- Kyiv School of Economics

- About the School

- News

- IMPACT OF FOREIGN COMPANIES SELF-SANCTIONING ON RF ECONOMY

IMPACT OF FOREIGN COMPANIES SELF-SANCTIONING ON RF ECONOMY

24 May 2022

Prepared by the KSE Institute team and KSE members of the Board of Directors; 16-22.05.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE DATABASE SNAPSHOT as of 22.05.2022

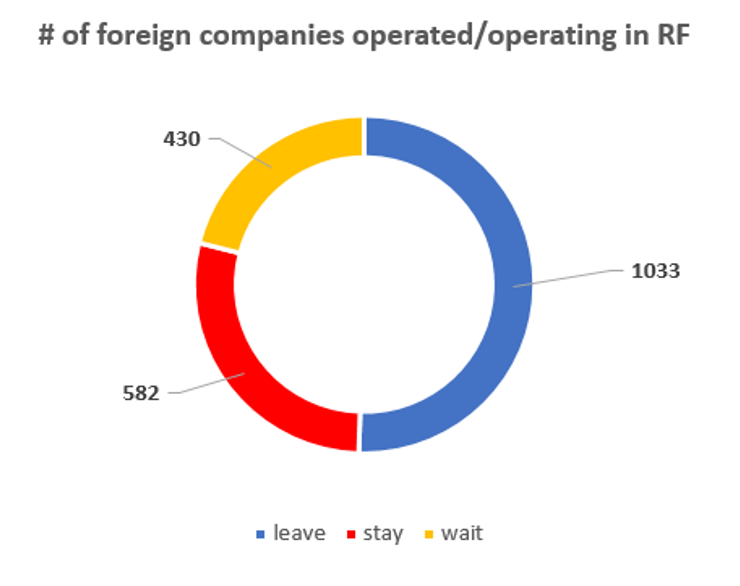

Number of the companies that continue Russian operations (KSE’s status “stay”¹ ) – 582 (+2 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status “wait”) – 430 (+8 per week)

Number of the companies that have curtailed Russian operations (KSE’s status “leave”) – 1 033 (+16 per week)

