- Kyiv School of Economics

- About the School

- News

- 38th issue of the weekly digest on impact of foreign companies’ exit on RF economy

38th issue of the weekly digest on impact of foreign companies’ exit on RF economy

30 January 2023

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 23-29.01.2023

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we became partners with Rubargo. Rubargo allows you to find any brand or company that is operating in Russia just by scanning barcodes.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

KSE DATABASE SNAPSHOT as of 29.01.2023

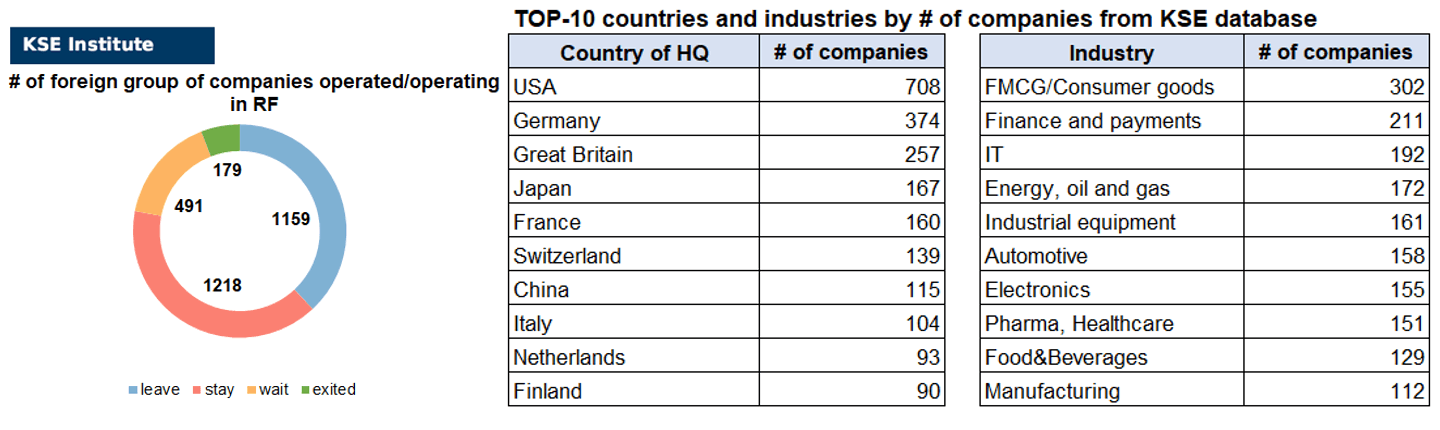

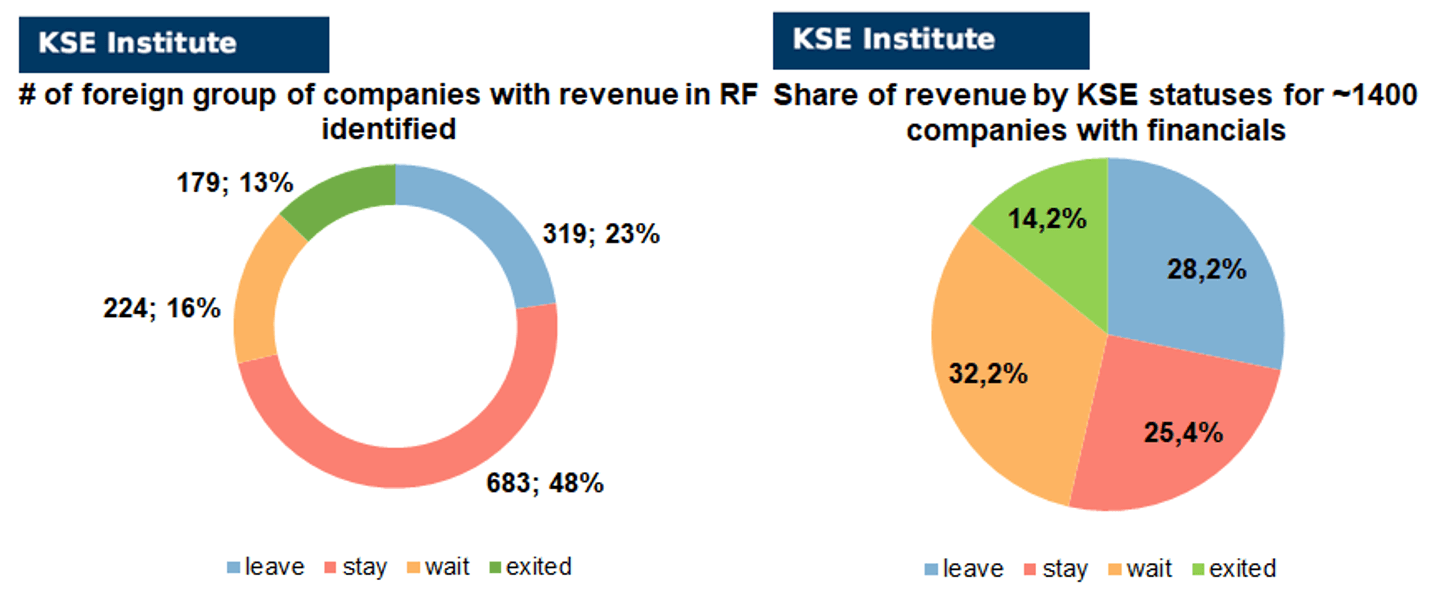

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 218 (+15 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 491 (+2 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 159 (+3 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 179 (+2 per week)

