and provides below the detailed analysis, more details will be provided further, once we have complete information.

As you can see from the charts above, companies which fully exited Russia were able to generate 2.3% less of revenue in 2022 (20.5% from total volume) than in 2021 (22.8% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-7.1%) revenue in 2022 (20.5% from total volume) than in 2021 (27.6% from total volume). At the same time, staying companies were able to generate much (+11.4%) more revenue in 2022 (42.3% from total volume) than in 2021 (30.9% from total volume). Companies with status “wait“⁴ gained almost the same share (-2.0%) of revenue in 2022 (16.7% from total volume) vs 18.7% from total volume in 2021. So the key conclusion is that money matters for those companies who are still tied with its local business in Russia.

Summarizing the first results of new data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($323.2bn⁵ in 2022 vs $328.3bn in 2021) and will probably even increase once we receive remaining reporting for ~90-100 companies (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

More infographics and analytics see in the special section of our website at the link https://leave-russia.org/bi-analytics

Key updates from the latest Russian news:

Tinder, who left Russia, was fined for refusing to localize the data of Russians

04.09.2023 | The сourt in Moscow fined 10 million rubles from Match Group, which owns the dating site Tinder, for repeatedly refusing to localize the personal data of Russians in the Russian Federation.

https://www.kommersant.ru/doc/6197179

Raiffeisenbank decided to register a new logo in Russia

8.09.2023 | Raiffeisenbank has filed applications for registration of new versions of its logo with Rospatent. In the applications, it is presented in several versions – in Russian and English with the letter “R” on a white and yellow background. Earlier, Austria’s Raiffeisen Bank International announced its intention to sell its business in Russia or withdraw Raiffeisenbank from its perimeter.

https://www.forbes.ru/finansy/496127-rajffajzenbank-resil-zaregistrirovat-novyj-logotip-v-rossii

Volvo’s assets in Russia have been acquired by a Russian investor

8.09.2023 | The Ministry of Industry and Trade of the Russian Federation has identified a Russian investor, which was transferred local assets of Volvo, as well as a partner for the development of the automobile plant in Kaluga. This was reported by the press service of the ministry.

Putin approved the procedure for payments on Eurobonds to foreign depositories

09.09.2023 | Putin approved a new procedure for payments on Eurobonds. Russia will be able to open ruble accounts of the “I” type, the beneficiaries of which will be bond owners. Accounts will be opened in the name of the foreign depositary.

https://www.rbc.ru/finances/09/09/2023/64fc77dd9a79475584e736d1

Central Bank: the decree on Eurobonds does not apply to the exchange of assets with foreign investors

10.09.2023 | The decree of Russian President Vladimir Putin on the temporary procedure for the fulfillment of debt obligations under Eurobonds does not concern the issue of the exchange of assets with foreign investors, the press service of the Bank of Russia reported to TASS.

https://www.kommersant.ru/doc/6209839

Sberbank: bank’s strong numbers point to weakness of sanctions

11.09.2023 | If a currency reflects a country’s economic health, Russia’s banks should be in intensive care. Yet the country’s largest retail lender, Sberbank, is trumpeting a return on equity that western counterparts can only dream of.

https://www.ft.com/content/381e259c-8574-4cd8-a04a-0fdec6aaad28

The assets of the only bank in the Russian Federation with Indian capital show significant growth

14.09.2023 | The assets of the only bank in Russia wholly owned by Indian owners (Commercial Indo Bank) are showing significant growth. Over the course of a year and a half, they increased by more than 11 times, and the funds raised increased by 18.6 times. According to experts, the bank was faced with an influx of funds from non-residents, who could redirect them from other Russian banks. Moreover, the bank prefers not to expand lending, but to keep funds on deposit with the Central Bank of the Russian Federation.

https://www.kommersant.ru/doc/6212050

Experts evaluate the proposal to introduce repatriation of foreign currency earnings of exporters to the Russian Federation

14.09.2023 | The Russian Ministry of Finance proposed introducing a mandatory return of exporters’ foreign currency earnings to Russia, Ivan Chebeskov, director of the department’s financial policy department, told Izvestia. From today to September 22, the Central Bank of Russia will increase foreign currency sales by almost 10 times. The daily volume of Bank of Russia operations will be 21.4 billion rubles instead of 2.3 billion.

Russian billionaires withdrew $50 billion worth of assets from Europe

14.09.2023 | The richest Russians have withdrawn a total of at least $50 billion in assets from Europe in a year and a half, writes Bloomberg. Among the first were the assets of Andrei Guryev and Viktor Rashnikov in Switzerland and Cyprus. “Now Russia seems less evil than foreign countries,” explained Natalya Kuznetsova, partner at DRT (formerly Deloitte).

https://www.forbes.ru/milliardery/496425-rossijskie-milliardery-vyveli-iz-evropy-aktivy-na-50-mlrd

The United States has made a large-scale expansion of the sanctions list for the Russian Federation

14.09.2023 | The United States on Thursday made one of the largest updates to the Russian segment of the SDN List this year. A number of large Russian entrepreneurs have been under American sanctions since September 14, according to a statement from the US Treasury.

https://www.interfax.ru/business/920862

Former Finnish-Russian Chamber of Commerce recognized undesirable in Russia

14.09.2023 | The Prosecutor General’s Office claims that EastCham Finland “forced other companies to stop working in Russia” and advised Finnish companies on methods of withdrawal from the Russian market.

https://www.rbc.ru/politics/14/09/2023/65030c769a7947c1d160e420

WEEKLY FOCUS: Analysis of German companies and their positions in Russia after 17 months of war

After the collapse of the USSR, Russia sought economic dividends in the form of huge Western loans and technologies, primarily for the development of oil and raw material deposits in Siberia and other remote areas. The supply of oil and natural gas to Europe makes it possible to import food and consumer goods necessary for Russia. Until recently, the most important role in the implementation of these plans was assigned to Germany.

Germany is one of the key European countries for Russia. Relations between Russia and Germany have always had a special importance in the international arena. The trajectory of the development of European civilization, the arrangement and balance of forces in the global world depend on their nature. Germany is traditionally one of Russia’s largest trading partners.