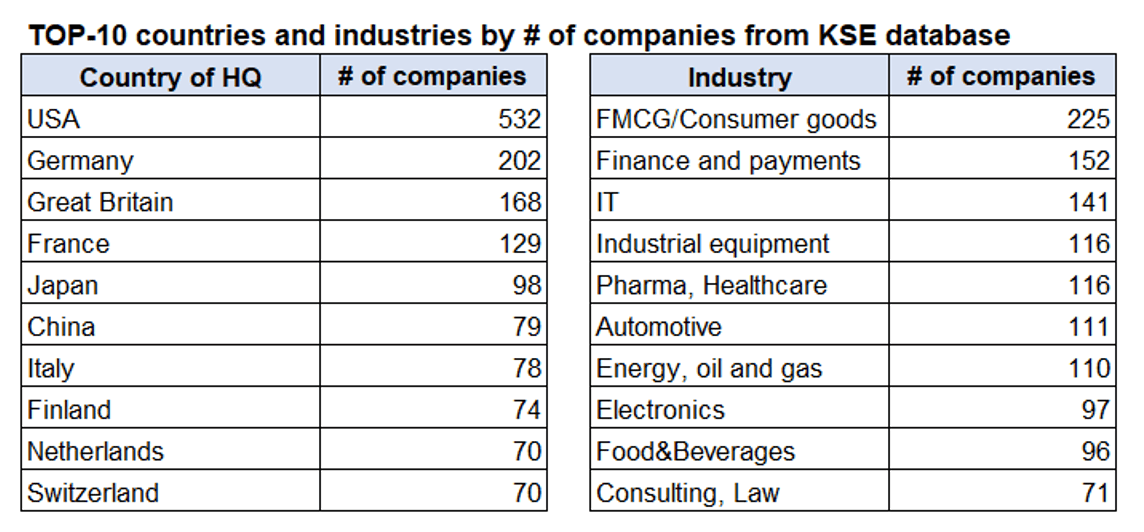

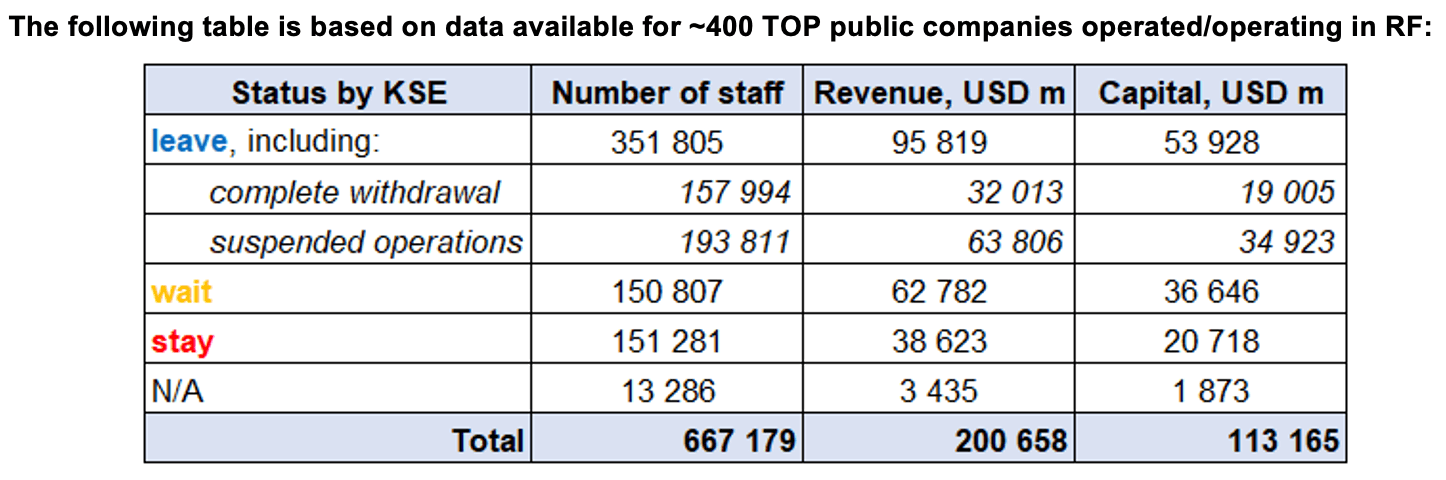

As of May 22, we have identified about 2,045 companies and organizations and analyzed their position on the Russian market. About half of them are public ones, for ~ 400 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity), which allowed us to calculate the value of capital invested in the country (about $113 billion), local revenue (about $200 billion), as well as staff (almost 0.7 million people). 1,439 foreign companies from 70 countries and 55 industries have reduced, suspended or ceased operations in Russia.

As can be seen from the tables below, As of May 22, companies that declared a complete withdrawal from Russia had $32bn in revenues and $19bn in capital; companies that suspended their operations on the Russian market had yearly revenue of $63.8bn and $34.9bn in capital. TOP-10 companies-the largest taxpayers ~ $13,7bn of taxes annually – haven’t completely withdrawn yet, although suspended or scaled back.

