- Kyiv School of Economics

- About the School

- News

- KSE Institute’s Russia Chartbook – Russia’s Overheating Economy Increasingly Hard To Manage

KSE Institute’s Russia Chartbook – Russia’s Overheating Economy Increasingly Hard To Manage

30 August 2024

KSE Institute has released its new August Russia Chartbook “Russia’s Overheating Economy Increasingly Hard To Manage.” The Russian government’s efforts to maintain macroeconomic stability are facing growing challenges, yet it still retains the capacity to manage them. To put more pressure on its economy and expose vulnerabilities, it is crucial for Ukraine’s allies to consistently strengthen sanctions against Russia.

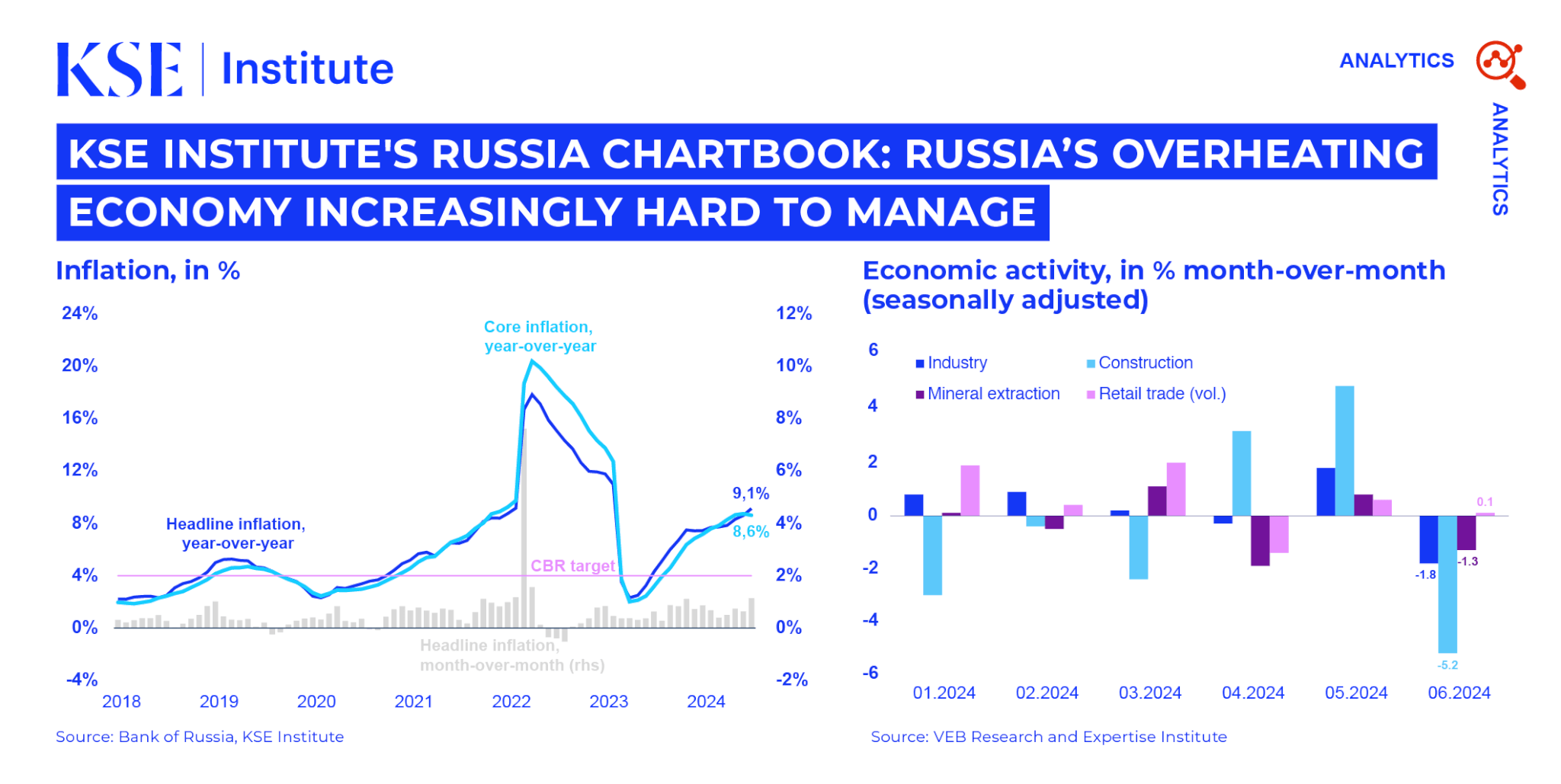

The Russian economy is showing signs of weakening as activity in several key sectors slowed down in June, largely due to tighter monetary policies. Despite the central bank raising its policy rate to 18%, a significant increase since early 2023, inflation continues to rise. This suggests that managing the economy amidst war and sanctions is becoming increasingly challenging, even though headline indicators like GDP remain strong.

Favorable external environment continues to ensure Russia’s macroeconomic stability. Although Russia’s current account shifted to a deficit in July due to weaker exports, stronger imports, and larger service and income deficits, the January-July surplus reached $39.7 billion, nearly 70% higher than the same period in 2023. This growth was mainly due to a $13.5 billion increase in the trade surplus, driven by reduced imports and stable exports, with higher oil revenues balancing weaker exports of other goods.

Oil revenues remain high due to weak enforcement of energy sanctions. In July, the discount on Russian oil export prices—a key indicator of price cap enforcement—dropped to its lowest level since the start of the full-scale invasion, at $10.6 per barrel. This allowed Russia to earn an extra $15 per barrel of crude oil, totaling approximately $2.2 billion. The reduced discount is partly due to the limited vessel designation campaign, which has enabled Russia to rebuild its shadow fleet capacity.

As a result, strong profits have contributed to Russia not facing major fiscal constraints. Over the first seven months of 2024, Russia’s federal budget deficit reached 1.4 trillion rubles, which is 64% of the full-year target and 47% less than the same period in 2023. A significant 36% increase in revenues more than offset a 23% rise in spending.

These factors maintain the stability of the Russian economy, but vulnerabilities remain. While Russia is on track to meet its 2024 deficit target, significant risks are emerging, including a slowing economy, attacks on oil infrastructure, increased spending due to the Kursk situation, and rising borrowing costs. Reduced financial reserves could pose a problem if the economy slows further. With the loss of $300 billion in CBR reserves and decreased liquid assets in the National Wealth Fund, the Ministry of Finance may need to rely more on domestic borrowing, increasing debt service costs.