- Kyiv School of Economics

- About the School

- News

- Russian Oil Tracker – November 2025: Ukrainian drone strikes cut oil exports from Tuapse threefold

Russian Oil Tracker – November 2025: Ukrainian drone strikes cut oil exports from Tuapse threefold

17 December 2025

In October 2025, Russia’s oil export revenues decreased by ~$0.4 billion MoM to $13.1 billion, according to the November edition of the Russian Oil Tracker by the KSE Institute. Revenues from crude oil exports declined by $420 million to $8.8 billion, while revenues from oil products remained broadly unchanged at ~$4.3 billion.

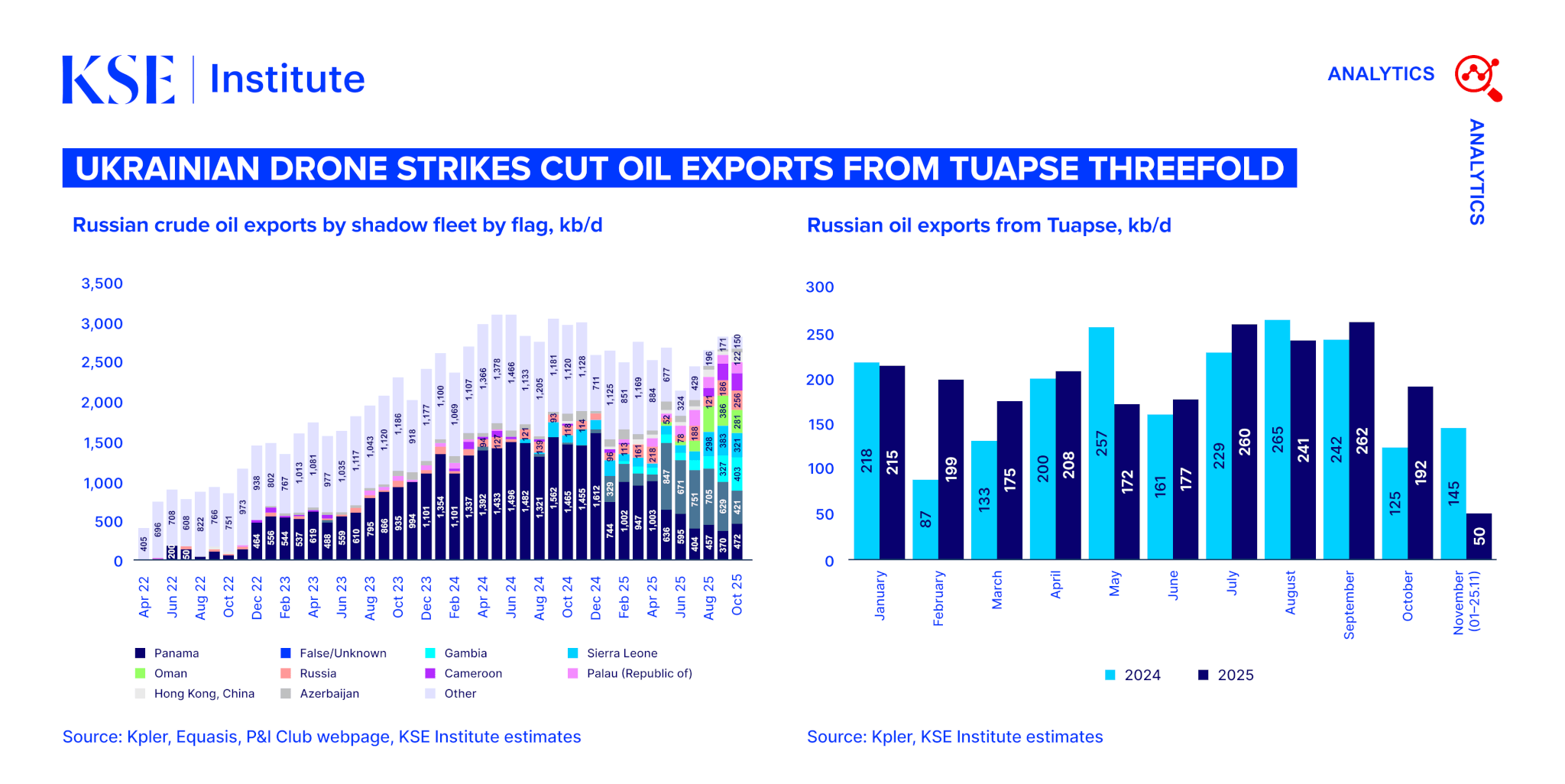

Following Ukrainian drone strikes on the Tuapse port in the Black Sea, oil exports from the port fell threefold to around 50 kb/d in November. In January-October 2025, Tuapse accounted for approximately 4% of Russia’s seaborne oil exports. At the same time, loadings from the other Black Sea port, Novorossiysk, increased by 13% YoY to 835 kb/d.

Overall, Russia’s seaborne oil exports declined by 2.4% MoM and by 1.4% YoY. Tankers insured by International Group (IG) P&I clubs carried 26% of crude oil and 80% of oil products.

The shadow fleet continues to play a key role in transporting Russian oil. According to KSE Institute estimates, in October, 161 Russian shadow fleet tankers carrying crude oil and oil products departed Russian ports and engaged in ship-to-ship (STS) transfers. Of these vessels, 83% were older than 15 years.

The EU, US, UK, Canada, Australia, and New Zealand have collectively sanctioned 610 oil tankers involved in transporting Russian oil. At the same time, the number of designated vessels that continue loading in Russian ports keeps increasing on a monthly basis, once again highlighting weak sanctions enforcement.

To transport its oil, Russia increasingly relies on tankers sailing under unknown or fake flags. In October 2025, 15% of oil exports were shipped by tankers registered under flags such as the Comoros, Malawi, Benin, Gambia, Guinea, Timor-Leste, and others.

India remained the largest importer of Russian seaborne crude oil, increasing its imports by 7.5% MoM to 1,829 kb/d, accounting for 49% of total seaborne exports. China, the second-largest buyer, reduced its crude oil imports by 28.1% to 1,045 kb/d. Turkey retained its position as the largest importer of Russian oil products, with imports of 461 kb/d.

After US sanctions against Rosneft and Lukoil came into effect on November 22, unloading volumes of Russian oil at the end of the month showed no material changes compared to the first 21 days of November. Meanwhile, unloading of Russian crude oil in China declined by 12% MoM and by 9% YoY.

In October, all Russian crude oil grades traded well above the revised EU price cap, while oil products traded below or close to the unchanged product caps. Discounts for Urals FOB Primorsk, Urals FOB Novorossiysk, and ESPO FOB Kozmino to ICE Brent remained broadly unchanged compared to September, while the discount for Urals DAP WCI to Dubai M1 narrowed by $1.9 per barrel.

According to KSE Institute estimates, under current price caps and the status quo of sanctions, Russia’s oil revenues are expected to reach $158 billion in 2025 and $129 billion in 2026. In 2027, revenues are not expected to recover due to weakening global oil markets. If discounts on Urals and ESPO widen to $30/bbl and $20/bbl relative to forecast Brent prices, revenues could fall to $73 billion in 2026 and $77 billion in 2027. Under weak sanctions enforcement, revenues could instead reach around $156 billion in both 2026 and 2027.