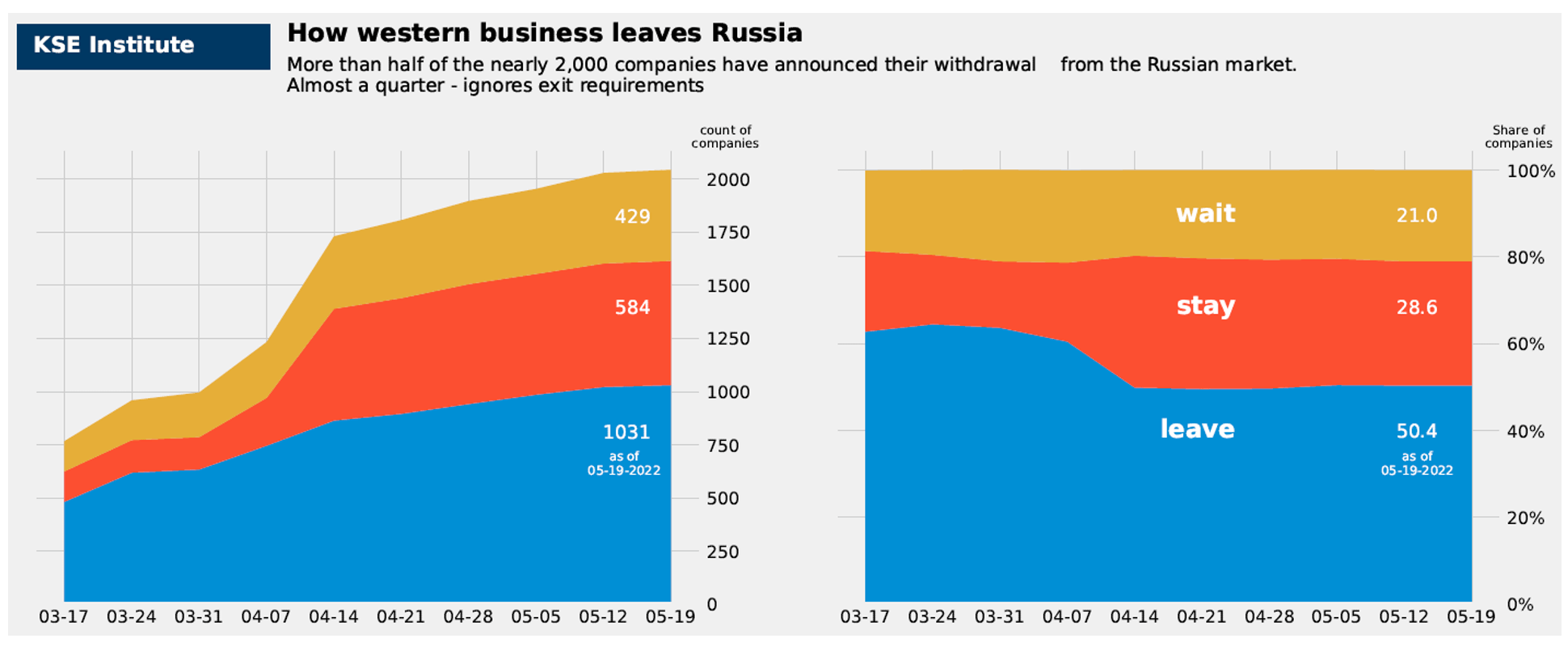

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. But during this time we see an increase in the share of those companies that remain in the Russian market. However, more than half (50.4%) of foreign companies have already announced their withdrawal from the Russian market, although another 28.6% are still remaining in the country.