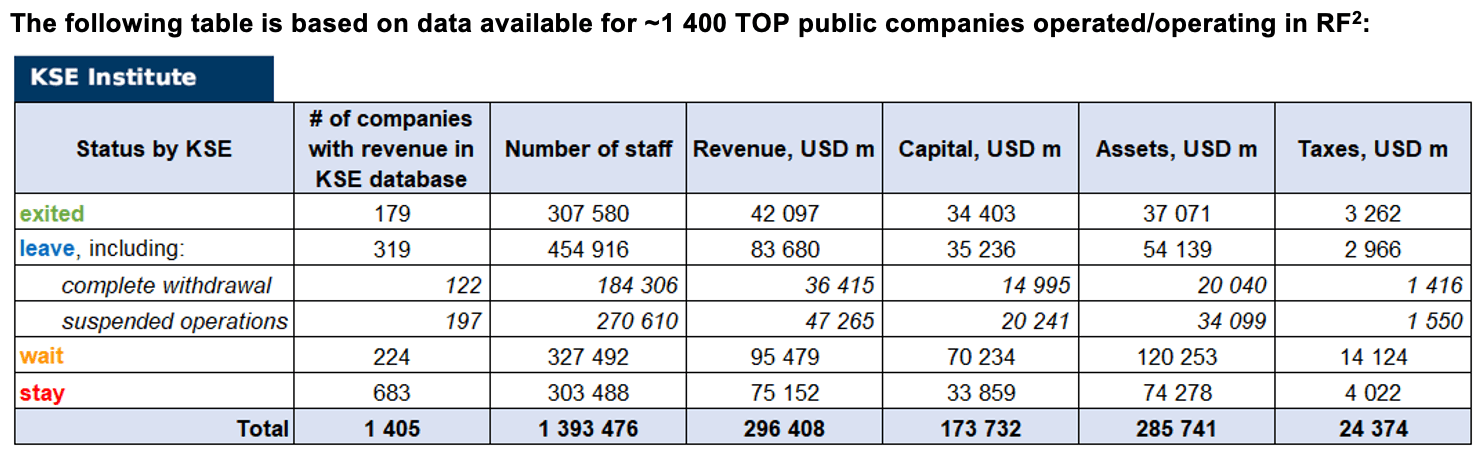

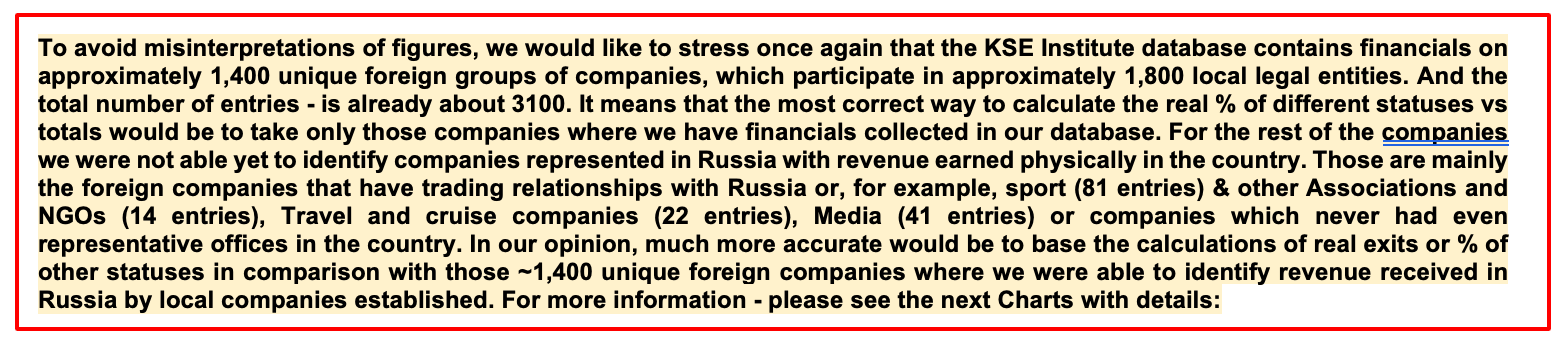

As of January 29, we have identified about 3,047 companies, organizations and their brands from 88 countries and 56 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 400 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $173.7 billion), local revenue (about $296.4 billion), local assets (about $285.7 billion) as well as staff (about 1.393 million people) and taxes paid (about $24.4 billion). 1,650 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 179 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