For reference: Russia’s trade with Germany in 2021 amounted to 56.9 billion US dollars, an increase of 35.87% (15.1 billion US dollars) compared to 2020. Russian exports to Germany in 2021 amounted to 29.6 billion US dollars, an increase of 59.98% (11.1 billion US dollars) compared to 2020. Russia’s imports from Germany in 2021 amounted to 27.3 billion US dollars, an increase of 16.79% (3.9 billion US dollars) compared to 2020. Russia’s trade balance with Germany in 2021 was positive in the form of 2.3 billion US dollars, while at the end of 2020 it was negative in the form of 4.9 billion US dollars. Germany’s share in Russia’s foreign trade turnover in 2021 was 7.2% against 7.3% in 2020. In 2021, Germany ranked 2-nd in terms of share in Russian trade (also 2nd in 2020). The share of Germany in Russia’s exports in 2021 was 6% against 5.5% in 2020. In terms of share in Russian exports in 2021, Germany took 3-rd place (4-th place in 2020). The share of Germany in Russia’s imports in 2021 was 9.3% against 10.1% in 2020. In terms of share in Russian imports in 2021, Germany took 2-nd place (in 2020 – also 2-nd place)⁶

For quite a long time, Russia has been under the influence of Western economic sanctions. Already in 2014, economic sanctions against Russia were aimed exclusively at competitive sectors of the economy, in particular, at the gas and oil industry. It was the raw materials orientation of the Russian economy that became the main target of sanctions by the United States and its allies, in particular, Germany, since, until the beginning of the large-scale Russian-Ukrainian war in 2022, Russia was the world’s largest gas producer and the dependence of European countries on Russian gas ranged from zero to one hundred percent (Germany consumed the most Russian gas in Europe). Russia has the world’s largest discovered natural gas reserves and the second largest oil reserves⁷

In this regard, geopolitical risks for Germany’s energy and climate security have grown significantly since Russian annexation of Crimea in 2014. The share of Russian gas rose to 49% of total German gas imports in 2019, up from 34% in 2009. This German economic position at the time of the Russian invasion of Ukraine in February 2022 was one of the most vulnerable EU countries in terms of security of supply and general energy and climate security in relation to Russia. At the same time, the German industry has been under the close attention of the public and the media since the start of military operations in Ukraine, because Germany is often accused of having indirectly contributed to the strengthening of Putin’s aggressive regime through its long-term close economic cooperation with Russia – especially in the import of energy carriers.

Given this, the cornerstone of Russo-German economic ties was the import of cheap Russian energy to power German heavy manufacturing, which was then exported back as high value-added and sophisticated technology products. German companies have invested more than 21 billion euros in Russia by the end of 2021, making the country the third largest investor in Russia after Cyprus and the Netherlands⁸, but in 2022, German companies reduced their own investments in Russia. As a result of the reduction of direct investment loans to Russian enterprises, the return of funds from Russia to Germany in the amount of 3 billion euros was observed⁹

At the same time, it is worth noting that Russian direct foreign investments in Germany are relatively insignificant, they are concentrated in several strategic sectors of the economy, such as energy supply (mainly oil refining, transportation, storage and distribution of natural gas).

As of the end of 2022, there were 1 713 companies in Germany with the ultimate beneficial owner in Russia¹⁰.Russian corporate presence in Germany is concentrated in about 40 large companies that specialize in oil refining, supply and distribution of natural gas, production of metal and plastic products, glass production, and transport. These firms employ thousands of employees and own billions in strategic assets. EU sanctions have limited the ability of these companies to gain further strategic advantage and acquire more assets in certain industries in Europe.

Russian annexation of Crimea in 2014 and Western sanctions led to the fact that the number of German companies investing in Russia fell by a third. However, by 2020, that number was just under 4 000 companies, and many were convinced that their presence could help anchor Russia in the democratic sphere. On February 24, 2022, that belief was shattered, leaving companies of all sizes wondering what to do next. While some companies announced their decision to withdraw from the Russian market and began severing business ties, others tried and still try to stay, allegedly out of loyalty to their employees, despite Western sanctions that have created huge obstacles for banking and cross-border transactions.

Before the beginning of the Russian invasion of Ukraine, about 400 German companies worked in Russia. Currently, there are fewer of them. In 2022, they paid only in profit tax more than 400 million US dollars to the Russian budget (and before the war was started the total amount of taxes paid by German companies was more than 2.3 billion US dollars). This is a record figure among all EU countries – only companies from the USA gave a larger amount as tax deductions¹¹

Based on available data from the KSE Institute, Germany is one of the leading foreign employers in Russia (hired before the invasion about 165,000 people), it was third after the USA (hired about 400,000 people) and France (about 250,000 people), which was in 2nd place.¹²

