- Kyiv School of Economics

- About the School

- News

- Special Report “Bold Measures Are Needed as Russia’s Oil Is Slipping Beyond G7 Reach”

Special Report “Bold Measures Are Needed as Russia’s Oil Is Slipping Beyond G7 Reach”

20 November 2023

Following Russia’s full-scale invasion of Ukraine in 2022, the G7/EU imposed a price cap on the country’s oil exports–at $60 per barrel for crude oil. But Russia has found ways to circumvent this measure. It now depends on a “shadow fleet” of vessels that do not fall under the price cap for over 70% of its seaborne crude oil exports. At the same time, sanctions appear to be violated systematically. Altogether, this has led to a rebound in export earnings and oil-related budget revenues.

KSE Institute has released its new Special Report titled “Bold Measures Are Needed as Russia’s Oil Is Slipping Beyond G7 Reach.” The study examines price cap violations and steps needed to preserve the effectiveness of oil sanctions.

Recent data on Russian crude oil prices from the IEA and Russia’s Ministry of Finance raise concerns about compliance with price caps. In October, Russia reported an average Urals price of $81.52/barrel. Assuming 100% compliance for the 39% of volumes with G7/EU participation, the remaining 61% had to have been sold at above $95/barrel, unlikely given that this would be a premium to Brent.