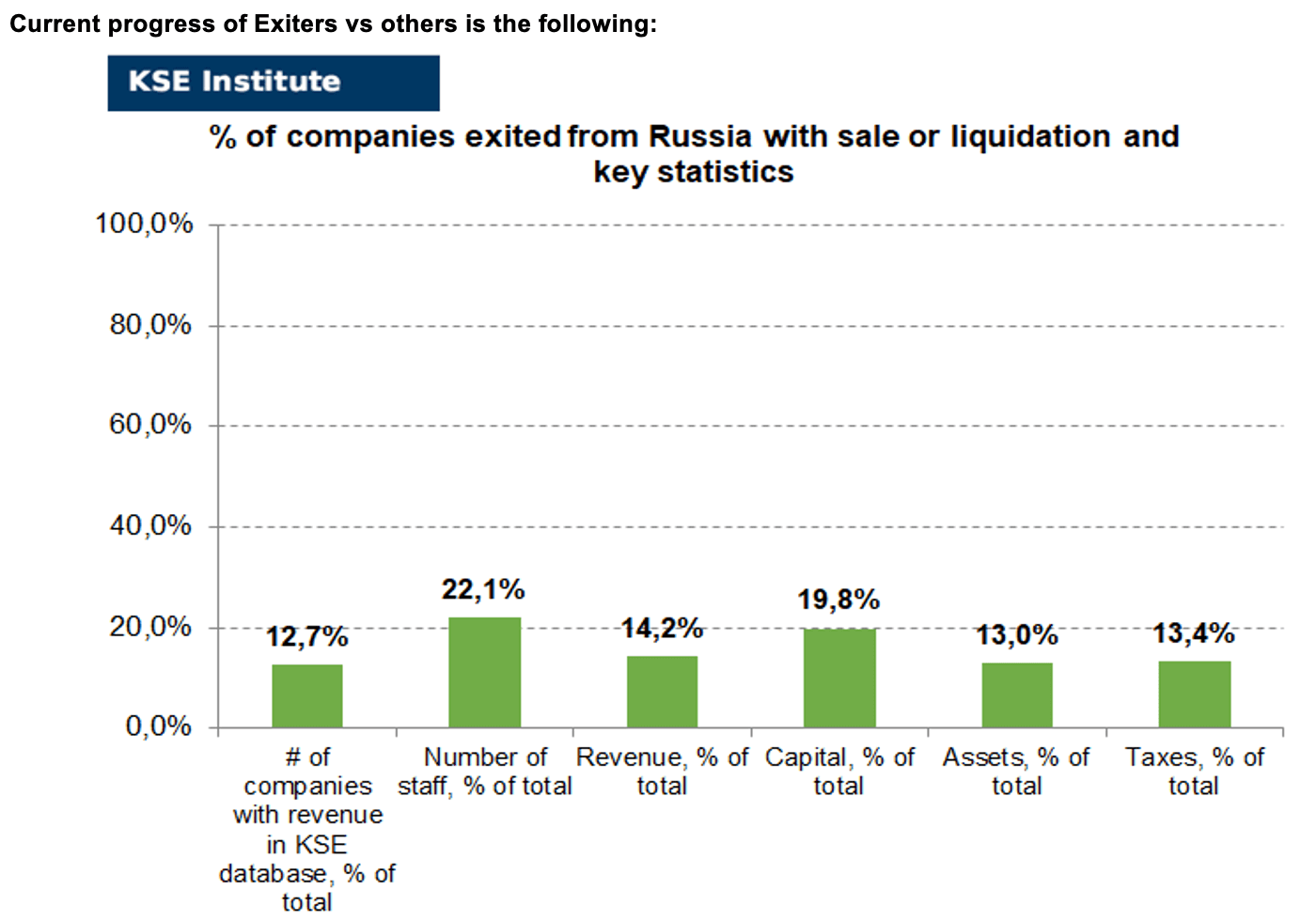

As can be seen from the tables below, as of January 29, 179 companies which had already completely exited from the Russian Federation, had at least 307,600 personnel, $42.1 bn in annual revenue, $34.4bn in capital and $37.1bn in assets; companies, that declared a complete withdrawal from Russia had 184,300 personnel, $36.4bn in revenues, $15.0bn in capital and $20.0bn in assets; companies that suspended operations on the Russian market had 270,600 personnel, annual revenue of $47.3bn, $20.2bn in capital and $34.1bn in assets.

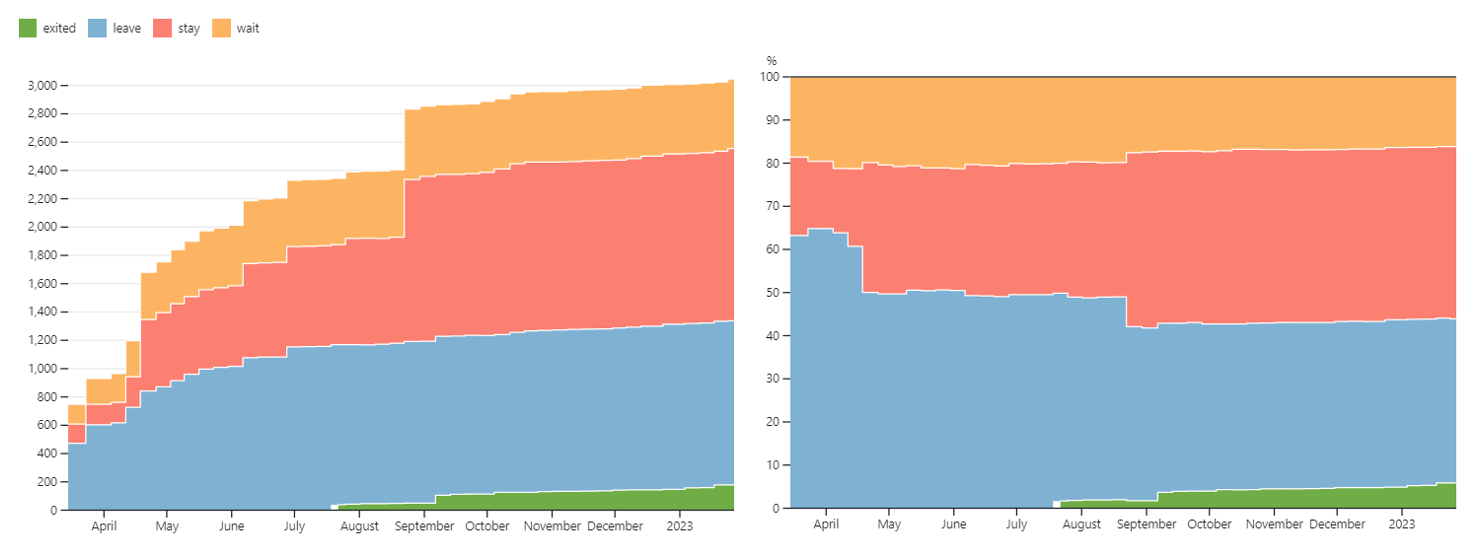

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last 5 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database). However, if to operate with the total numbers in KSE database, about 38.0% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 40.0% are still remaining in the country, 16.1% are waiting and only 5.9% made a complete exit³.

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 179 companies that completely left the country, since they employed 22.1% of the personnel employed in foreign companies, the companies owned about 13.0% of the assets, had 19.8% of capital invested by foreign companies, only last year they generated revenue of $42.1 billion or 14.2% of total revenue and paid $3.3 billion of taxes or 13.4% of total taxes paid by the companies observed. Data on 1,400 TOP companies is presented in the table above.

As it is visible on the charts above, roughly similar % of exited is obtained based on number of companies (13%) and on share of revenue withdrawn (14%). At the same time, a totally different picture is for those who are still staying – 48% of companies represent 25% of revenue and 16% of waiting companies represent 32% of revenue generated in Russia. The first conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

More infographics and analytics see in the special section of our website at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: Analysis on Polish companies and their positions in Russia

In recent years, many international experts have considered Poland as a promising country for investment. The Polish economy was considered safe for doing business and long-term planning, with a low risk of financial crisis, providing ample opportunities for investment due to the modernization of infrastructure and the introduction of modern technologies at enterprises. Despite the global economic crisis of 2009, Poland strengthened its position in Europe, because Poland is one of the largest EU member states. Poland is the 6-th most populous country in the EU and is the largest market in Central and Eastern Europe.