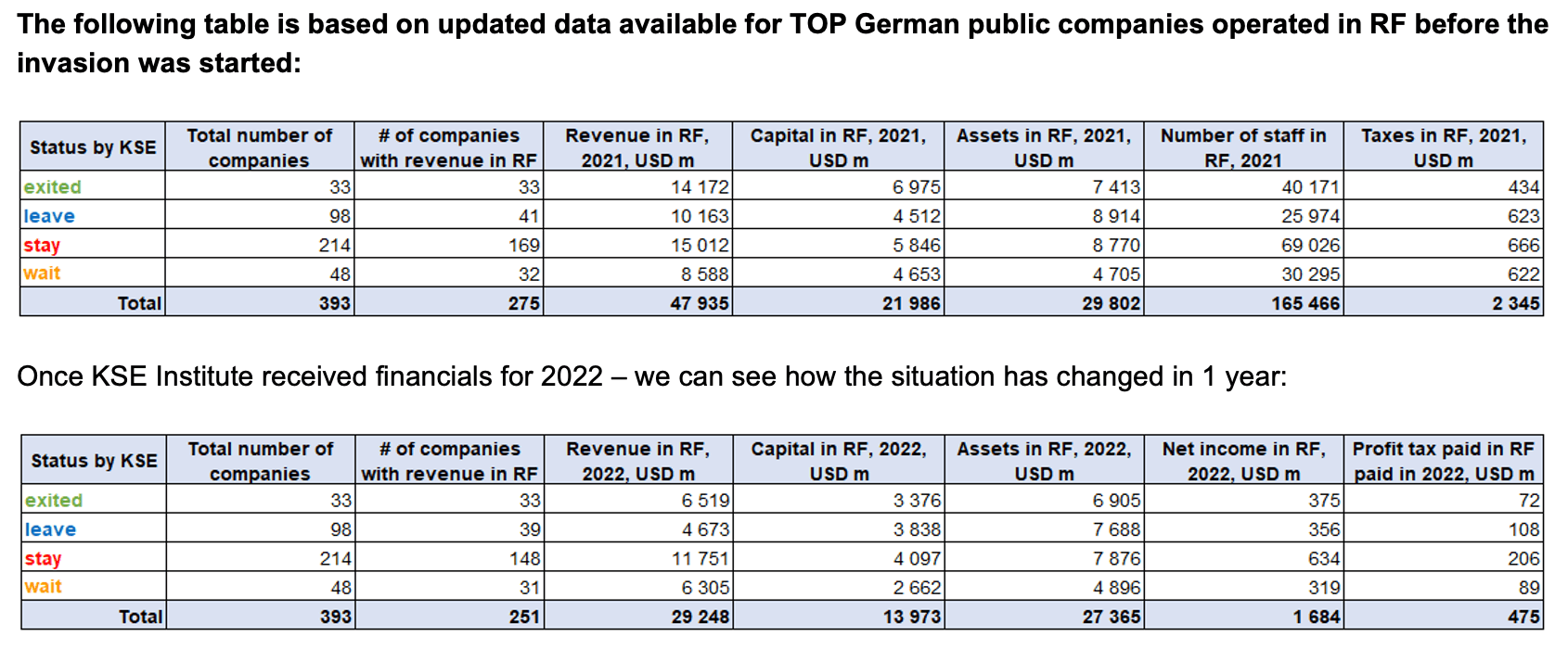

According to data collected by the KSE Institute¹³ in 2021 TOP 275 German companies with a share in the capital of 50+% provided jobs for 165,000 people, those companies generated $47.9 bn in annual revenue, had $22.0 bn in capital and $29.8 bn in assets. As of 15/09/2022 only 33 German companies have fully exited Russia through selling or liquidation of their business/assets or its part to a local partner and left the market.

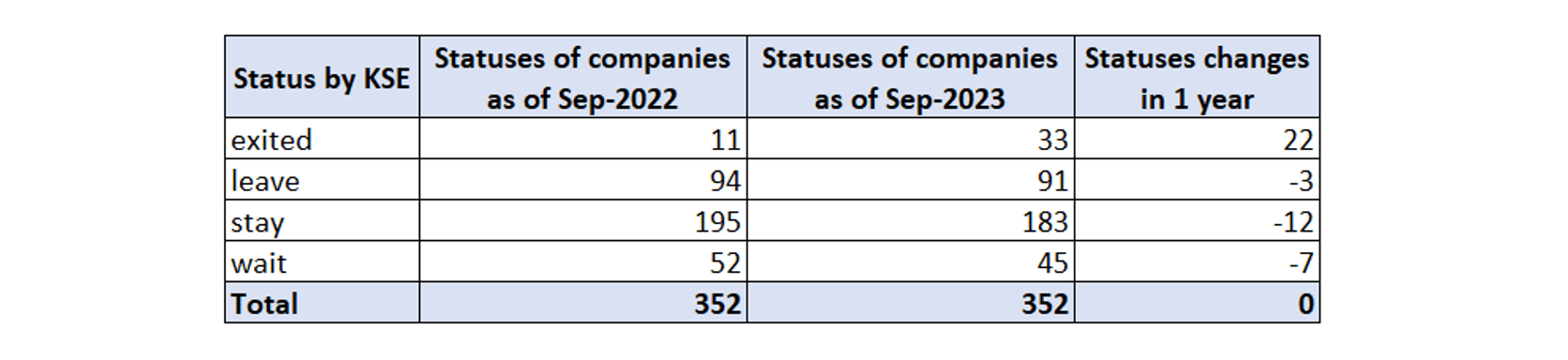

A year ago KSE Institute made its first analysis on German companie¹⁴, at that moment we identified 352 companies from Germany that had relations with Russia, in 1 year we see that number of fully exited increased from 11 to 33 as of September 2023, for illustrative purposes only the same companies which were in the database a year ago are taken into account in the table below:

But since that time, we managed to identify more than 40 new German companies that had connections with Russia.

So, as it is visible from the table above, combined % of staying companies with HQs in Germany (with KSE statuses “stay” and “wait”) is still quite high – 67% based on total number of companies, 71% based on number of companies with revenue or 62% based on volume of revenue received in RF in 2022 and this share in % is increased for +13% vs 2021 when it was ~49% – which means that more companies prefer to wait and stay in the country even though nominal volume of their revenue, in total, significantly decreased in 2022 vs 2021.

Many German companies left Russia after the start of the full-scale war against Ukraine – among them Siemens, Daimler, Mercedes-Benz Group, Henkel, Robert Bosch, Wella etc. At the same time, such giants as Metro, Bayer, HeidelbergCement, Hochland, Knauf Gips and others continue to earn money in Russia and pay taxes to the budget of the aggressor country. Some of the remaining German companies took advantage of the departure of competitors and only increased their turnover.¹⁵

For reference: in 2022, trade between Russia and Germany decreased by 45.2% compared to the previous year and amounted to 14.6 billion euros. For comparison, in 2012, the trade turnover reached a record mark of 80 billion euros. Russia ranked 11-th in the ranking of Germany’s trading partners. In 2021, it will be the 15-th, and according to the results of last year, it will be the 23-rd. The reason for this is the increased gas and oil prices. But at the same time, the import of other goods decreased by 41.5%. Germany earned 3.1 billion euros from the sale of medications to Russians. This article of export took the first place in the rating. As an example, the pharmaceutical company Stada (Germany) paid taxes to the Russian budget in 2022 in the amount of 53.6 million US dollars¹⁶

Germany’s foreign trade with Russia in 2022 was marked by a record 30-year increase in imports over exports. The foreign trade balance amounted to 20.7 billion euros¹⁷

Before the start of the war in Ukraine, according to the Association of German Chambers of Commerce and Industry¹⁸ more than 3 600 German companies worked with Russia, many of them for decades. Some decided to leave the Russian market, but others still work in Russia. Some German industries are particularly numerous in Russia. First of all, these are pharmaceutical and agrochemical companies, as well as those that trade in food products, consumer goods and agricultural machinery.

