- Kyiv School of Economics

- About the School

- News

- Russian Oil Revenues Decline Despite Active Shadow Fleet and Higher Oil Prices

Russian Oil Revenues Decline Despite Active Shadow Fleet and Higher Oil Prices

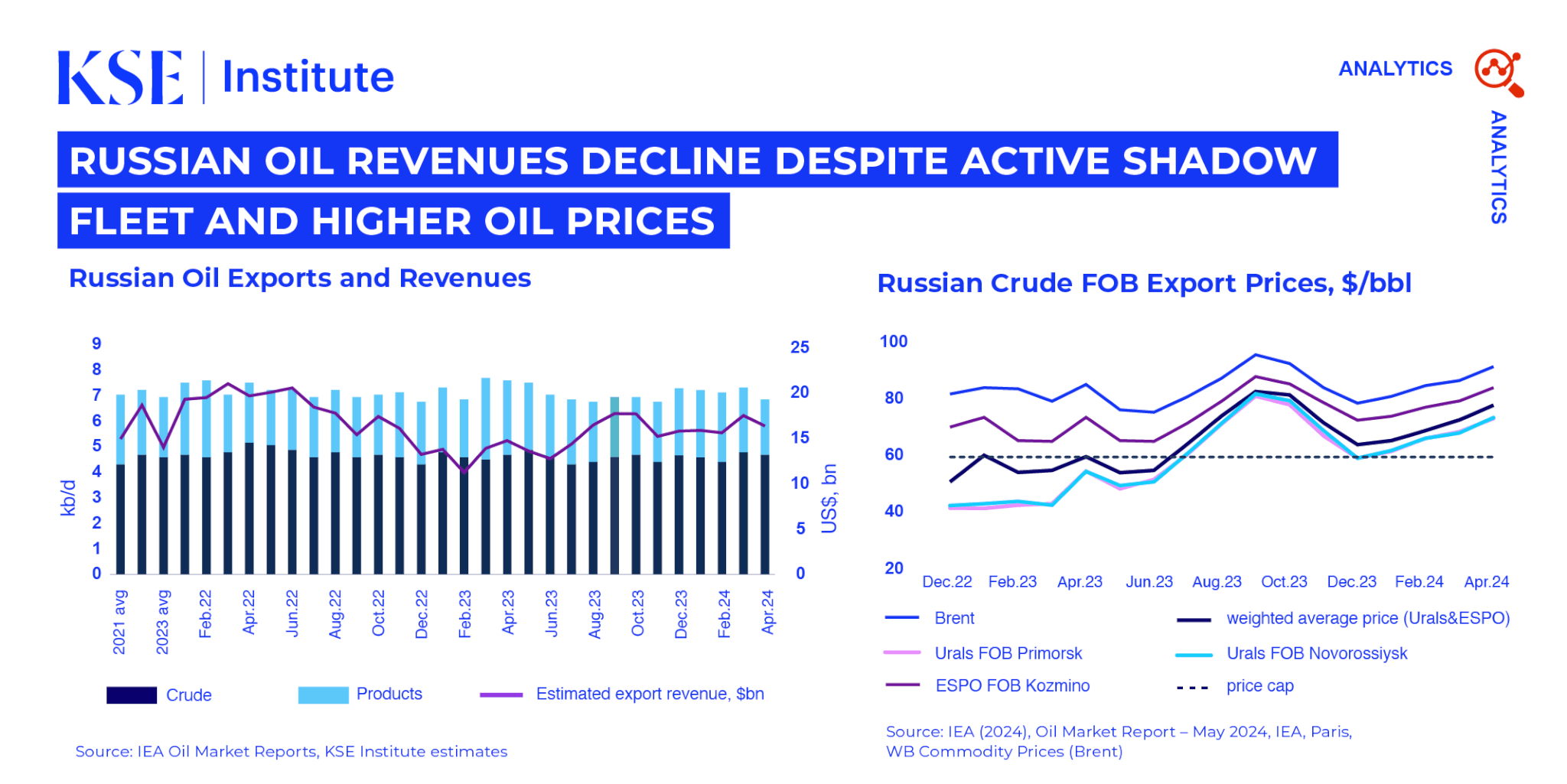

Russian oil export revenues decreased to $17.2 billion in April due to both lower oil products volumes and prices of diesel and naphtha, according to the May ‘Russian Oil Tracker’ by KSE Institute. Higher crude oil prices and the extensive use of a shadow fleet could not offset the decline in oil export volumes.

In April 2024, Russian seaborne oil export volumes decreased by 7%, driven by a 17% MoM drop in oil product exports, while crude exports remained stable. This decline, coupled with reduced prices for naphtha and diesel, resulted in a decrease in Russian oil revenues. In April 2024, these revenues fell by $1.2 billion to $17.2 billion. Since March 2022, Russia has lost an estimated $126 billion in oil export revenues due to the unprovoked invasion.

The shadow fleet set a record by exporting about 3.1 million barrels per day, 83% of total crude exports. KSE Institute reports that 228 Russian shadow fleet tankers left Russian ports in April 2024, with two involved in ship-to-ship (STS) transfers. Notably, 85% of these tankers are over 15 years old.

The record-breaking shadow fleet operations in April were partly enabled by Russia’s decreased reliance on Western maritime services. This reliance dropped to 29%, with only 17% of crude and 52% of oil products shipped under IG P&I insurance coverage.

Furthermore, the use of ship-to-ship (STS) transfers allows Russia to export more oil by concealing its origin. From January 2023 to April 2024, a total of 27.5 million barrels of crude and 80.2 million barrels of oil products were transferred through STS operations.

Despite OFAC’s strategy of sanctioning individual tankers, Russia continues to expand its shadow fleet to counteract these measures. As of May 28, 2024, 32 out of 41 sanctioned vessels have been unloaded and have no scheduled voyages. One vessel was removed from the sanction list, and another provides coastal shuttle services within the Black Sea, violating OFAC sanctions. Two sanctioned vessels started voyages with commercial cargo but remain unloaded. To replace these tankers, Russia has added 38 new tankers with a DWT equivalent to 90% of the sanctioned fleet for oil exports since December 2023.

Maintenance and expansion of the shadow fleet enables Russia to bypass the oil price cap. In April 2024, Urals FOB Primorsk and Novorossiysk increased by 4.3/bbl and 5.1/bbl to around $73/bbl while ESPO FOB Kozmino increased by 4.4/bbl to around $83/bbl. The discount for all crude grades changed only marginally month-over-month in April.

UAE, Chinese, and Greek ship managers assist Russia in circumventing sanctions. Stream Ship Management Fzco has topped the list of the ten largest crude shippers for the second consecutive month after acquiring tankers from sanctioned OFAC Oil Tankers Scf Mgmt Fzc. Three Greek companies remain among the top ten Russian crude shippers, while Moldova-based Adel Ship Management Srl joined the top ten crude shippers for the first time.

Moreover, demand for Russian oil remains high. In April 2024, India, the largest importer of Russian seaborne crude, increased imports by 9% MoM (to 1859 kb/d). Altogether, India, China, and Turkey accounted for 90% of Russian crude oil exports. Despite a 28% MoM decline in Russian oil product imports (by 113 kb/d), Turkey remained the top buyer of Russian oil products in April 2024.

KSE Institute projects Russian oil revenues to reach $172 billion and $142 billion in 2024 and 2025 under the base case with current oil price caps and stronger sanctions enforcement. However, if sanctions enforcement is weak, Russian oil revenues could increase, reaching $194 billion in 2024 and $188 billion in 2025.