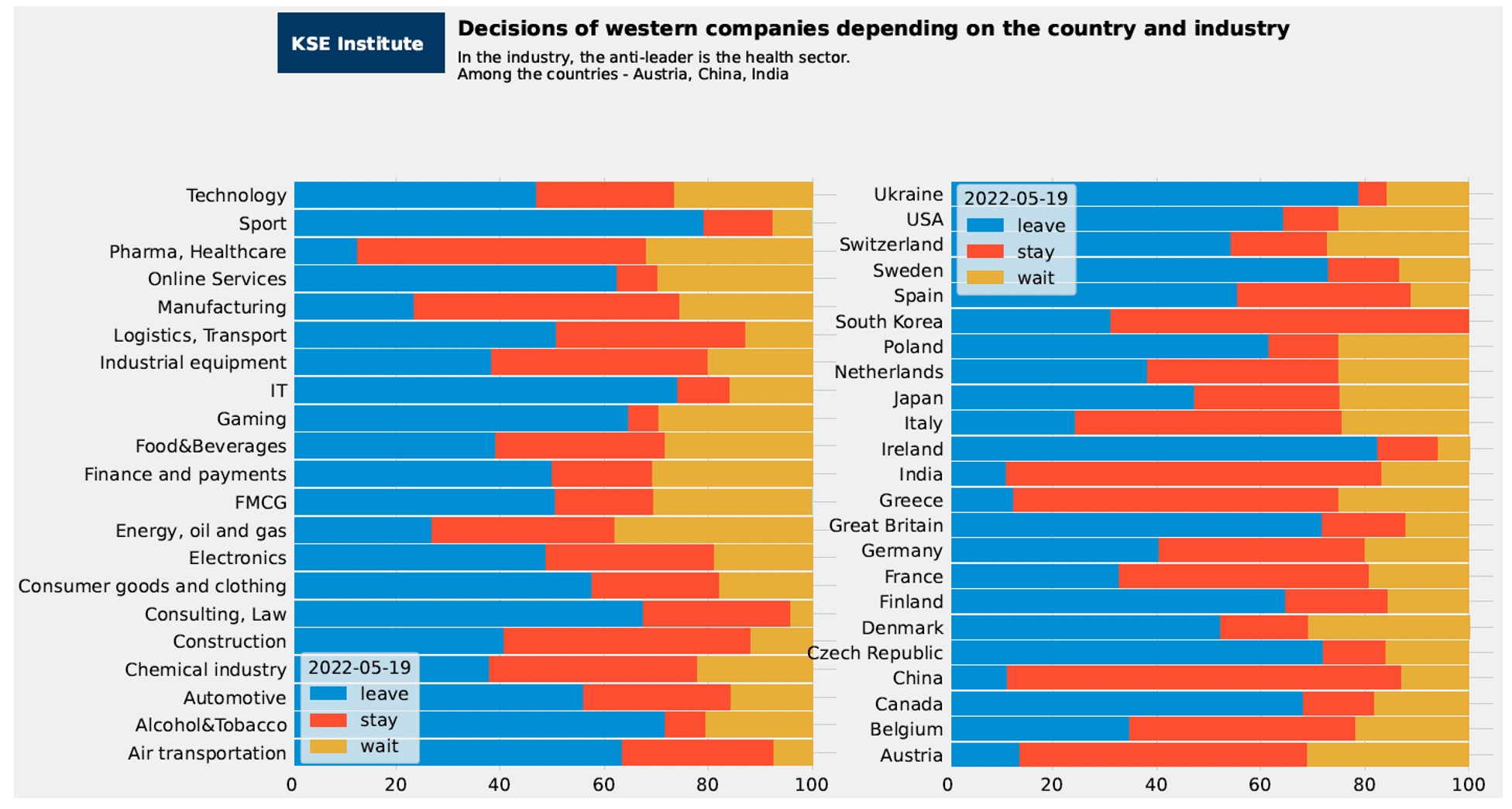

The actions of companies by sector (based on the KSE database, with at least 50 companies representing the industry and with at least 40 companies per country) are shown in the graphs above.

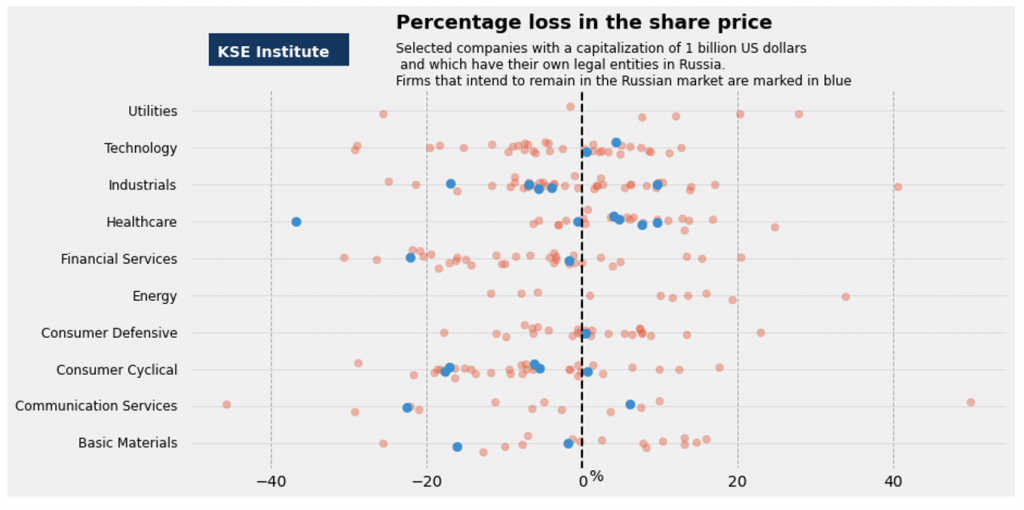

Impact on stock prices/capitalization of companies’ HQ²

WEEKLY FOCUS. CONSULTING, AUDIT AND LEGAL ADVISORY SECTOR

From the first week of March 2022, companies providing professional accounting, consulting and legal services have started to announce their withdrawal from Russia. In total, KSE’s base includes 48 companies that have fully or partly left the market including:

- • Audit companies PwC, KPMG, Ernst & Young, Deloitte, Grant Thornton

- • Consulting companies Accenture, McKinsey, BCG, Kearney, Oliver Wyman

- • Law firms Baker McKenzie, Allen & Overy, Clifford Chance, Freshfields, Dentons, DLA Piper, Norton Rose Fulbright, Hogan Lovells and White & Case.

Even close relations of some companies with the Russian government did not stop them from taking action. For example, according to NBC³, the consulting company McKinsey advised both Rostec and the US Department of Defense. Legal giant Baker McKenzie had been in the Russian market for more than 30 years and had defended the interests of Gazprom, VTB and Rostec. Rostec supplies the Russian army with missiles that fly to Ukrainian cities.