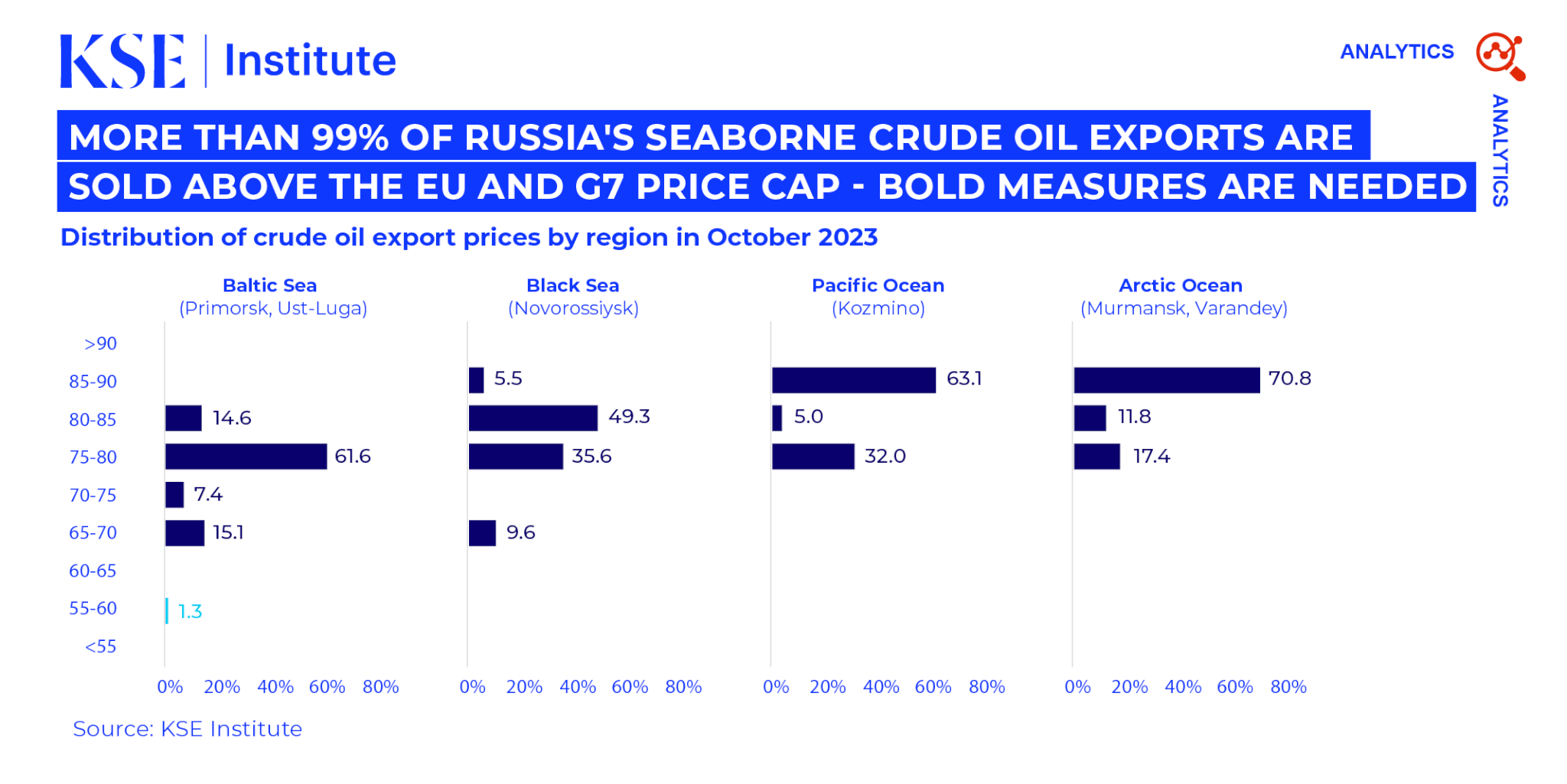

KSE Institute’s analysis shows that in October, more than 99% of seaborne crude oil exports were priced above $60/barrel. This trend was consistent across regions/ports: Urals prices (Baltic and Black Sea exports) stood at $77.0/barrel, ESPO prices (Pacific Ocean exports) at $83.0/barrel, and prices for crude types from Arctic Ocean ports at $85.0/barrel. The overall average for seaborne crude oil exports last month was $79.4/barrel.

More fundamentally, the price cap’s leverage diminishes with a growing ‘shadow fleet’. In fact, only 28.5% of total seaborne exports of Russian crude oil took place with G7/EU participation in October, down from 51% in H1 2023. G7/EU participation varies by region: Black Sea (41%), Baltic Sea (39%), Arctic Ocean (23%), and Pacific Ocean (12%).

A significant issue has emerged as “attestations fraud”, initially identified in crude oil exports from the port of Kozmino, has extended to the broader Russian oil market. It means that traders and brokers are likely providing false pricing information to G7/EU service providers. Many entities attesting to compliance, often tied to Russian oil companies, pose a significant challenge for enforcement.

Moreover, concerns arise about the ability of companies involved to cover clean-up costs, which can exceed $1 billion in the event of an oil spill in the Baltic Sea or Mediterranean. In fact, in May 2023, an 18-year-old tanker with 340k barrels of crude oil lost engine power in the Baltic Sea, narrowly avoiding grounding off Denmark’s coast.

A similar situation occurred in 2002 with the Aframax Prestige disaster. A 26-year-old ship caused a major oil spill in the Baltic Sea, having avoided critical inspections at the departure port. Investigations couldn’t identify the ultimate beneficiaries. The aftermath required years of remediation and cost over €2.5 billion.

Bold and rapid action is needed to preserve the effectiveness of oil sanctions. 3 critical measures that can prevent Russia from sanctions evasion include:

1. Strengthen Price Cap Implementation: G7/EU authorities must ensure coalition service providers have robust proof of oil prices and can effectively implement the price cap, involving financial institutions, requiring attestations from reputable entities, and increasing evidence requirements.

2. Leverage Geographical “Choke Points”: EU coastal states should use strategic points to limit Russia’s “shadow fleet” by requiring proper spill insurance in territorial waters, addressing environmental risks.

3. Enhance Penalties: Price cap coalition countries should increase penalties for price cap violations, including tougher measures for G7/EU companies, direct sanctions for third-country actors, and applying extraterritorial sanctions by the U.S.

These measures aim to reinforce the existing sanctions framework and can tackle Russian efforts of sanctions evasion.