- Kyiv School of Economics

- About the School

- News

- Russia Chartbook by KSE Institute — Rosneft-Lukoil Sanctions Bite; Budget Deficit Will Soar in December

Russia Chartbook by KSE Institute — Rosneft-Lukoil Sanctions Bite; Budget Deficit Will Soar in December

29 December 2025

KSE Institute has published the December edition of its Russia Chartbook: “Rosneft-Lukoil Sanctions Bite; Budget Deficit Will Soar in December.” As Russia’s fiscal and economic problems deepen, this creates a favorable moment for Ukraine’s allies to ramp up sanctions pressure and limit the Kremlin’s war-financing capabilities even further.

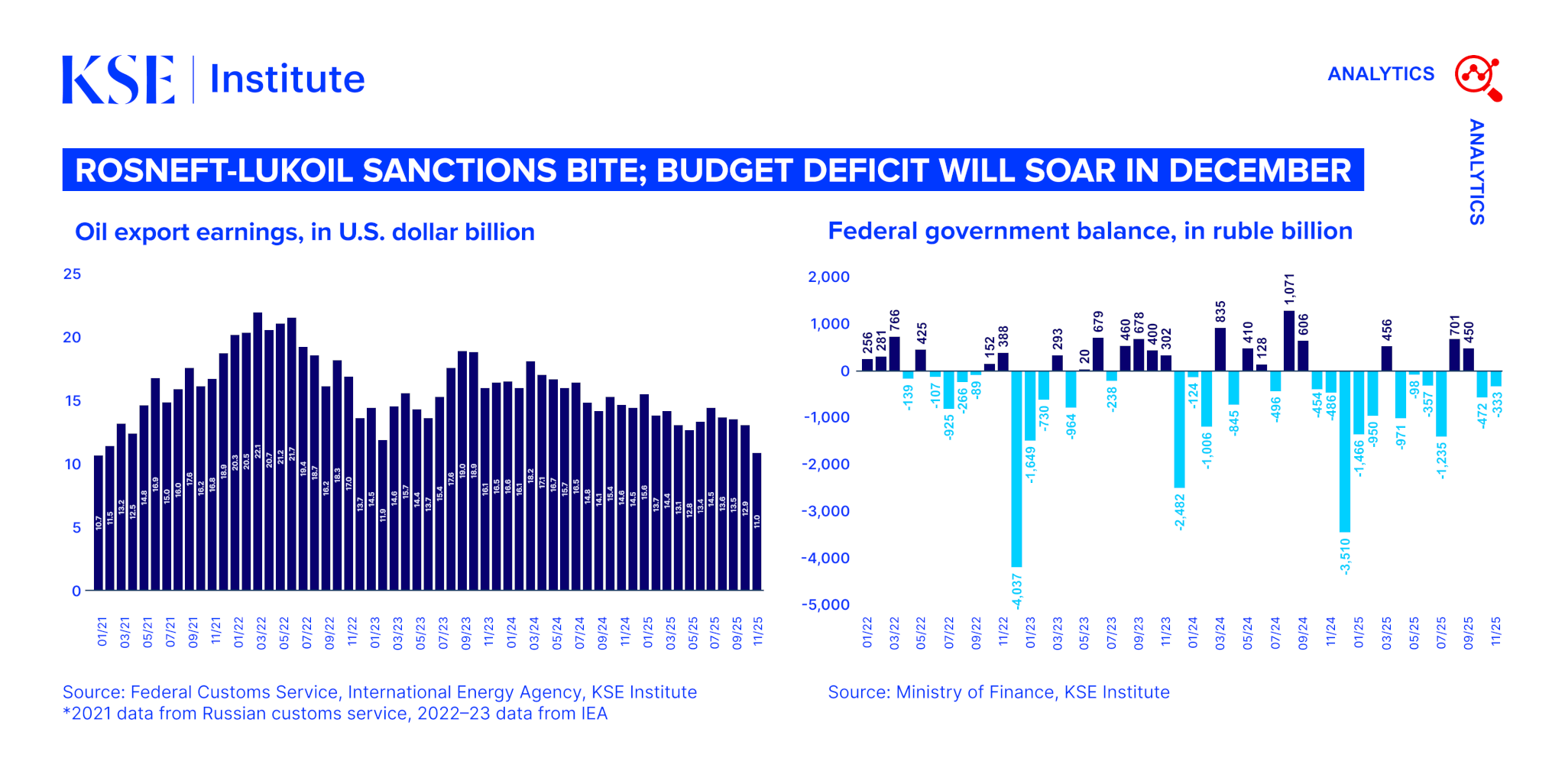

New US sanctions on Rosneft and Lukoil are starting to take effect, with Russia’s oil export earnings dropping to $11.0 billion in November from $12.9 billion in October as the average export price plunged to $47.1/bbl – despite relatively stable global prices. Total export volumes also contracted significantly to 6.8 mb/d in November from 7.3 mb/d in October, as key buyers like China, India, and Turkey reduced purchases by an average of 30%. The amount of Russian “oil on the water” – shipments that left Russia but have not found a buyer – rose noticeably as well, which means that export volumes could fall further going forward. While these dynamics may be a temporary result of supply chain readjustments, they could become structural if sanctions pressure persists.

The budget remains a key challenge as year-end spending looms, with Russia’s federal budget recording a deficit of 4.3 trillion rubles over January-November – an increase from the January-October figure of 4.0 trillion. Oil and gas revenues dropped 22% y-o-y, non-oil revenues grew only 11%, and expenditures rose by 13%. Given the year-to-date performance and historical patterns of heavy spending in December, it is highly likely that Russia will breach the revised deficit target of 5.7 trillion rubles. Should December spending turn out like last year, the full-year deficit would reach 7.8 trillion. With Russian oil export prices dropping sharply following new sanctions, O&G revenues will likely also weaken further in December, adding further to downside risks.

With other options constrained, domestic borrowing has taken center stage. In November alone, the Ministry of Finance borrowed 2.0 trillion rubles – the highest number by far since the start of the full-scale invasion. Consequently, OFZ issuance in January-November was 225% higher than in January-November 2024. This massive surge in debt is expected to be inflationary – particularly if supported by CBR repo operations to create sufficient demand from Russian banks – further complicating efforts to stabilize prices. For the moment, the CBR’s persistently tight monetary policy has brought inflation down to 6.7% y-o-y in November (from 7.7% in October). The recent rate cut to 16% appears largely symbolic and is unlikely to significantly stimulate business activity.

Economic activity has nearly stalled, with the economy teetering on the edge of stagnation as growth slowed to just 0.1% q-o-q in Q3 from 0.3% in Q2. Y-o-y growth has slowed in parallel to 0.6% in Q3 from 1.1% in Q2 and 1.4% in Q1. Consequently, most forecasters have significantly downgraded their outlooks, now projecting full-year growth of less than 1% in 2025 and around 1% in 2026. The fundamental constraints of the Russian economy are, thus, finally taking their toll after the manufactured war boom in 2023-24.