The most famous of them are the pharmaceutical and agrochemical company Bayer, Metro, the manufacturer of agricultural machinery Claas and the chain of construction and grocery stores Globus. In addition, pharmaceutical companies Merck and Stada, and medical technology company Fresenius are also active in Russia.

Thus, German companies continue their activities in Russia, explaining this with large investments made in recent years. For example, the agricultural machinery manufacturer Claas has quadrupled the production of combine harvesters at its factory in Russia over the past five years.

For reference: in 2021, Claas Group invested again in the plant, increasing the number of employees there to 800. Pharmaceutical giant Bayer announced the termination of all non-core activities in Russia and Belarus. However, this does not mean a complete stop of supplies. For now, the company intends to continue supplying Russia with pharmaceutical and agricultural products, such as medications for cancer or cardiovascular diseases, as well as seeds for agriculture.

The Globus chain of retail stores manages 19 hypermarkets in Russia, where almost 10 000 of Russians workers were employed.

Metro is one of those German companies whose activity in Russia is particularly noticeable. In Russia, it achieves significantly higher profitability in 93 of its enterprises than in the domestic German market¹⁹

Also, it is worth noting that Germany is the leading country in terms of the origin of goods that, bypassing sanctions, end up in Russia. Among the transit countries are Kazakhstan, Georgia, Armenia, Kyrgyzstan and other Central Asian countries. Large all-terrain vehicle and trucks, as well as cars, fuel and chemicals are mainly supplied from Germany²⁰

How are German companies reacting?

So out of 393 companies in the database, 67% of companies are still staying in Russia, while another 25% are leaving and only 8% completely exited through sales or liquidations. Some of the German companies are among the examples of clean breaks from the Russian market, while others defy demands for exit despite pressure.

Exit completed:

Volkswagen (Status by KSE – exited) Volkswagen has completed the sale of its Kaluga production plant in Russia and its local subsidiaries, the German carmaker said, ending months of wrangling with Russian authorities over the deal. After sale and changes in the official register incorporated in May 2023 (VOLKSWAGEN AKTIENGESELLSCHAFT, ŠKODA AUTO A.S. and VOLKSWAGEN FINANCE LUXEMBOURG S.A. were deleted as owners) LLC “ART-FINANCE” became the new owner and key company was renamed from LLC “VOLKSWAGEN GROUP RUS” to LLC “AGR”, which also took over official Instagram account in Russia and it provides service of Volkswagen cars in Russia.

Henkel (Status by KSE – exited) The consortium that acquires the Henkel business activities in Russia includes Augment Investments, Kismet Capital Group and Elbrus Services. All acquirers have established and long-standing business relationships in Western countries and are not subject to EU or US sanctions.The agreed purchase price amounts to 54 billion rubles, which corresponds to around 600 million euros. The relevant Russian authorities have already approved the transaction. 04.2023: Founder entry HENKEL AG & CO removed. KGAALID HOLDING LIMITED becomes the new founder of the organization.

HAVI (Status by KSE – exited) The owner of the former McDonald’s restaurants in Russia, Oleksandr Govor, bought the private Russian logistics company HAVI, which has 14 distribution centers. Vkusno i Tochka reported that Govor will keep HAVI’s management and more than 1,200 employees, changing the company to “Logistics – i Tochka”. May 2023 – the new founder of the organization becomes LLC “LOGISTICS AND POINT”. The record about the founder of “HAVI GLOBAL LOGISTIK GMBH” LLC has been deleted.

Robert Bosch (Status by KSE – exited) Bosch sold the Russian business in Engels. We are talking about three plants for the production of spark plugs, power tools and heating boilers. The assets of the German group were acquired by the S8 Capital holding of Armen Sargsyan. Bosch sold the Russian business (all 6 local companies).

Obi Group (Status by KSE – exited) a German chain of hardware stores in Wermelskirchen, which operates throughout Europe.

On July 27, German OBI GmH signed an agreement with a group of Russian investors on the sale of six legal entities of the Russian chain of OBI DIY stores. The amount of the transaction is symbolic 1 euro. At the beginning of 2022, it included 27 hypermarkets, which employed about 4,900 employees.

At the end of 2022, the Chechen businessman Valid Korchagin became the co-owner of one of the largest chains of construction hypermarkets in Russia, OBI. The network operated in the country for two decades and belonged to a German company. After the owners decided to leave Russia, the network changed hands through unknown intermediaries. At first, shares in OBI went to businessman Joseph Lyokumovych from Israel and entrepreneur Ilya Kolobov. But later, 90% of the trading network was transferred to the “Modul-2” company, which is also connected to the “Syndika” holding of Senator Kanokov, and 10% to Korchagin.

Daimler Truck (Status by KSE – exited) is one of the world’s largest commercial vehicle manufacturers, with over 35 main locations worldwide and approximately 100,000 employees. Suspended business including partnership with Kamaz. Daimler Truck was in talks over a stake in Russia’s Kamaz. DK RUS LLC (ID 7714790325) was sold to KAMAZ, agreement dated January 13, 2023. And the second LLC EVOBUS RUSSLAND (Inn 7707281292) is in the liquidation stage from December 2022.

Siemens (Status by KSE – exited) is a German multinational conglomerate corporation and the largest industrial manufacturing company in Europe.

Siemens has already sold 4 large factories (SIEMENS ENERGETIKA TRANSFORMATORY LLC, Siemens Gas Turbine Technologies LLC, Siemens Transformers LLC, and Siemens Finance LLC). The Group’s assets still remained in the Russian Federation in 2022 (in total, they had more than a dozen legal entities), but a clear trend towards exit is visible. In April 2023 finalized sales of assets.

