- Kyiv School of Economics

- About the School

- News

- Russian Oil Tracker – January 2026: Russia’s oil export structure shifts as Rosneft and Lukoil lose dominance

Russian Oil Tracker – January 2026: Russia’s oil export structure shifts as Rosneft and Lukoil lose dominance

11 February 2026

In December 2025, Russia’s oil export revenues increased by around $0.3 billion month-over-month (MoM) to $11.4 billion, according to the January edition of the Russian Oil Tracker by the KSE Institute. Higher export volumes — up by ~0.6 mb/d — offset a substantial decline in crude oil and oil product prices. Revenues from crude oil exports averaged $6.8 billion, while oil product revenues stood at $4.5 billion. At the same time, the structure of Russian crude exports is shifting, with the share of India and Turkey declining markedly.

Russian seaborne oil exports rose by 15.0%MoM and by 11.3% year-on-year (YoY) in December. Tankers insured by the International Group of P&I Clubs shipped 24% of crude oil and 74% of oil products.

In December and the first half of January, unloading volumes of Russian crude oil in Indian ports declined by roughly one-third to 1.2 mb/d. At the same time, India’s imports of Russian oil products fell to zero, with the country replacing these volumes with supplies from Saudi Arabia and the UAE. China, by contrast, increased its unloading volumes of Russian crude to 1.5 mb/d, while Turkey’s imports remained broadly unchanged.

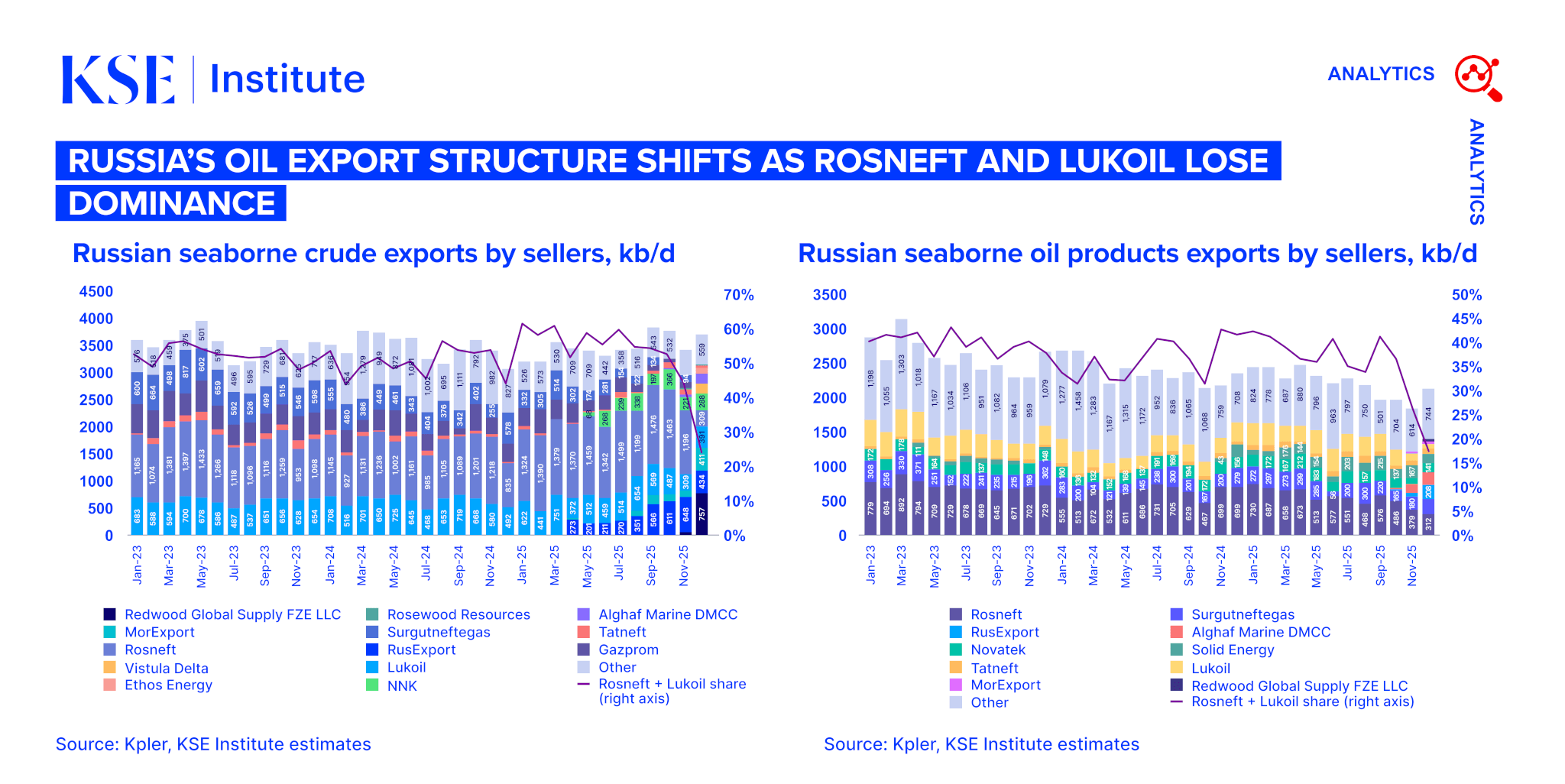

The structure of Russian crude oil sellers also shifted in December. Rosneft and Lukoil’s share in Russian crude oil exports fell from 51% in 2023–2024 to 19% in December 2025, pointing to a restructuring of export chains and the growing role of alternative traders. New exporters — Redwood Global Supply FZE LLC, Vistula Delta, Ethos Energy, and Rosewood Resources — entered the market and jointly accounted for 29% of total crude oil exports in December.

The shadow fleet continues to play a key role in transporting Russian oil. According to KSE Institute estimates, 178 tankers carrying crude oil and oil products departed Russian ports or engaged in ship-to-ship (STS) transfers in December, with 89% of these vessels older than 15 years. The largest share of crude oil transported by the shadow fleet was carried by tankers sailing under the flags of Cameroon, Sierra Leone, and unspecified jurisdictions — including false or unknown flags — which together accounted for 54% of the relevant volumes.

In December, average Urals FOB Primorsk and Urals FOB Novorossiysk prices declined by $5.9/bbl and $5.2/bbl MoMh to around $37.6/bbl and $37.5/bbl, respectively, trading roughly $10 below the EU’s revised price cap. ESPO FOB Kozmino decreased by $5.7/bbl to $48.3/bbl, approaching the revised cap. Both premium and discounted oil products traded below their unchanged price caps.

According to KSE Institute estimates, under current price caps and the status quo of sanctions, Russia’s oil revenues could decline from $160 bn in 2025 to around $112 billion in 2026-2027 amid weakening global oil markets. If discounts on Urals and ESPO widen to $25/bbl and $15/bbl relative to forecast Brent prices, revenues could fall to $79 billion and $66 billion, respectively. Under weak sanctions enforcement, revenues could instead reach around $126 billion and $128 billion.