Russian-Polish economic relations have a long and complicated history. To date, bilateral relations are in a rather contradictory situation, in particular, Poland’s mistrust of everything Russian and the deep antipathy of the present Russian Government towards Warsaw, especially after the Smolensk air disaster in 2010. If Poland insists on the need for democratic development of the post-Soviet states, Russia believes that such actions are aimed at reducing Russian influence in Europe. Modern Poland is experiencing a turning point related to both the change in foreign policy and the formation of a new economic policy.

On November 2, 2004, the Russian-Polish international agreement on economic cooperation was concluded. It is worth noting that, due to the circumstances, trade has become the main form of economic relations between Russia and Poland.

The development of economic relations between Poland and Russia during 2004–2016 was different in its dynamics. Its marked weakening was due to two important events. In the first case, this is the impact of the global economic crisis that shook the United States in 2007. The second case concerns the sanctions of the European Union directed against Russia and related to the annexation of Crimea.

For reference: the structure of mutual trade between Russia and Poland is characterized by a high degree of asymmetry. If until recently Russian exports to Poland were dominated by raw materials (about 90%), then about a third of Polish exports to Russia were machine-building products. In recent years, Poland annually consumed more than 15 billion м3 of natural gas, a third of which was provided by its own production, and the rest due to imports from Russia⁴. In 2015, among the EU member states, Poland took the fifth place in terms of trade turnover with Russia, and among all of Russian trading partners, Poland took the 12-th place. In 2015, the value of Polish investments in Russia amounted to 20 million US dollars. For comparison, in 2014, the value of Polish investments amounted to 70 million US dollars⁵.

For many years, Russian-Polish relations have not improved in the field of investments. As of 2014, Russian investors invested 2 billion euros in the Polish economy, which was 0.33% of all foreign investments in Poland. For Russia, this indicator is one of the worst in both absolute and percentage terms in all of Eastern Europe. The penetration of Russian investors into the Polish market was mainly concentrated in the fields of raw materials and minerals⁶.

As a result of EU sanctions against Russia introduced in 2014 and retaliatory steps by the Russian side, there was a sharp reduction in trade between Russia and Poland. From the end of 2016 to 2019, due to the improvement of the situation on world markets, Russian-Polish trade indicators increased, but never reached the “pre-crisis” level (in 2013 – 27.9 billion US dollars). In 2020, Poland’s share in Russian foreign trade turnover was 2.8% (11-th place among all Russian trading partners). Russia ranks 3-rd in Poland’s imports (after Germany and China) and 7-th in its exports⁷.

For reference: in 2021, Russian trade with Poland amounted to 22.5 billion US dollars, an increase of 57.27% (8.2 billion US dollars) compared to 2020. Russian exports to Poland in 2021 amounted to 16.7 billion US dollars, an increase of 76.72% (7.3 billion US dollars) compared to 2020. Russian imports from Poland in 2021 amounted to 5.8 billion US dollars, an increase of 19.42% (944.3 million US dollars) compared to 2020. Poland’s share in Russian foreign trade turnover in 2021 was 2.9% against 2.5% in 2020. In 2021, Poland ranked 11-th in terms of share in Russian trade (12-th in 2020). The share of Poland in Russian exports in 2021 was 3.4% against 2.8130% in 2020. Poland ranked 11-th in terms of share in Russian exports in 2021 (also 11-th in 2020). Poland’s share in Russian imports in 2021 was 2%. Poland ranked 11-th in terms of share in Russian imports in 2021 (also 11-th in 2020)⁸.

In 2022, with the beginning of Russian large-scale military aggression against Ukraine, Poland instantly reacted to this event and supported Ukraine. Warsaw, together with other Western allies, imposed financial restrictions on Russia in order to punish the latter for its military escalation against Ukraine.

As of March 2022, about a thousand Russian companies were working in Poland, and Russian foreign direct investment in Poland amounted to about 1.1 billion Polish zlotys⁹ and already on April 26, 2022, the Polish Government introduced sanctions against a list of 33 companies. The list of sanctioned companies includes Polish and foreign companies that are connected or owned by Russian persons and that are considered connected to the Russian Government. These companies are prohibited from any participation in public tenders in Poland. These companies are of key importance for the economic strategy of the Russian Government, providing it with a significant source of income in the context of the invasion of Ukraine¹⁰.