Continental (Status by KSE – exited) is a German manufacturer of tires, automotive electronics and other components. Continental decided to leave Russia in March 2023 and had already received permission from Moscow, but asked the American Ministry of Trade to check the deal before closing, the answer was delayed. 23.05.2023: JSC “S8 INDUSTRIAL ASSETS” becomes the new founder of the organization. Records about previous founders were removed: PRIVATE COMPANY LIMITED LIABILITY CONTINENTAL GLOBAL HOLDING NETHERLANDS, SIJIECH HOLDING B.V. and CONTINENTAL GLOBAL HOLDING NETHERLANDS B.V.

On the way to leave:

SAP (Status by KSE – leave) is the largest non-American software company by revenue, the world’s third-largest publicly-traded software company by revenue, and the largest German company by market capitalization. In April 2022, the Waldorf, Germany-based enterprise software company announced plans to pull out of Russia following the invasion, which triggered a series of Western sanctions against Russian companies. However, support for customers who were not initially targeted by Western sanctions continued, as early termination would have resulted in fines for the company. In September 2023, SAP notified partners and clients about the termination of support for its solutions in Russia. The developer’s clients have already started to transfer technical support of their systems to local IT companies.

Uniper SE (Status by KSE – leave) is an energy company based in Düsseldorf, Germany. Suspend new Russian gas purchases/divest Unipro. Uniper had found a local buyer for Unipro; it had yet to receive “presidential approval”, suggesting the sale was being personally blocked by Putin. The Federal Property Management Agency received foreigners’ shares in Unipro under temporary management. Uniper takes €4bn hit after losing control of its Russian subsidiary. The German energy concern Uniper does not count on the resumption of Russian gas supplies and is waiting for a court decision on a lawsuit against Gazprom Export for gas supplies no earlier than 2024.

BMW (Status by KSE – leave) is a German multinational corporate manufacturer of luxury vehicles and motorcycles. According to press reports, the company is discontinuing local production in Russia and exporting to the Russian market. The German automobile concerns Mercedes-Benz and BMW disconnected Russian dealers from the software, which was used for car maintenance.

BASF SE (Status by KSE – leave) is a German multinational chemical company and the largest chemical producer in the world. BASF has not conducted new business in Russia and Belarus, in light of the war of aggression against Ukraine ordered by the Russian government. BASF strongly condemns the Russian attack on Ukraine and the violence against the civilian population. The Board of Executive Directors of BASF SE has now decided to also wind down the company’s remaining business activities in Russia and Belarus by the beginning of July 2022. Exempt from this decision is business to support food production, as the war risks triggering a global food crisis. 07.2023: The record about the founder of CONSTRUCTION RESEARCH AND TECHNOLOGY GMBH has been deleted. The record about the founder MASTER BUILDERS SOLUTIONS DEUCHLAND GMBH has been removed. MBSS HONG KONG LIMITED becomes the new founder of the organization.

Defy demands for exit despite pressure:

Bayer (Status by KSE – wait) is a German multinational pharmaceutical and life sciences company and one of the largest pharmaceutical companies in the world. In March, Bayer AG announced that it was cutting its presence in Russia and Belarus. The company suspended advertising activities, terminated all investment projects, and stopped considering any business proposals. But in August, the company decided to continue supplying agricultural products to Russian farmers. Bayer added that it expects Russian authorities to help protect the free flow of agricultural products. It has 700 employees in Russia and generates 2,26% of its turnover in Russia. According to customs data, in 2023 the company is the largest exporter of corn seeds to Russia.

HeidelbergCement (Status by KSE – wait) The company is freezing all new investments in Russia. HeidelbergCement is present with three cement plants all for domestic operations. At the P&L level in 2021, the company revenue accounted in Russia was around 1%.

In January 2023, the company announced “Heidelberg Materials as a global company strongly condemns this war against the Ukrainian people. As you correctly noted, we fully support all sanctions on Russia and immediately stopped all investments almost one year ago. We operate a pure local business in Russia, on a limited scale and only for local needs. We ensure that our reduced activities in Russia are fully compliant with international and other laws as well as with international human rights standards.”

Riol Chemie GmbH (Status by KSE – stay) is a German distributor of chemicals, reagents, deactivation agents and others. The chemical company is at the center of an investigation by public prosecutors, who suspect that executives at the firm exported toxic substances and special laboratory material to Russia in more than 30 instances over the past three and a half years without obtaining the necessary permits.

Conclusion

Of all the European countries, Germany is most interested in ending the conflict between Russia and Ukraine, since only peace in Europe will allow to return the profitability of German companies that received Russian energy resources at attractive prices and, probably, to restore the powerful investments of German companies in Russia. To do this, on the one hand, it must coordinate its Russian policy with its NATO and EU allies, and on the other hand, take into account the opinion of Moscow.

The Kremlin’s war in Ukraine nullified decades of active German foreign policy toward Russia. The scale and brutality of the Russian invasion of Ukraine provoked a strong response from German society and the German Government after the initial shock. As a result, Germany quickly implemented an extraordinary policy of economic security and isolation in the energy sector, and supported unprecedented EU and G-7 sanctions, as well as technology and goods controls on Russia. The Russian-Ukrainian war put an end to the “special” nature of Russian-German relations. Most of the German companies that worked in Russia stopped their activities in Russia due to public opinion and unwillingness to lose their own image.

German companies remaining on the Russian market are currently caught between Western sanctions and public outrage on the one hand, and an increasingly hostile Russian government on the other (one example is the introduction of interim management at Uniper SE and essentially its nationalization). The Kremlin is making it harder for Western companies to sell their Russian assets – and imposing tough conditions when they do. German investors, like others on the list of “unfriendly” countries, now need to receive official permission from a Ministry or Department, sometimes even from the President of Russia personally, regarding the sale of their own assets in Russia. Therefore, it is not surprising that some German companies did not leave the Russian market completely. At the same time, the created obstacles to exiting the Russian market have no analogues in the world.