Most companies have announced restructuring their Russian offices into new independent firms and relocating their employees abroad. But it’s easier said than done. Some companies had strong links between the CIS offices, while offices in Russia were the main ones in the region. Leaving the market for them means significant organizational changes.

In May 2022 UK and US governments banned the export of accounting, auditing and PR services. On the one hand, these sanctions formalized the exit of companies. On the other hand, they accelerated it. For Russian firms, sanctions mean that they will not be able to gain the best world experience for business development and wash their reputation.

Legal services were not included in the sanctions package. More than 20 international law firms were operating in Russia prior to February 24, but only a few remained in April. Some companies continue to serve Russian customers, despite the closure of their offices. Among them are Latham & Watkins, White & Case and Debevoise & Plimpton, but these companies also ask judges to withdraw from representing Russian companies.

Reputational risks and the constant expansion of sanctions impact these decisions. So far, law firms have not come under sanctions, but it is noted that the US is constantly reevaluating the breadth of services sanctions and talking actively with the UK government.

What’s new last week – key news from Daily monitoring

16.05.2022

*Aramco (Saudi Arabia,Energy, oil and gas) Status by KSE – stay

Saudi Aramco Posts Record Quarterly Profit on Surging Oil Prices. Aramco, said its quarterly profit swelled to $39.5 billion in the quarter, a period during which Saudi Arabia, the de facto leader of the Organization of the Petroleum Exporting Countries, continued to rebuff U.S. requests to pump more oil to help tame surging crude prices, instead sticking by an agreement with Russia to only marginally increase output.

*McDonald’s (USA, Public catering) Status by KSE – leave

On May 16 McDonald’s announced that they will start to seek buyers for its Russian store network (sub-status was changed from suspension to withdrawal).

Update On May 19: McDonald’s Corp. has agreed to sell its Russian business to existing licensee Alexander Govor after saying days earlier it will exit the Russian market.

*Harrods (Great Britain, Luxury) Status by KSE – wait

Harrods will not supply Russian clients with “luxury goods” > £300.

*Authentic Brands Group – Reebok (USA, Sport) Status by KSE – leave

Reebok sold stores in Russia. The Reebok sporting goods division, a brand of the American company Authentic Brands Group (ABG), has ceased operations in the Russian Federation – a network of more than 100 outlets was sold to the Turkish holding FLO Retailing.

https://www.rbc.ua/ukr/news/reebok-prodal-magaziny-rf-1652675828.html

*Renault (France Automotive) Status by KSE – leave

Russia’s Renault assets become state property of Russia: Lada and Moskvichi will be produced

https://t.me/minpromtorg_ru/279

*Stora Enso (Finland, Consumer goods and clothing) Status by KSE – leave

Stora Enso has divested its three corrugated packaging plants in Russia. The Company’s Lukhovitsy, Arzamas and Balabanovo packaging plants have been divested to local management.

*Atria (Finland, Food & Beverages) Status by KSE – leave

Atria sold its fast food business in Russia

*UniCredit (Italy,Finance and payments) Status by KSE – stay

UniCredit, Citi consider swapping assets with Russian institutions

17.05.2022

*Gett (Great Britain, Online Services) Status by KSE – wait

Gett taxi service announced that it will stop supporting and ensuring the functioning of the mobile application for drivers from the Russian Federation from June 1.

https://www.epravda.com.ua/rus/news/2022/05/16/687101/

*Home Credit (Czech Republic, Finance and payments) Status by KSE – leave

Home Credit will leave the Russian market, and the Kazakh bank of the investment group will also be sold.

*Samsung Heavy Industries (South Korea, Industrial equipment) Status by KSE – stay

Samsung Heavy Industries plans to move forward with the construction of three more ice-breaking LNG carrier hulls for Russia

The specialised vessels needed to ship the fuel from its vast projects in the frozen north, from some of the planet’s richest gasfields. Moscow also aims to start year-round cargo shipments along the “Northern Sea Route”, which connects East Asia with Europe via the Bering Strait between Russia and Alaska, within the next couple of years.