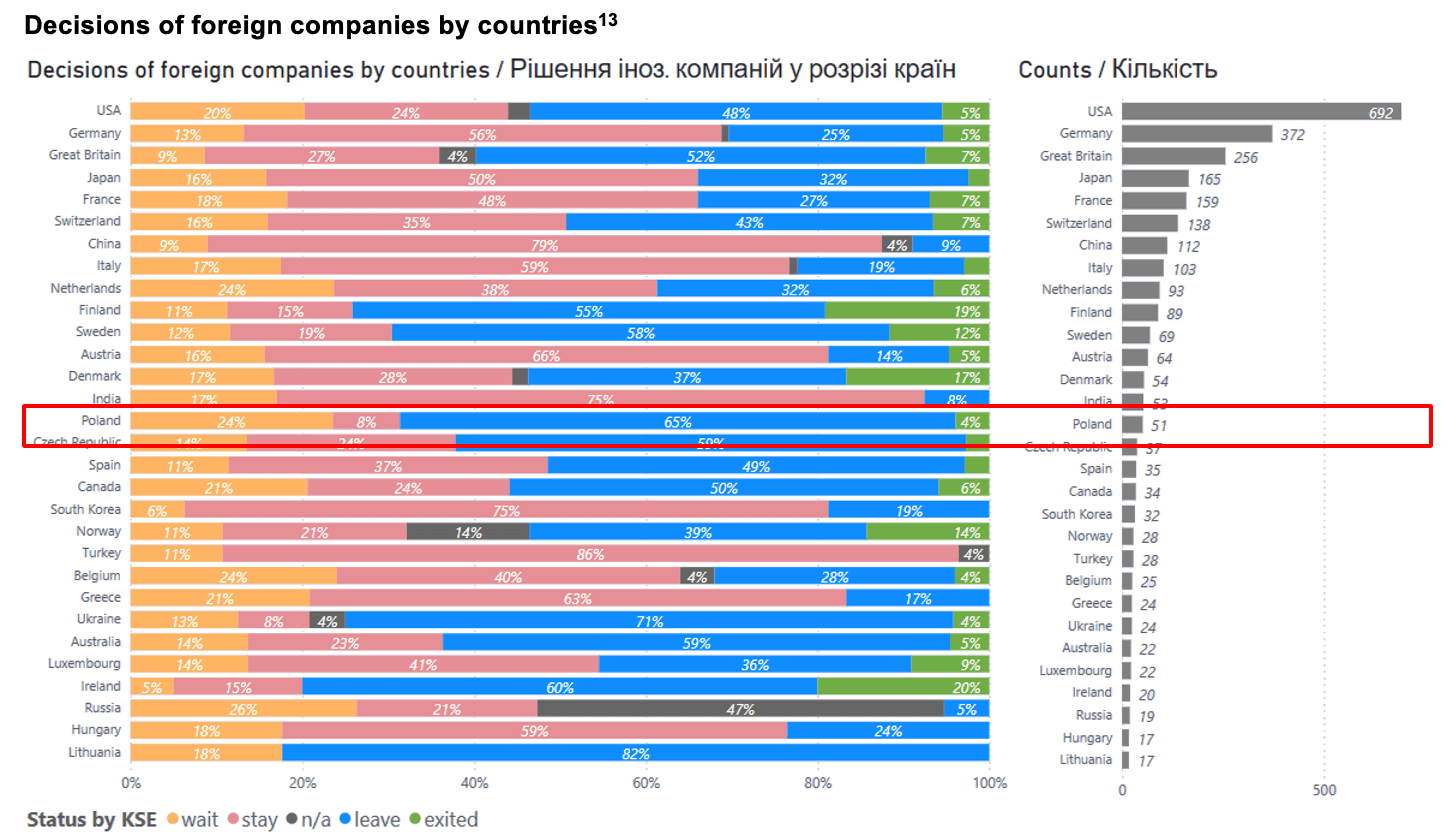

Of the more than 1 100 Western companies that announced plans to limit their operations in Russia in 2022, a quarter of which from Poland¹¹.