As a conclusion, it can be stated that Germany currently has limited direct economic ties with Russia, which is connected with the war in Ukraine and this, in turn, has a negative effect on the domestic economic situation in Germany itself. Thus, according to the OECD, there is already stagnation in the German economy in 2023 and its growth is expected to be only 1.3% in 2024. Investor and consumer confidence improved thanks to the Government’s strong support for energy prices, rapid substitution of energy imports from Russia, and lower energy prices. The budget deficit will be reduced in 2023 and 2024. GDP has declined by 2.1% in the fourth quarter of 2022 and by 1.2% in the first quarter of 2023. Before the start of Russia’s war of aggression against Ukraine, Germany was heavily dependent on Russian gas, oil and coal, with approximately one-third of its primary energy sources coming from Russia. Since then, energy imports from Russia have plummeted due to the EU embargo on coal and oil, the destruction of gas pipelines and the rapid diversification of energy suppliers²¹

Mass migration of Ukrainian citizens to German territory is also likely to affect the development of German-Russian relations. The integration of Ukrainian refugees into German society will lead to an increase in their participation in the political life of Germany. This circumstance will lead to the strengthening of anti-Russian discourse in Germany in the future.

What’s new last month – key news from Daily monitoring

(updated on a bi-weekly basis)²²

01.09.2023

*International Esports Federation (IESF) (South Korea, Association, NGO) Status by KSE – stay

On August 28, the Ukrainian eSports Federation (UESF) announced that despite all the protests and efforts of the Ukrainian side to prevent it, the international eSports federation IESF managed to return the Russians to its tournaments and lift the ban on the use of the flag.

*Mars (USA, Food & Beverages) Status by KSE – stay

*Pepsi (USA, Food & Beverages) Status by KSE – stay

NACP added PepsiCo and Mars to the list of international sponsors of the war

*Wise PLC (Great Britain, Finance and payments) Status by KSE – leave

Fintech giant Wise allowed Russia sanctions target to withdraw money, U.K. government says

03.09.2023

*Hyatt (USA, Hospitality, Real estate) Status by KSE – leave

*Belmond Limited (Bermuda, Hospitality, Real estate) Status by KSE – leave

*Four Season hotels (Canada, Hospitality, Real estate) Status by KSE – leave

*Intercontinental Hotels (Great Britain, Hospitality, Real estate) Status by KSE – leave

*Marriott (USA, Hospitality, Real estate) Status by KSE – exited

Since the spring of last year, Hyatt, InterContinental, Marriott, CPI Hotels, Belmond, Sokos, Four Seasons, BWH and Wyndham have left the Russian market.

https://www.kommersant.ru/doc/6187040

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – wait

*Olympic Council of Asia (Kuwait, Sport) Status by KSE – wait

Athletes from Russia will not compete at Hangzhou Asian Games, International Olympic Committee decides

*United Nations (UN) (USA, Association, NGO) Status by KSE – stay

UN suggests connecting Russian Agricultural Bank subsidiary to SWIFT and unlocking assets of Russian companies

https://www.pravda.com.ua/eng/news/2023/09/2/7418175/

*Barilla Group (Italy, Food & Beverages) Status by KSE – wait

*Ferrero SpA (Italy, Food & Beverages) Status by KSE – stay

Barilla Continues To Produce Pasta In Russia

https://www.standforukraine.it/en/2023/08/31/barilla-maintains-pasta-production-in-russia/

04.09.2023

*Industrial and Commercial Bank of China (ICBC) (China, Finance and payments) Status by KSE – stay

*Bank of China (China, Finance and payments) Status by KSE – stay

*China Construction Bank (China, Finance and payments) Status by KSE – stay

*Agricultural Bank of China (China, Finance and payments) Status by KSE – stay

Chinese lenders extend billions of dollars to Russian banks after western sanctions

https://www.ft.com/content/96349a26-d868-4bd1-948f-b17f87cc5c72

https://www.kommersant.ru/doc/6197090

*Pepsi (USA, Food & Beverages) Status by KSE – stay

SAS are taking swift action and have already announced a boycott of

PepsiCo products due to their continued business in russia and financially fueling russias war!

https://twitter.com/IneBackIversen/status/1697954241212486089?s=20

*Twitch (USA, Online Services) Status by KSE – wait

The Tagansky Court of Moscow fined the Twitch service 13 million rubles. for repeated refusal to localize personal data of Russian users in databases in Russia.

https://www.rbc.ru/rbcfreenews/64f590fd9a79470e8fb81e49

*Citi (Citigroup) (USA, Finance and payments) Status by KSE – wait

Citibank is shutting down its network of ATMs in Russia

05.09.2023

*World Aquatics (Switzerland, Sport) Status by KSE – stay

World Aquatics to allow Russian and Belarusian athletes to compete as ‘Individual Neutral Athletes;’ Paris still uncertain

*SAP (Germany, IT) Status by KSE – leave

The German supplier of industrial software SAP stops supporting its solutions in Russia.

*Little Caesars (USA, Public catering) Status by KSE – wait

The general manager of Russian franchises, says he has kept operating despite silence from Detroit-based Little Caesar Enterprises.

*Philip Morris (USA, Alcohol & Tobacco) Status by KSE – stay

*Nestle (Switzerland, FMCG) Status by KSE – stay

Companies such as Nestle, Philip Morris International and similar Western corporations that continue to operate in Russia are the most likely potential targets for nationalization by the Russian authorities.

