- Kyiv School of Economics

- About the School

- News

- Russia Chartbook by KSE Institute — Spending Cuts Keep Budget on Target; Russian Oil Prices Continue to Plunge

Russia Chartbook by KSE Institute — Spending Cuts Keep Budget on Target; Russian Oil Prices Continue to Plunge

28 January 2026

KSE Institute has published the January edition of its Russia Chartbook, “Spending Cuts Keep Budget on Target; Russian Oil Prices Continue to Plunge.” While Russia formally met its revised budget target for 2025, underlying financial and macroeconomic constraints continue to intensify. This creates a favourable moment for Ukraine’s partners to step up sanctions pressure and further constrain the Kremlin’s ability to finance the war.

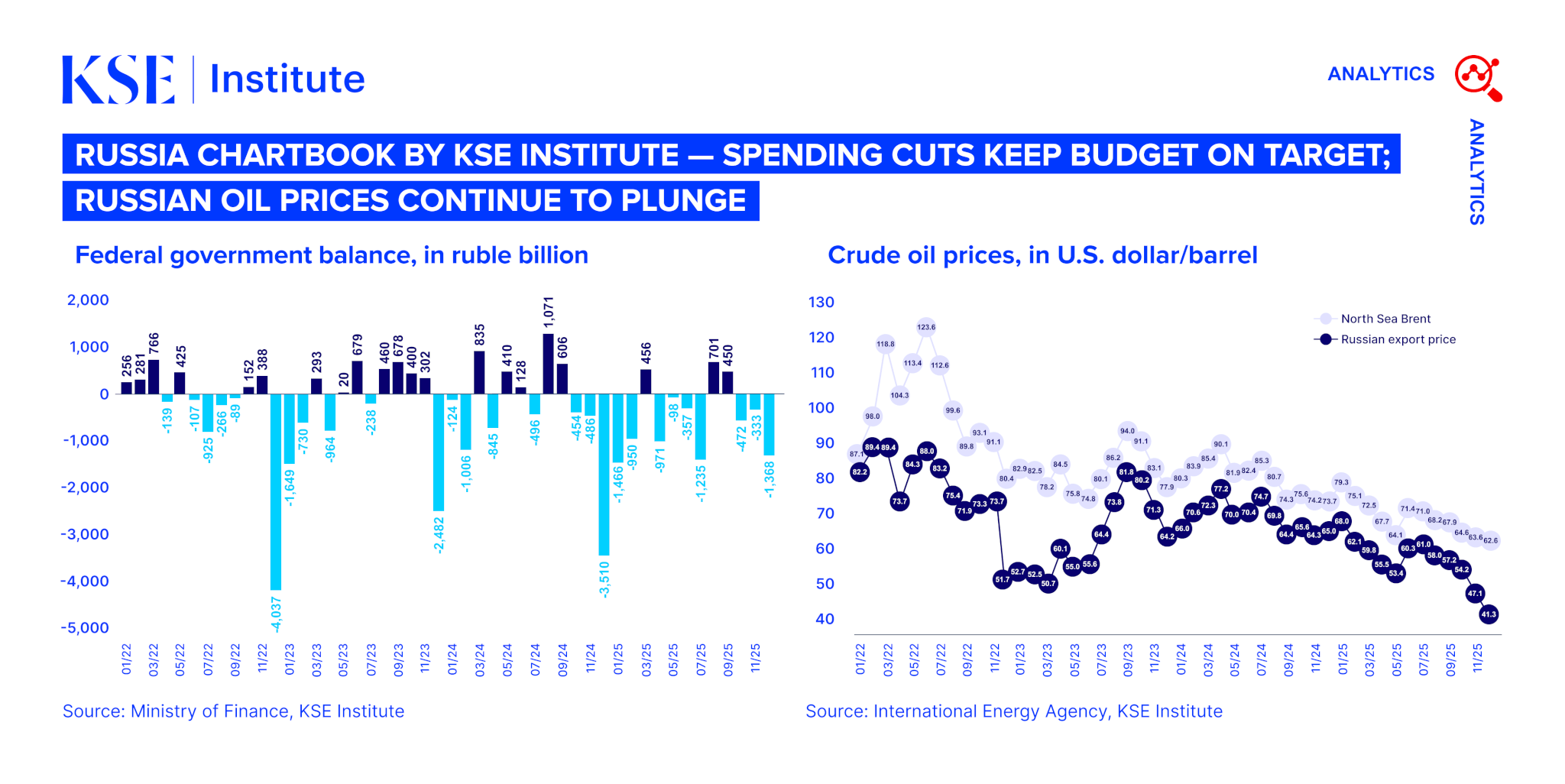

Russian oil prices continued to fall sharply at the end of the year. In December, Russia sold crude oil at an average price of $41.3 per barrel, while Urals dropped below $38 per barrel. Discounts to global benchmarks widened to $21.3 and $25.0 per barrel, respectively. The combination of recent US sanctions on Rosneft and Lukoil and a significantly oversupplied global oil market has pushed Russia into an environment more challenging than even in early 2023. While recent geopolitical tensions temporarily supported global prices, KSE Institute expects Brent to fall back to around $55 per barrel in the coming months and remain at this level throughout 2026–27.

In December, lower prices were partially offset by higher export volumes. At the same time, China and India are appearing to scale back purchases, while the volume of Russian “oil on the water” — shipments without a buyer accumulating in open seas — has increased. This situation cannot be sustained for long. If the behaviour of Russia’s largest oil importers does not change, export volumes will eventually decline, followed by a reduction in production due to limited storage capacity.

Russia’s federal budget formally met its full-year target in 2025 due to spending cuts. The deficit amounted to 5.6 trillion rubles, in line with the revised plan but 63% higher than in 2024. According to preliminary data from the Ministry of Finance, the December deficit reached 1.4 trillion rubles — significantly lower than in December 2024 (3.5 trillion) and December 2023 (2.5 trillion). This likely reflects either substantial spending cuts, constraining the government’s ability to meet its obligations, including war-related spending, or a shift of expenditures into early 2026. At the same time, fundamental budget dynamics remain unfavourable: oil and gas revenues fell in December to their lowest level since January 2023, while growth in revenues not related to oil and gas slowed sharply in 2025, to 13% (down from 25–26% in 2023–24). With the economy effectively stalling in Q3, downside risks continue to build.

Deficit financing increasingly relies on domestic borrowing. In 2025, new OFZ issuance reached around 7 trillion rubles — in line with the original plan but 74% higher than in 2024. This allowed Russia to avoid drawing on National Welfare Fund assets and preserve this critical macro-financial buffer for 2026. Domestic banks remain the only significant buyers of government debt, while the Central Bank has supported their absorption capacity through large-scale repo operations, with outstanding volumes exceeding 5 trillion rubles. If high deficits persist and such support becomes permanent, the Central Bank’s ability to control inflation will be increasingly constrained. While tight monetary policy in 2024–25 brought inflation down to 5.6% year-on-year in December, this has come at the cost of a sharp slowdown in economic activity. According to IMF estimates, Russia’s GDP grew by only around 0.6% in 2025, compared to 4.1–4.3% in 2023–24.