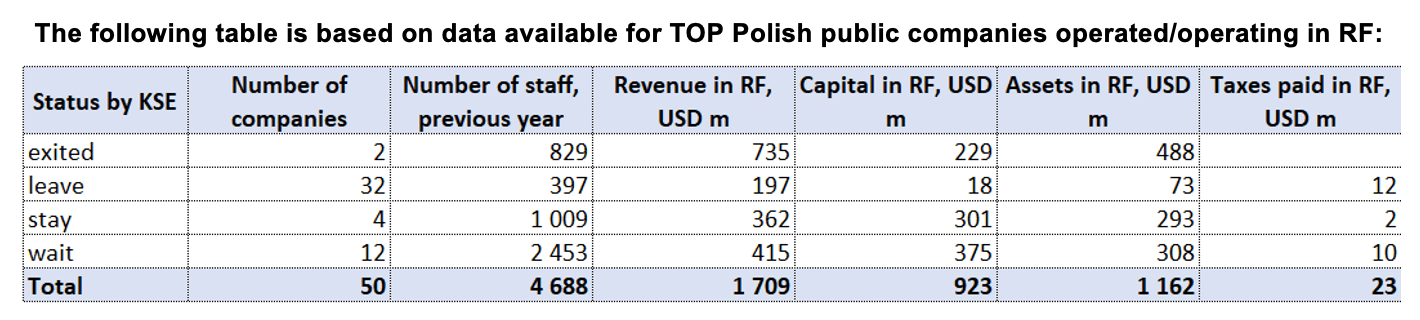

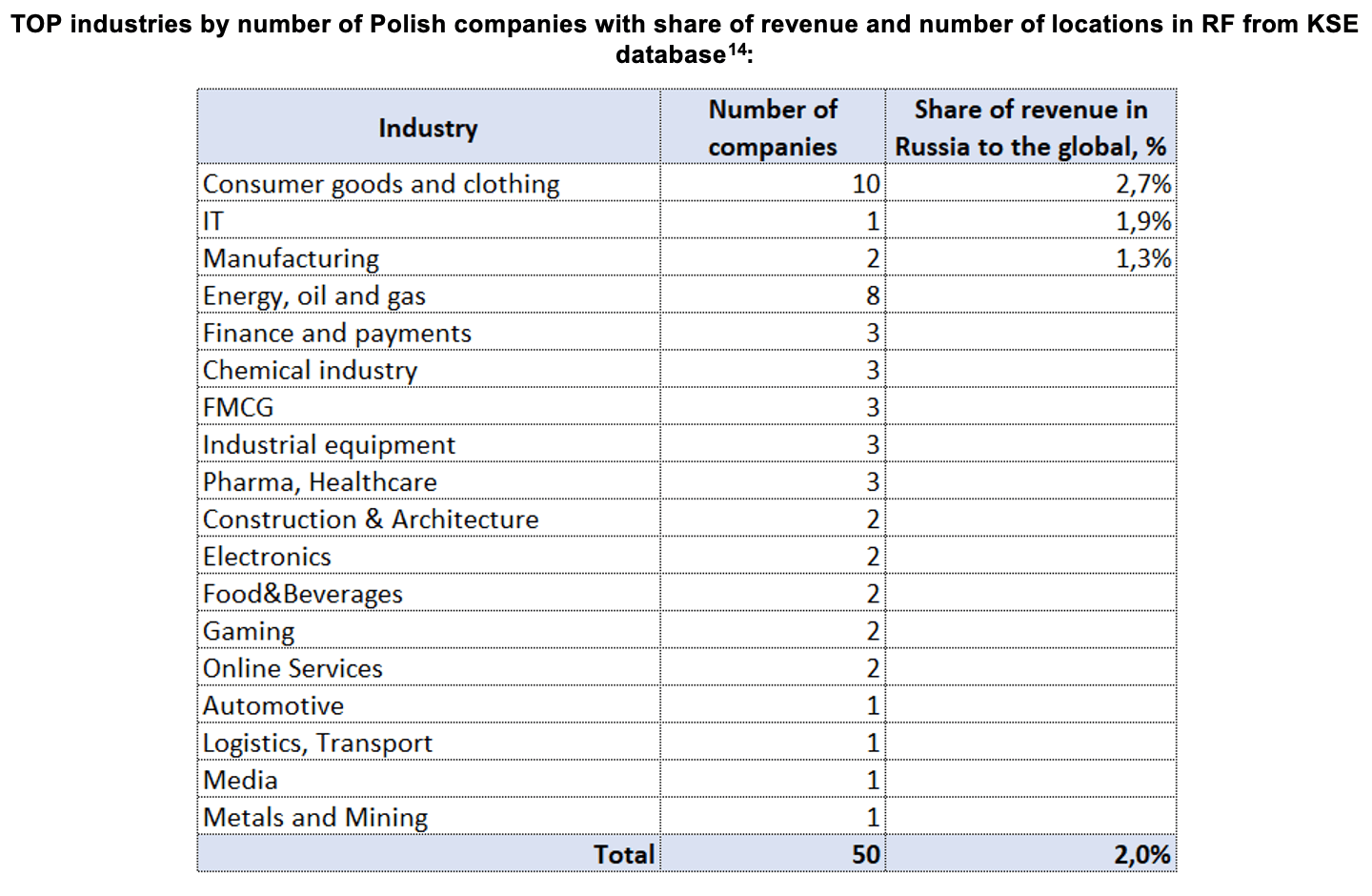

According to data collected by the KSE Institute¹², in 2021 50 Polish companies (with share in capital 50+%) provided jobs for at least 4,688 people in Russia, those companies generated $1.7 bn in annual revenue, paid $23 mn of taxes, had $923 mn in capital and $1.2 bn in assets.

2 companies (4% of total number) which generated ~43% of revenue have completely left the Russian market and sold their shares, 32 companies (64% of 50 companies observed) have announced plans to leave or suspend their activity in Russia, in 2021 they employed 400 people (it need to be noted that a lot of companies are trading ones and don’t have staff or offices in the country), generated $197 mn (12%) in annual revenue, had $18 mn in capital and $73 mn in assets. Only few Polish companies (at least 4 or 8% of total number) are still staying and 12 companies (24%) are waiting and limiting their investments. These 2 groups generated a still significant portion of the revenue ($777 mn or 45%) received by Polish companies in Russia and employed 74% of staff.

The most “dependent” on Russia in terms of revenue share (1%+) in this country are Polish companies in the following industries: Consumer goods and clothing, IT and Manufacturing.

Out of 50 companies in the KSE database, only 8% of Polish companies stay in Russia, another 24% are waiting and somewhat limiting their activities, while 64% are announced leaving or suspended their activity and 4% have already left with the sale of their shares. Some of the Polish companies are among the examples of clean breaks from the Russian market, while others defy demands for exit despite pressure.

Clean breaks

2 Polish companies (or 4%) included in the KSE database have completely left the Russian market and sold their shares (all of them have “exited”¹⁵, status by KSE, legally there are no Polish beneficiaries anymore):

LPP (Consumer goods and clothing, Status by KSE – exited) is a Polish clothing manufacturer that designs, manufactures and distributes clothing. The clothing manufacturer LPP Group closed its stores in Russia on March 29 due to the Russian military operation in Ukraine. The company also stopped all sales, investments and development plans in the country. The Polish retailer LPP (Reserved, Cropp, Mohito and Sinsay brands), which announced the sale of its Russian business to a consortium from China back in May, transferred its stores in the Russian Federation to a company registered in the UAE and its top manager.

Hortex (Food & Beverages, Status by KSE – exited) Hortex is investigating the frozen fruit and vegetable market in Central and Eastern Europe. In Russia, the company had two plants in the Moscow region and one in Karelia. Hortex left the Russian market. The Agama group became the new owner of Ortika Frozen Foods, which imports and sells frozen products under this brand in the Russian Federation.

Companies that are waiting have just reduced their activities

PGNiG (Energy, oil and gas, Status by KSE – wait) is a Polish state oil and gas company. The company does not see the possibility of switching to the ruble in calculations for the supply of Russian gas, gradually abandons Russian gas, replacing it with liquefied gas. But PGNiG will continue to perform the contract under the previously agreed terms.

CANPACK (Manufacturing, Status by KSE – wait) is a leading manufacturer of beverage packaging.The company’s employees in Russia continue to operate its two factories for the production of aluminum beverage cans in accordance with current legislation, sanctions and counter-sanctions, where these factories are focused on the local market. Due to continued aggression, the company will no longer invest in Russia.

Polpharma (Pharma, Healthcare, Status by KSE – wait) is a Polish pharmaceutical company that produces medicines for cardiology, gastroenterology and neurology. “Our company’s products for the Russian market at the moment include only pediatric products, products used in emergency cases or in the treatment of chronic diseases. These products are important for health, so their deliveries to Russia will continue. However, we have abandoned products that are of a vital nature and only improve the quality of life. Such actions are in line with the scope of international economic sanctions applied to the Russian Federation, as they do not apply to the supply of medicines,” the company said in a statement.

Companies that are leaving Russia

PKN Orlen SA (Energy, oil and gas, Status by KSE – leave) is a Polish oil refinery, the largest in Poland. It is engaged in the extraction, processing and sale of oil and gasoline. Polish oil concern Orlen will not renew the contract for the supply of Russian oil, which expires in January 2023. “The only existing contract for the supply of Russian oil in 2023 will cease to operate after the introduction of sanctions, which we are ready for,” company spokeswoman Edita Olkovich said.

Żabka (FMCG, Status by KSE – leave) is a chain of convenience stores in Poland. “In connection with the current situation, economic instruments are becoming for the international community a key means of countering Russian aggression against Ukraine. Aware of this, we have decided to suspend orders for products from the Russian Federation and Belarus. As a result, marketing messages related to these products will also be withdrawn,” the company said in a statement.