EU banning exports of vessels, marine systems or equipment to Russia for most purposes,

*Flugger (Denmark, Manufacturing) Status by KSE – wait

The Danish paint maker said on April 8 it had initiated the sale of its Russian and Belarusian companies. The operations of the companies in Russia and Belarus will continue until the sale is completed, to secure our local employees and to avoid nationalization of the company.

https://www.flugger.com/en/news/sale-of-Russian-and-Belarusian-companies/

18.05.2022

*Canva (Australia, IT) Status by KSE – wait

Australian tech company Canva continues operating in Russia in face of Ukrainian outrage. Canva’s head of communications, Lachlan Andrews, said the company suspended payments to and from Russia on 1 March. “The free version of Canva remains available in Russia along with a prominent banner displaying our opposition to the war and directing users to our pro-peace and anti-war templates,” he said.

*Allianz SE (Germany, Insurance) Status by KSE – wait

Allianz SE has refuted recent media reports that the insurer would fully exit the Russian insurance market.

19.05.2022

*Avolon (Ireland, Aircraft industry) Status by KSE – wait

Aircraft leasing firm Avolon recorded a first quarter loss of $182m as a result of its inability to reclaim aircraft it owns that were in Russia when it invaded Ukraine.

https://www.rte.ie/news/business/2022/0503/1295852-avolon-records-182m-loss-due-to-russia-writedown/

*Alphabet (Google) (USA, Online Services) Status by KSE – leave

Google is terminating its commercial presence in Russia. Some employees of the company wanted to leave the company and stay in Russia. However, in the near future Google will no longer have employees in Russia.

https://www.wsj.com/articles/google-subsidiary-in-russia-to-file-for-bankruptcy-11652876597

*Bristol-Myers Squibb (BMS) (USA, Pharma, Healthcare) Status by KSE – leave

On May 18, the American pharmaceutical company Bristol-Myers Squibb (BMS) began the process of transferring Russian business to its partner in Central and Eastern Europe, Swixx BioPharma.

https://www.epravda.com.ua/news/2022/05/19/687205/

*ONGC (India, Energy, Oil and Gas) Status by KSE – stay

India’s ONGC looking to buy additional stakes in Russian oil assets

https://www.offshore-technology.com/news/ongc-stakes-russian-oil/

*Societe Generale (France, Finance and Payments) Status by KSE – leave

Societe Generale has closed the sale of rosbank and its russian insurance subsidiaries https://www.societegenerale.com/en/news/press-release/closing-sale-rosbank-and-its-subsidiaries

*Arla Foods (Denmark, Food & Beverages) Status by KSE – leave

Arla quits Russia, selling business to management

The Danish firm announced it was suspending its business in Russia in early March.

*International Basketball Federation (FIBA) (Switzerland, Sport) Status by KSE – leave

No FIBA Official Basketball Competitions are to be held in Russia or Belarus until further notice.

Teams from the RBF and the BBF are to be withdrawn from the following FIBA National Team Competitions

https://www.fiba.basketball/news/fiba-decisions-on-russia-and-belarus-for-upcoming-competitions

20.05.2022

*Marugame Seimen (Japan, Food & Beverages) Status by KSE – leave

Marugame Seimen udon chain operator says has ended franchises in Moscow operating against orders.

https://japannews.yomiuri.co.jp/business/companies/20220520-30190/

*Kelly Services (USA, Industry Professional services) Status by KSE – leave

International recruitment agency Kelly Services sells business in Russia and leaves the market

*Zurich Insurance (Switzerland, Insurance) Status by KSE – leave

Zurich Insurance Group (Zurich) has agreed to sell its business in Russia to 11 members of the unit’s team. Under its new owners, the business will operate independently under a different brand, while Zurich will no longer conduct business operations in Russia

https://www.zurich.com/en/media/news-releases/2022/2022-0520-01

*LPP (Poland, Consumer goods and clothing) Status by KSE – leave

Polish retailer and clothing manufacturer LPP SA, which owns the brands Reserved, Cropp, House, Mohito and Sinsay, has decided to sell its Russian business to a Chinese consortium.

More details on daily basis:

KSE Telegram bot on news monitoring @exit_ru_bot

Subscribe to the SelfSanctions project on Twitter.

At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities.

Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine.

The database contains a lot of information:

• We collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities.

• We created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring).

• We do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo finance. At the same time, the KSE database is more complete and comprehensive and contains 40 percent more information, as it also includes the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot.

¹- KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

²The chart represents only public companies with a capitalization of $1 billion and, according to our data, own assets in Russia and received annual revenue of 5 billion rubles and more.