*Stark Logistics (India, Logistics, Transport) Status by KSE – stay

The Prime Minister of Estonia, Kaya Kallas, said that she financed her husband’s companies Stark Logistics and Stark Warehousing, which provided transport and warehouse services in Russia, from her own funds, which she managed to accumulate before the start of her career in politics.

https://www.kommersant.ru/doc/6197432

*YouTube (USA, Online Services) Status by KSE – wait

Disruptions in the work of YouTube in Russia were linked to the work of Roskomnadzor

*Binance (China, Finance and payments) Status by KSE – wait

Russian users of the Binance bitcoin exchange will be able to withdraw funds if the company leaves the country.

https://forklog.com/news/binance-pozvolit-klientam-iz-rf-vyvesti-aktivy-v-sluchae-uhoda-iz-strany

*Aviva (Great Britain, Insurance) Status by KSE – leave

Trading company XTX Markets, founded by the Russian-born billionaire Alexander Herko, sued investment funds Aviva Investors and Legal & General (LGIM), which refused to work with the company’s investments on the grounds that its owner was a Russian citizen

*Unilever (Great Britain, Consumer goods and clothing) Status by KSE – stay

Here comes Russia’s corporate hit list

https://www.ft.com/content/b4a473c4-b582-406f-82bb-c05a8130fe9d

06.09.2023

*Virgin Media O2 (Great Britain, Telecom) Status by KSE – stay

Virgin Media 02 is to buy a British broadband company owned by a Russian oligarch-backed investment company, after the government forced its sale on national security grounds.

https://www.ft.com/content/e9c46724-680b-49c1-b225-112b9775c28f

*DPD (Germany, Logistics, Transport) Status by KSE – leave

GeoPost is negotiating the sale of its DPD business in Russia with a number of large local logistics operators

https://www.kommersant.ru/doc/6198328

*AerCap (Ireland, Air transportation) Status by KSE – leave

Lessor AerCap agrees settlement over Aeroflot jets stranded in Russia

*Wintershall Dea AG (Germany, Energy, oil and gas) Status by KSE – leave

Wintershall Dea will cut some 500 jobs, or roughly a quarter of its staff, in a separation of its Russian activities

07.09.2023

*British American Tobacco (Great Britain, Alcohol&Tobacco) Status by KSE – leave

Tobacco firm BAT sells Russian business to local management

*Binance (China, Finance and payments) Status by KSE – wait

Top Binance execs in Russia leave as firm considers exiting the market

*Sisecam (Turkey, Chemical industry) Status by KSE – stay

NACP included the Turkish glass manufacturer Sisecam in the list of international sponsors of the war.

*Schlumberger (SLB) (USA, Energy, oil and gas) Status by KSE – wait

*Baker Hughes (USA, Energy, oil and gas) Status by KSE – exited

*Halliburton (USA, Energy, oil and gas) Status by KSE – exited

Foreign Relations chair seeks answers from US oil firms on Russia business after Ukraine invasion

08.09.2023

*Volvo Cars (Sweden, Automotive) Status by KSE – exited

Swedish truck maker Volvo AB’s Russian assets have been transferred to an undisclosed Russian investor, the Ministry of Industry and Trade said in a statement.

A number of subsidiary structures of the Swedish car concern Volvo in Russia, including the truck production plant in Kaluga, have come under the operational control of businessman Igor Kim, according to EGRUL data.

https://www.interfax.ru/business/919694

*Nvidia (USA, IT) Status by KSE – exited

*Texas Instruments (USA, Electronics) Status by KSE – wait

*Intel (USA, IT) Status by KSE – stay

*Azu International Ltd (Turkey, IT) Status by KSE – stay

The Dangerous Loophole in Western Sanctions on Russia

https://foreignpolicy.com/2023/09/07/western-sanctions-russia-ukraine-war/?tpcc=recirc_latest062921

*HSBC (Great Britain, Finance and payments) Status by KSE – leave

HSBC Group will end money transfer services to and from Russia and Belarus for its corporate clients next month as financial institutions react to Western sanctions over the war in Ukraine.

https://asia.nikkei.com/Business/Finance/HSBC-to-halt-corporate-remittances-to-and-from-Russia

*Huawei (China, Electronics) Status by KSE – wait

*Nokia (Finland, IT) Status by KSE – leave

*Ericsson (Sweden, Telecom) Status by KSE – wait

Chinese equipment has raised questions among Russian telecommunications operators

10.09.2023

*Rockwool (Denmark, Construction & Architecture) Status by KSE – stay

How systematic it was: 31 Russian warships loaded with Rockwool

https://danwatch.dk/en/how-systematic-it-was-31-russian-warships-loaded-with-rockwool/

*Volvo Cars (Sweden, Automotive) Status by KSE – exited

Businessman Igor Kim received operational control in Volvo structures in the Russian Federation

https://www.ft.com/content/4235bffb-7e2d-4316-ba01-fe0d6a6ab410

https://www.interfax.ru/business/919694

*Euroclear (Belgium, Finance and payments) Status by KSE – wait

In the first half of the year, the Belgian bank Euroclear received 1.74 billion euros in profit from frozen Russian assets.

11.09.2023

*MERO ČR (Czech Republic, Energy, oil and gas) Status by KSE – stay

The Czech Republic announced that the share of Russian oil imports through the Druzhba oil pipeline has reached its peak since 2012.

https://www.ceskenoviny.cz/zpravy/cesko-vyuziva-stale-vice-ruske-ropy/2412016

*Allegrini (Italy, Alcohol & Tobacco) Status by KSE – stay

Luding Group became the exclusive distributor in the Russian Federation of the Italian winery Allegrini, which was previously part of the MBG Wine portfolio.

https://www.kommersant.ru/doc/6209637

*Analog Devices (USA, Electronics) Status by KSE – wait

*Texas Instruments (USA, Electronics) Status by KSE – wait

How Europe turns a blind eye to Russia smuggling dual-use microchips

https://theins.ru/en/politics/264419

*OMV (Austria, Energy, oil and gas) Status by KSE – stay

*Wintershall Dea AG (Germany, Energy, oil and gas) Status by KSE – leave

Putin extended the ban on the purchase of gas from joint ventures with OMV and Wintershall above the established price

https://www.kommersant.ru/doc/6210548

*Mazda (Japan, Automotive) Status by KSE – leave

“Sollers” restarts the factory in Vladivostok

Instead of Mazda, analogues of Chinese pickup trucks will be produced there

https://www.kommersant.ru/doc/6209870

*Decathlon (France, Consumer goods and clothing) Status by KSE – leave

Decathlon stores will open by the end of this year after the sale to the new owner is completed, the asset sale transaction has already been approved by the government commission.

https://tass.ru/ekonomika/18704859

*Nissan (Japan, Automotive) Status by KSE – exited

The Japanese company Nissan no longer has warranty obligations to the owners of its cars in the Russian Federation.