Wielton (Automotive, Status by KSE – leave) The group has subsidiaries in Ukraine and Russia, created to carry out commercial, marketing and advertising activities. The company also has an assembly plant for Wielton products in Russia. At the same time, until February 2022, the Group made direct sales of products in these markets from the parent company Wielton SA. The Group’s revenues from sales in these markets in 2021 amounted to PLN 299.5 million, which was approximately 11.1% of Wielton Group’s sales revenues. The board of Wielton SA has decided to suspend the supply of the group’s products to the Russian market until further notice. Wielton has not made any deliveries to the Russian market since February 24 of this year.

SMAY (Consumer goods and clothing, Status by KSE – leave) Due to the current armed conflict, the management board of SMAY decided to immediately terminate the cooperation with its current partner from Russia. All current orders have been canceled and the brand partner’s Russian website has been closed down. Until the end of the ongoing conflict, the company will not respond to any demand from the Russian market.

Summary

It is worth noting that against the background of the geopolitical crisis in Europe, according to the OECD¹⁶Poland’s real GDP growth is forecast to slow to 0.9% in 2023 due to higher energy prices as a result of the Russian war of aggression against Ukraine, weakening domestic demand, and worsening external conditions, recovering to 2.4% in 2024. National defense spending is planned to increase from 2.2% of GDP in 2022 to 3% by 2023. A further escalation of the war would increase uncertainty, increase inflation and strain public finances. About 1.3 million Ukrainian refugees (equivalent to 3.5% of the Polish population) are currently housed in Poland.

Summarizing, it should be emphasized the existing dependence of the economic relations of both countries on their political relations. The worse the political relations, the greater the negative impact on economic relations. The situation becomes even more complicated when at the same time there is a deterioration of political relations within the framework of multilateral commitments. An example can be the political decision of the EU and the USA regarding economic sanctions directed against Russia, supported by the Polish Government, as well as counter-sanctions from Russia.

A number of Polish companies that sell their products to Russia or have Russian contractors have been affected by the large-scale sanctions that were imposed on Russia for its invasion of Ukraine. These sanctions affected the income received by some Polish companies from Russian partners, as well as their working capital. At the same time, Poland is unwavering in its commitment to support Ukraine in its struggle for protection from Russian aggression.

According to the data of the universal electronic population registration system PESEL, as of December 27, 2022, there are 950,000 refugees in Poland due to the war in Ukraine. This is 400 thousand people less than in the summer of 2022. Taking into account that before the war there were 1.2 – 1.3 million refugees in Poland, the total number of Ukrainian citizens in Poland today is 2.3 million (about 71% of refugees in the country – women, 47% – children under the age of 18)¹⁷.

The large influx of refugees has affected the society and economy of Poland, the bne IntelliNews¹⁸ writes. The country predicted that by the end of 2022, 18 billion Polish zlotys (3.83 billion euros) would be spent on helping Ukrainian refugees, including payments, organization of education for Ukrainian children, and medical care. In fact, Poles have spent much more on helping refugees – through private assistance, ranging from one-time donations of money and basic necessities to long-term renting of apartments or rooms in their homes.

The country predicted that by the end of 2022, 18 billion Polish zlotys (3.83 billion euros) would be spent on helping Ukrainian refugees, including payments, organization of education for Ukrainian children, and medical care. In fact, Poles have spent much more on helping refugees – through private assistance, ranging from one-time donations of money and basic necessities to long-term renting of apartments or rooms in their homes.

However, Ukrainians are not just recipients of aid. More than a million new consumers helped support retail sales, which had declined due to inflation. While the Poles cut back on their spending, the Ukrainians continued to shop. Sales of textiles, clothing and footwear jumped by 41.9% in March compared to the same month a year earlier, and 121.4% year-on-year in April. In October 2022, refugees continued to stimulate the sale of textiles, clothing and footwear, as well as pharmaceuticals and cosmetics.

In 2022, Ukrainians spent almost 1 billion euros in Polish shopping centers. According to Selectivv Data Tank¹⁹, the occupancy of Polish shopping malls increased by 18.9% in December 2022. This is a consequence of the influx of visitors from abroad. Thus, the number of Ukrainians in Polish shopping centers has almost tripled. They make up 18% of all guests. According to the data of the Central Statistical Office, every fifth buyer of a shopping center in Poland was from Ukraine, and the value of purchases is billions of Polish zlotys. In 2021, Ukrainians spent half as much money in Polish stores²⁰.

The war in Ukraine will affect Poland’s economic growth, although Poland’s trade with Russia and Ukraine is not crucial to the Polish economy. However, the impact will not be very significant, although it will be felt, since Poland is a frontline state of the European Union and a neighbor and true friend of Ukraine.

You can also contribute by spreading the status of the company calling for the exit from Russia on social networks directly from the company cards on the website https://leave-russia.org/.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)²¹

23.01.2023

*State Bank of India (SBI) (India, Finance and payments) Status by KSE – stay

*Canara Bank (India, Finance and payments) Status by KSE – exited

Canara Bank has entered into a share sale agreement in relation to sale of equity shares held by it in Moscow-based CIBL with SBI, the bank said in a regulatory filing.

*Hamleys (Great Britain, Consumer goods and clothing) Status by KSE – leave

Hamleys, a chain of children’s goods stores based in Britain, could not cope with financial difficulties and competition with other players in the segment in the Russian market. Now the franchisee of the brand in the Russian Federation — Alexander Mamut’s “Wanderkind” company — will rename the points of sale to “Vinny” and will add clothing and footwear to the assortment.

https://www.kommersant.ru/doc/5772280?tg

*Royal Pay Europe (Latvia, Finance and payments) Status by KSE – stay

*1xBet (Cyprus, Entertainment) Status by KSE – stay

On January 12, the President of Ukraine, Volodymyr Zelenskyi, signed a decree on the application of sanctions against the Latvian company with Russian roots, Royal Pay Europe, which is a partner of the Russian bookmaker 1xBet.

*Vesoft (China, IT) Status by KSE – stay

In January 2023, Vesoft, the Chinese developer of the Nebula Graph open source graph DBMS, had a distributor in Russia – Factor Group.

*Toyota (Japan, Automotive) Status by KSE – stay

At the end of last year, the Toyota concern was the first car manufacturer to resume direct deliveries of spare parts to Russia. We are talking about details that did not fall under sanctions. Also, the Russian subsidiary of Toyota Motor (the official supplier of products in the Russian Federation) allowed its dealers to import spare parts subject to restrictions, such as electronics, in parallel.

*BP (British Petroleum) (Great Britain, Energy, oil and gas) Status by KSE – wait

*Pepsi (USA, Food & Beverages) Status by KSE – wait

*Siemens Healthineers (Germany, Pharma, Healthcare) Status by KSE – stay

BP, Siemens and PepsiCo branded ‘hypocrites’ for donating to Ukraine while failing to fully exit Russia

*Sony Music Group (USA, Entertainment) Status by KSE exited

Structures of former top managers of Warner Music Russia bought the Kiss Koala label, which manages the local catalog of Sony Music, which left Russia

https://www.kommersant.ru/doc/5772915

*Coca-Cola HBC AG (Switzerland, FMCG) Status by KSE – wait

Traces of the new Russian cola lead to Switzerland

https://switzerlandtimes.ch/business/traces-of-the-new-russian-cola-lead-to-switzerland/

24.01.2023

*Tokio Marine (Japan, Finance and payments) Status by KSE – stay

*Sompo Japan Insurance (Japan, Insurance) Status by KSE – stay

*Mitsui Sumitomo Insurance Co (Japan, Insurance) Status by KSE – stay

Japanese insurers will charge 80% more for gas carriers in Russian waters

https://www.kommersant.ru/doc/5783700

*PVH (USA, Consumer goods and clothing) Status by KSE – leave

Clothing brands that have left Russia are massively filing lawsuits due to parallel imports

25.01.2023

*Ingenico (France, Finance and payments) Status by KSE – leave

The supplier of terminals for accepting cards, the French company Ingenico, whose services are used by the largest banks, is considering the possibility of leaving Russia

https://lentafeed.com/@banksta/33330/

*Binance (China, Finance and payments) Status by KSE – wait

Binance Russian users complain about account blocking

https://finance.rambler.ru/markets/50079936-rossiyskie-polzovateli-binance-zhaluyutsya-na-blokirovku-akkauntov/

*JPMorgan (USA, Finance and payments) Status by KSE – wait

*BNY Mellon (USA, Finance and payments) Status by KSE – wait

JPMorgan Chase and Bank of New York Mellon will stop servicing Gazprombank’s correspondent accounts at the end of January.

https://www.rbc.ru/finances/24/01/2023/63cff2759a7947f783033c8f

26.01.2023

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – leave

Paris Olympics 2024: IOC aiming to include Russian athletes despite Ukrainian president’s call for their ban

*Bonava (Sweden, Construction & Architecture) Status by KSE – exited

Bonava writes down €98m Russian business operations

https://reactnews.com/article/bonava-writes-down-e98m-russian-business-operations/

*Wintershall Dea AG (Germany, Energy, oil and gas) Status by KSE – leave

Wintershall’s empty bank accounts expose plight of western companies still in Russia

https://www.ft.com/content/3f98d24b-8ed5-4c26-94e3-36c75354cf89

*Legrand (France, Electronics) Status by KSE – leave

France’s Legrand to leave Russia — company

https://tass.com/economy/1567149

*International Paper (USA,Consumer goods and clothing) Status by KSE – leave

International Paper to sell stake in Russian joint venture

https://seekingalpha.com/news/3927433-international-paper-to-sell-stake-in-russian-joint-venture

*UEFA (Switzerland, Sport) Status by KSE – leave

Russian football teams to remain banned from UEFA competition due to ongoing war in Ukraine

https://theathletic.com/4120983/2023/01/24/russia-football-ban-uefa/

27.01.2023

*Ikano Bank (Sweden, Finance and payments) Status by KSE – leave

Russia allows Credit Europe Bank to buy Ikano Bank

https://www.retailbankerinternational.com/news/credit-europe-bank-ikano-acquisition/

*BIOMAR (Denmark, Food & Beverages) Status by KSE – leave

BioMar partners with Benson Hill after ending Russian raw material sourcing…

*VEON (Netherlands, Telecom) Status by KSE – leave

Russia ministries oppose Veon plans to sell Russian mobile business

*IBM (USA, IT) Status by KSE – leave

IBM cuts 3900 jobs blaming its exit from Russia and rising inflation

*H&M (Hennes and Mauritz) (Sweden, Consumer goods and clothing) Status by KSE – leave

H&M Earnings Hit By Russia Exit, Soaring Costs

https://www.barrons.com/news/h-m-ends-tough-2022-with-fourth-quarter-loss-01674804908

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁵ http://www.sov-europe.ru/images/pdf/2016/6-2016/Jakimowicz_6-2016.pdf

⁶ https://www.if24.ru/rossijskij-kapital-v-polshe/

⁷ https://poland.mid.ru/torgovo-ekonomiceskoe-sotrudnicestvo

⁸ https://russian-trade.com/reports-and-reviews/2022-02/torgovlya-mezhdu-rossiey-i-polshey-v-2021-g/

⁹ https://wbj.pl/there-are-still-almost-1000-russian-companies-in-poland/post/133944

¹⁴ https://leave-russia.org/uk?flt%5B131%5D%5Beq%5D%5B0%5D=448

¹⁵ The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities.

¹⁶ https://issuu.com/oecd.publishing/docs/poland-oecd-economic-outlook-projection-note-novem

¹⁸ https://www.intellinews.com/tide-of-ukrainian-refugees-transforms-polish-society-265900/

¹⁹ https://selectivv.com/en/knowledge_center/report-ukrainians-in-poland-2022/

²⁰ https://in-poland.com/ukraintsy-potratili-pochti-1-mlrd-evro-na-pokupki-v-polskikh-magazinakh/

²¹ Recently, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site