https://news.finance.ua/ua/nissan-bil-she-ne-bude-obsluhovuvaty-svoi-avtomobili-v-rosii

*Strabag (Austria, Construction & Architecture) Status by KSE – leave

Strabag maps out next step to decrease Russian investor’s stake

12.09.2023

*Fraport (Germany,Air transportation) Status by KSE – stay

German Fraport AG, which owns 25% of the management company of the Pulkovo airport, is still selling its share, said the head of VTB Andrey Kostin.

https://www.kommersant.ru/doc/6210850

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

RBI allows rebranding of Raiffeisenbank after its sale or spin-off

https://www.kommersant.ru/doc/6211064

*Disney (USA, Entertainment) Status by KSE – leave

The Kaluga Liquor and Vodka Plant could not condemn the “Pirates of the Caribbean Sea” brand in Disney

13.09.2023

*ATS HEAVY EQUIPMENT & MACHINERY (United Arab Emirates, Industrial equipment) Status by KSE – stay

The Dubai company ATS Heavy Equipment & Machinery sold most parts to Russia.

https://www.pravda.com.ua/eng/news/2023/09/12/7419552/

*Right Direction Aero (Lithuania, Industrial equipment) Status by KSE – stay

In the customs databases it is indeed indicated that Lithuanian Right Direction Aero sold AI Fly goods on behalf of Kargoline.

https://www.pravda.com.ua/eng/news/2023/09/12/7419552/

*KARGOLINE (Kyrgyzstan, Logistics, Transport) Status by KSE – stay

Cargoline was registered a month after the start of the war in Ukraine, when Airbus, Boeing and other parts manufacturers banned Russian airlines.

https://www.pravda.com.ua/eng/news/2023/09/12/7419552/

*Apram Aerospace (Czech Republic, Industrial equipment) Status by KSE – stay

*Desert Sun Supply (United Arab Emirates, Industrial equipment) Status by KSE – stay

Russia buys sanctioned parts for aircraft through friendly countries: the UAE, China and Türkiye at the top

https://www.pravda.com.ua/eng/news/2023/09/12/7419552/

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

*Mitsui & Co. (Japan, Conglomerate) Status by KSE – stay

Russia’s Sakhalin-2 Back To Full Production After Maintenance

*PVH (USA, Luxury) Status by KSE – exited

The owner of Calvin Klein and Tommy Hilfiger went out of business in Russia

https://news.finance.ua/ua/vlasnyk-calvin-klein-i-tommy-hilfiger-vyyshov-iz-biznesu-v-rosii

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

By order dated September 13, the Bank of Russia canceled Raiffeisenbank’s license to operate as a specialized depository of investment, share investment and non-state pension funds

14.09.2023

*State Bank of India (SBI) (India, Finance and payments) Status by KSE – stay

A bank with Indian capital sends funds to the Central Bank of the Russian Federation

https://www.kommersant.ru/doc/6212050

*VEON (Netherlands, Telecom) Status by KSE – leave

VEON Finalizes Agreement for Sale of Russian Operations; Shares Rise Pre-Bell

*Cargill (USA, Agriculture) Status by KSE – leave

Cargill denies sale of stake in Russian grain terminal

*Ingka (Netherlands, Consumer goods and clothing) Status by KSE – wait

The network of shopping centers may be sold to the structure of Gazprombank

15.09.2023

*Demirci Bilisim Ticaret Sanayi (Turkey, Defense) Status by KSE – stay

*Margiana Insaat Dis Ticaret (Turkey, Defense) Status by KSE – stay

*DENKAR SHIP CONSTRUCTION INCORPORATED COMPANY (Turkey, Marine Transportation) Status by KSE – stay

* ID SHIPPING (Turkey, Marine Transportation) Status by KSE – stay

*CTL LIMITED (Turkey,Electronics) Status by KSE – stay

US sanctions 5 Turkish firms in broad Russia action on over 150 targets

https://www.reuters.com/world/us-sanction-five-turkey-based-firms-broad-russia-action-2023-09-14/

*Siberica (Finland, Logistics, Transport) Status by KSE – stay

*Luminor (Finland, Logistics, Transport) Status by KSE – stay

The USA expanded sanctions against companies and individuals from Russia. Finnish companies Siberica and Luminor, as well as members of their management who are citizens of France and Estonia, are also on black lists.

*Shree Ramkrishna Exports (SRK) (India, Metals and Mining) Status by KSE – stay

The NACP lists one of the world’s largest diamond producers and exporting companies, Shree Ramkrishna Exports (SRK), on its list of international war sponsors.

*British American Tobacco (Great Britain, Alcohol&Tobacco) Status by KSE – exited

Further to our announcement on 7 September 2023, we have now completed the sale of our Russian and Belarusian businesses. The sale has been carried out in compliance with local and international laws and follows the receipt of all necessary approvals.

https://www.bat.com/group/sites/UK__CRHJSY.nsf/vwPagesWebLive/DOCVMKY2

https://www.epravda.com.ua/news/2023/09/14/704334/

*Indian Oil Corporation (India, Energy, oil and gas) Status by KSE – stay

*Bharat Petroleum (BPCL) (India, Energy, oil and gas) Status by KSE – stay

*ONGC Videsh Ltd (India, Energy, oil and gas) Status by KSE – stay

Indian oil firms want their $600 million stuck in Russia to be used for payments to Moscow

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 7500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ After 18 months of war started by Russia in Ukraine we assume that there was quite enough time to make the decision to leave the country-aggressor for all international business. That’s why for KSE Institute companies marked with statuses “stay” and “wait” essentially there are no significant differences.

⁵ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before.

¹⁶ https://daily.rbc.ua/ukr/show/ki-farmgiganti-prodovzhuyut-pratsyuvati-rf-1674642609.html

¹⁷ https://ru.mdz-moskau.eu/o-tovaroobmene-mezhdu-rossiej-i-germaniej/

¹⁸ https://monitor-press.info/uk/news/19309-veliki-nimecki-kompaniyi-nadali-pracyuyut-v-rosiyi

¹⁹ https://monitor-press.info/uk/news/19309-veliki-nimecki-kompaniyi-nadali-pracyuyut-v-rosiyi

²² A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website